The US Federal Reserve kept the Fed Funds rate unchanged at its FOMC rate-setting meeting yesterday, with the upper bound still at 5.50%. This had been the market consensus expectation and our own, and our view has been since April that the first cut from the Fed in this cycle will come at the September meeting. This looks increasingly likely to play out when looking at the language from the FOMC statement and chair Jerome Powell’s press conference following the decision, and our forecast remains that we will see two 25bps cuts before the end of the year, one in September and one in December, despite the dot plot of FOMC member projections having come down to just one cut in the latest summary of economic projections in June.

The notable change in the statement from the FOMC was that it is now ‘attentive to the risks on both sides of its dual mandate’, acknowledging greater risks to the labour market where previously it was focused almost solely on price growth. It went on to say that the risks to both were moving ‘into better balance.’ In Powell’s press conference he was more explicit, saying that if the ‘totality of the data’ and the ‘balance of risks’ are appropriate, then ‘a reduction in our policy rate could be on the table as soon as the next meeting in September.’

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

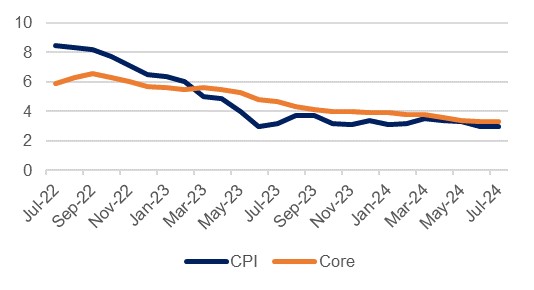

On inflation, the FOMC statement cautioned that it still needed ‘greater confidence’ that price growth would continue to move in the right direction before cutting, but Powell added that although the ‘job is not done on inflation…we can afford to dial back the restriction in our policy rate.’ Inflation has been cooling in recent prints, and at 3.0% y/y in June it was at the joint lowest since March 2021 when price growth first started accelerating (headline CPI had cooled to 3.0% previously in June 2023 before modestly picking up again thereafter). Core PCE inflation, the Fed’s preferred measure of price growth, slowed to 2.9% q/q in Q2, down from 3.7% the previous quarter. This still leaves price growth some way above the Fed’s 2% target, which informed our expectation of a hold yesterday, but it has been moving decisively in the right direction once again, reinforcing our expectation that the easing cycle will begin next month.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

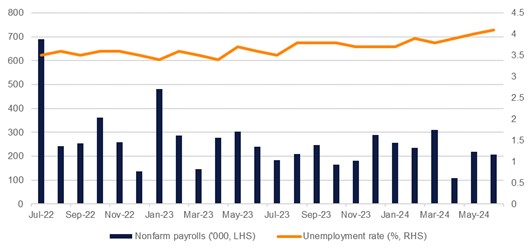

On the other side of the dual mandate, the labour market has been given increasing importance by Powell in recent press conferences, and his messaging was that while it remained robust for now it was slowing, and that the aim was to keep the unemployment rate low even as inflation came down. The labour market has remained resilient despite the extended period of higher rates, with a net gain of 206,000 on the NFP report last month, beating the predicted 190,000. The upside surprise in the Q2 GDP growth print (2.8% q/q annualised compared with the predicted 2.0%) also suggests that the economy and the labour market were not in immediate need of support from the Fed yesterday. Nevertheless, the previous months’ NFP prints were revised lower, job openings have been falling, and most of the new jobs last month came from the government and healthcare sectors, with retail jobs declining. The Fed will be hoping to secure a soft landing and so will likely look to start easing policy before there is a material downturn in employment data.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Markets were boosted by the dovish tone of the FOMC meeting yesterday, with a strong gain in US equities, especially the tech-heavy NASDAQ which had been under pressure in recent weeks. It closed up 2.6%, while the S&P 500 added 1.6%. Treasuries also rallied, falling by some 10bps on the day with the 2yr yield back to levels last seen in February. Markets have fully priced in the chance of a September cut, while 72.5bps of cuts are predicted by year-end.