Abu Dhabi has announced a AED 50bn (USD 13.6bn) package to boost economic growth over the next three years. The measures will include creating 10,000 jobs for Emiratis, settling outstanding dues to private sector contractors as well as steps to boost investment by tackling red tape. Public sector employees have also received a one-month salary bonus, which was announced last month. Higher oil prices have provided more room for governments in the region to boost spending, and the UAE is particularly well placed with respect to its budget – we anticipate a close-to-balanced consolidated budget this year after the new spending measures are taken into account. The recent announcements also support our view that non-oil sector growth in the UAE will be driven by government spending this year.

Economic data in the US overnight beat expectations again. The non-manufacturing ISM rose to 58.6 in May while the services PMI was revised higher for last month as well. The JOLTS survey showed there were a record number of job openings in April, providing further evidence of a tight labour market as firms found it increasingly difficult to find the right candidates. In the UK too, the services PMI rose by more than forecast to 54.0 in May, and contributing to a rise in the composite PMI to 54.5, the highest reading since February. The pound recovered on the news, and has strengthened further overnight. Eurozone PMIs were broadly in line with expectations, as was retail sales at 1.7% y/y in April.

Australia’s economy grew at a faster than expected 1.0% q/q (3.1% y/y) on the back of stronger export growth and weaker imports. Domestic demand was more subdued as wage growth remains modest and household indebtedness is high. The Reserve Bank of Australia kept rates on hold at 1.5% yesterday.

King Abdullah of Jordan has appointed Omar al-Razzaz as the new prime minister. Previous post-holder Hani Mulki was forced to resign on Monday after days of protest in the country made his position increasingly untenable. Mulki had been determined to push through planned tax hikes as part of Jordan’s IMF reform package, but with inflation having already risen to a five-year high last month, the population has become increasingly opposed to ongoing austerity measures. Protests continued Tuesday despite Mulki’s departure, suggesting that significant concessions could be needed to quell the unrest.

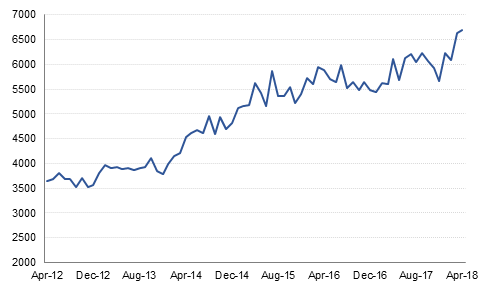

Source:Bloomberg, Emirates NBD Research

Source:Bloomberg, Emirates NBD Research

Treasuries closed higher following gains in bunds. Comments from the new Italian Prime Minister where he indicated that his government will follow a radical policy program weighed on bond markets. Yields on the 2y UST, 5y UST and 10y UST closed at 2.49% (-2 bps), 2.76% (-3 bps) and 2.92% (-2 bps) respectively. Yield on the 10y bund dropped -5 bps to 0.36% but rose +26 bps on Italian 10y government bonds to 2.77%.

Regional bonds continued to trade in a tight range. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped -1 bp to 4.60% and credit spreads widened 1 bp to 189 bps.

Dana Gas has received consent from majority of bond holders of its USD 700mn sukuk holders to restructure the debt.

In terms of rating action, Fitch revised the outlook on Qatar’s ratings to stable from negative. The rating agency said that public sector liquidity injections have stabilized the banking sector and stemmed the outflow of non-resident funding.

GBP was Tuesday’s biggest gainer, rising against the other major currencies following a stronger Services PMI (see macro). Over the course of the day GBPUSD rose 0.60% to reach 1.3393 in a move which pared Monday’s losses. As we go to print, GBPUSD is trading 0.06% higher at 1.3401. We anticipate the next level of resistance being near the 50% one year Fibonacci retracement 1.3483.

This morning’s outperformer is AUD which has advanced following stronger than expected growth data (see macro). Currently AUDUSD is trading 0.51% higher at 0.76553 and is on target to finish above the 50 day moving average (0.7606) for a third consecutive day. We anticipate the next level of resistance being at 0.7690, not far from the 38.2% one year Fibonacci retracement (0.7689).

Developed market equities closed mixed as the focus shifted back to the ongoing concerns over global trade. The S&P 500 index rose +0.1% while the Euro Stoxx 600 index dropped -0.3%.

Regional equities continued their positive run with the Tadawul adding +0.9% and Qatar Exchange gaining +2.1%. Dar Al Arkan, which accounted for more than a quarter of total turnover, rallied +4.6%. Samba (+4.1%) and Sabb (+2.3%) were other notable gainers.

Oil prices pared early session losses following an industry report which showed a drop in American crude stockpiles. The American Petroleum Institute was said to report that crude stockpiles fell over 2 million barrels last week. This helped offset sharp fall in prices following reports that the US government has asked Saudi Arabia and OPEC to increase output by 1 million barrels a day. The Brent oil price added +0.1% to close at USD 75.38/bbl and WTI gained +1.2% to close at USD 65.52/bbl.

Click here to Download Full article