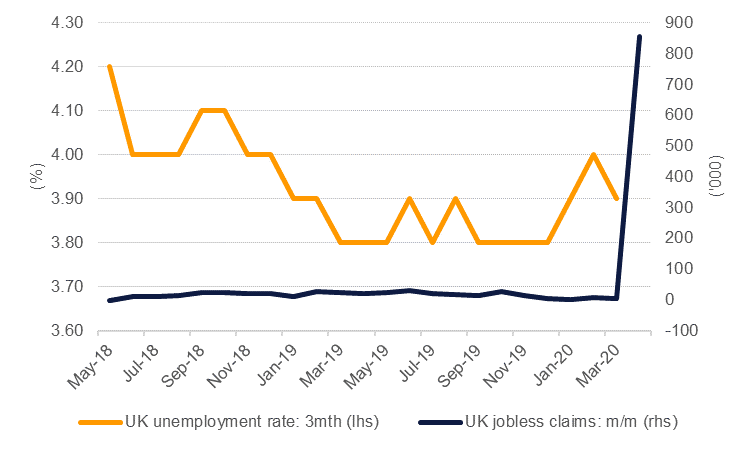

Labour data from the UK revealed how badly the jobs market was hit by lockdowns related to coronavirus. Jobless claims in April spiked to 856k compared with just 5.4k a month earlier. Data for the three months to March showed that the relative strength of the UK’s labour market was intact prior to the coronavirus taking hold of the country with the unemployment rate at 3.9%, actually lower than expected. The UK’s fiscal support measures have aimed to keep staff on payrolls through a wage subsidy scheme, unlike the US where the government has extended more unemployment benefits. Nevertheless, with the economy likely to endure a sharp contraction in Q2 the labour market in the UK is likely to show more and more weakening.

The ZEW measure of German investor confidence soared for May, likely on the hope that a vaccine for the coronavirus would be developed and economic conditions globally would return back to normal. After falling to 28.2 a month ago, the ZEW expectations survey jumped to 51. However, the assessment of the current condition remains very weak at -93.5, a little worse than a month earlier and weaker than market expectations.

Abu Dhabi tapped a bond issuance made earlier in April for an additional USD 3bn in funds. The 2025 maturity priced at 135bps over benchmark rates while the 10yr at 150bps and a 30yr at a coupon of 3.25%. Borrowing from the GCC year-to-date has hit USD 16bn as government raise funds as oil prices remain at depressed levels and economies drift a low levels of activity. Elsewhere in the region, Morocco is reportedly considering a new Eurobond issuance although details are minimal at this stage.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries closed higher in steady trading as the Fed Chair Jerome Powell reiterated his previous comments at Senate hearing. The focus also remained on heavy IG issuance. Yields on the 2y UST and 10y UST closed at 0.16% (-1 bp) and 0.68% (-4 bps) respectively.

Regional bonds continued their relentless positive run. The YTW on BB GCC Credit and High Yield index dropped 3 bps to 3.60% and credit spreads closed flat at 295 bps.

Abu Dhabi sold an additional USD 3bn as part of its three-tranche bond deal originally priced in April.

The dollar continued its bearish run after Monday's dramatic slump, but alternated gains with losses throughout the day, meeting support at 99.230 to bounce back to 99.470. The JPY fell after the Bank of Japan announced they will hold an emergency policy meeting on Friday to support struggling businesses. USDJPY is sitting just below the 50-day moving average of 107.77 and this will be the key figure to monitor in the coming days.

The euro strengthened against the dollar experiencing modest gains to reach 1.0940. Sterling faced positive movement after the UK announced a post-Brexit tariffs' regime despite recording a huge surge in jobless claims. The currency increased by over 0.50% to reach 1.2260. Similar to the Yen, the Pound is close to breaching the 50-day moving average of 1.2283. The AUD and NZD traded at peak prices in the closing hours of yesterday but have since reversed some of their gains this morning, currently trading at 0.6545 (+0.34%) and 0.6100 (+1.00%) respectively.

Following a sharp rally in the previous session, investors were a bit cagey yesterday as questions were raised about results from the vaccine trial. The S&P 500 index and the Euro Stoxx 600 index dropped -1.1% and -0.6% respectively.

Regional equities closed higher as investor sentiment remained positive following sustained strength in oil prices. Most indices closed higher with the Tadawul (+1.8%) leading the rally. Saudi Aramco jumped +3.1% to trim its year to date loss to 5.4%. Banking sector stocks also rallied.

Oil prices ended the day mixed overnight. Brent futures were down slightly at USD 34.65/b (a 0.5% decline) while WTI gained 2% to settle at USD 32.50/b. Neither contract is showing much momentum in early trading today.

Markets are relatively short on credible fundamental data points related to demand. News that China’s consumption has returned to pre-coronavirus levels will be welcome but remains challenging to confirm while consumer preferences—globally---for private transport in their cars vs public transport may not necessarily be a long-term shift in oil demand patterns.

The API reported a draw in crude stocks of 4.8m bbl last week with gasoline inventories also down. However, there was a healthy build (5.1m bbl) in distillates; diesel and jet fuel mainly.