The outlook is brightening in Jordan, following the past several years of pandemic-affected growth. While there remain significant challenges, not least from the ongoing threat of Covid-19 itself, for the time being it appears the worst has passed, and that conditions are approaching a more normal level. Our real GDP growth forecast of 3.0% this year is moderately higher than the consensus projection, predicated on an expectation that there will be a sizeable rebound in tourism, household spending will recover, and increased government investment will help stimulate activity.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Jordan’s real GDP growth rate slowed moderately in the third quarter, dropping to 2.7% y/y (from 3.2% in Q2), leading us to our 2021 estimate of 2.0% growth overall. Extractive industries were the primary growth generator with a 9.7% expansion, but construction (3.9%) transport & storage (3.5%) and manufacturing (3.2%) also held up well. This year we expect an ongoing improvement as the Covid-19 crisis should hopefully ease through the remainder of the year, enabling a recovery in the tourism sector in particular. Given that this was 16.3% of the total economy in 2019, but just 4.7% in 2020 according to the World Travel & Tourism Council (WT&TC), a fully revitalised tourism sector would provide a potential fillip to Jordanian growth this year. It should be noted, however, that at the time of writing at the end of January, Jordan is once again struggling with a resurgent virus that has seen daily case numbers rise back up to levels last seen during its last wave in late November/early December. This has led us to revise down our outlook from our previously more bullish 3.2% growth, given that the first quarter at least is likely to see diminished activity on the back of this.

Nevertheless, our expectation remains that the rest of the year should be stronger, barring any other new dangerous strain of the virus. Vaccination rates are comparatively low still, but mounting steadily, and economies are in any case getting better at coping with new outbreaks as the pandemic continues. At present there are no restrictions in place in Jordan, and borders are open, giving scope for a rebound in visitor numbers. Jordanian authorities are doing their best to market the country for those looking for a new destination in 2022 as international leisure travel restarts, coining the ‘Kingdom of Time’ brand to market its various high-draw attractions. A new United Airlines flight direct from the US will further help visitor numbers recover, and GDP sub-components such as Hotels & Restaurants will be boosted accordingly. Activity in this sector was still down -6.2% over 3Q 2021 compared to the same period in 2019.

A major employer in normal circumstances (18.6% of total employment in 2019 according to WT&TC), a resurgent tourism sector will also help boost domestic household spending. Unemployment in Jordan was persistently high even prior to the pandemic, averaging 18.7% over the three years to 2019, and it spiked even higher as the virus hit, rising to a peak of 25.0% in Q1 last year. However, it has started to decline in the last two prints, dropping to 23.2% in Q321, and we anticipate that it will decline further still as the economy rebounds. Rising inflation does pose a risk to private consumption, but price rises have been comparatively mild so far compared to what has been seen in many developed markets; y/y CPI hit 2.4% in December, but core inflation was at 2.0% and we would expect many of the energy and food price pressures to soften this year.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

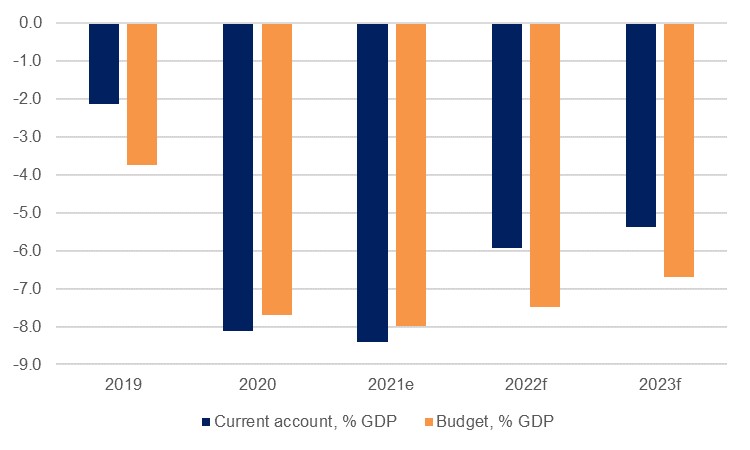

This general reopening rebound will be supported by an expansionary fiscal stance from the Jordanian government, which has pledged to boost capital investment this year. Despite this, we forecast that the budget deficit will continue to narrow, projecting a shortfall equivalent to 7.5% of GDP this year, from 8.0% last year, as government efforts to boost tax revenues have proven fruitful. Equally, ongoing IMF support comes with its own fiscal boost, and encourages further private investment from elsewhere. In January the Fund approved the latest disbursement of USD 335.2mn to Jordan as the country passed the third review of its current four-year USD 1.5bn support programme. The latest review by Fitch, whereby the agency upgraded its outlook to stable and affirmed its BB- rating is further supportive.