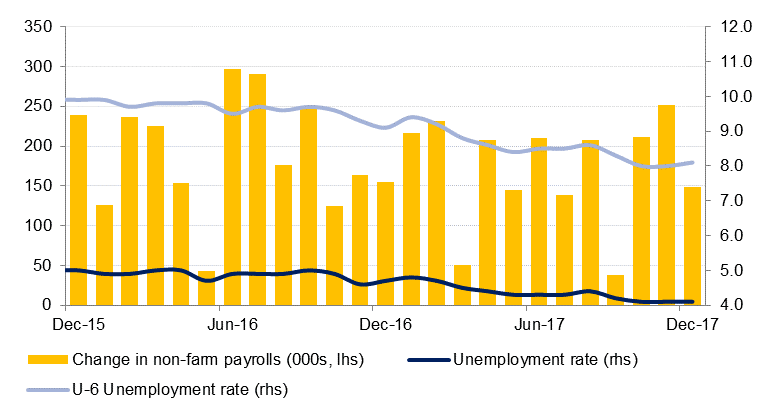

The start of the year has seen markets continue where they left off in 2017, largely ignoring uncomfortable political headlines and focusing instead on the positive fundamentals evident around the world. The passage of the tax bill in the US at the end of 2017, the continued rally in commodities and a string of strong economic data are providing strength to equities and also serving to keep bond yields pressured higher. Non-farm payroll jobs rose by 148k in the US in December, which was less than expected, but with the other details relatively solid. Prior payrolls were revised higher for November (to 252k from 228k) and the jobless rate held steady at 4.1% where it has been since October. The workweek was 34.5 for a second month, while hourly earnings were 0.3% which left the y/y rate at 2.5%. All in all the data was probably enough to keep the Fed’s views on the economy intact and to keep the dot-plot path tracking three rate hikes this year.

Eurozone inflation slowed in December, falling to 1.4% from 1.5% a month earlier. Core inflation, which strips out volatile energy and food prices, held at 0.9%. Inflation accelerated overall in 2017, to 1.5% on average from 0.2% in 2016, and improving economic conditions along with higher commodity prices should help improve inflation prospects in 2018. However, there are few signs yet that the regional Eurozone economy warrants further change in monetary policy beyond the ECB’s tapering of asset purchases this year.

Saudi Arabia will reinstate new year wage increases for public sector workers and will also introduce monthly payments to state workers to offset the impact of the introduction of VAT and higher energy prices at the start of the year. Soldiers on active duty will receive an additional monthly payment. The government also plans to bear some of the VAT costs for education and some health services and the first purchases of houses up to USD 226,660. The payments will help to support household consumption and thus non-oil sector growth. However, the move highlights the challenges facing the authorities as they attempt to restructure public spending. Separately, Saudi Arabia will reportedly finance the construction of a road and fishing facility in Oman. The Saudi Development Fund will provide a grant of USD 210mn for the projects as well as another USD 150mn to support Omani SMEs.

Bond markets started the year on a cautious note as positive economic data across the developed world caused benchmark yields to widen. Yields on 2yr and 10yr UST rose 7bps each to 1.96% and 2.48% respectively in the first week of trading and those on 10yr Gilts and Bunds closed at 1.24% (+6bps) and 0.43% (+1bp) respectively.

Regionally, GCC bonds had stable start to the year as benchmark yield widening was counter balanced by an average 7bps tightening in credit spreads on the Barclays GCC bond index from 130bps to 123bps thereby leaving the average yield on the index unchanged at 3.57%. Investors effectively shrugged off concerns about geopolitical events including the protests in Iran.

In the primary market, Sultanate of Oman rated Baa2 by Moodys has mandated banks for a triple tranche dollar bond as it looks to fund its OMR 3bn ($7.8bn) budget deficit for 2018. In another development, Oman is believed to have accepted a $210 million grant from the KSA government to fund development of its Duqm port where a fishing facility and oil refinery are underway.

Despite withstanding softer than expected employment data to rise on Friday, the dollar declined last week with the Dollar Index falling 0.12% to close at 91.95. This the third consecutive week that the index has closed below its 200 week moving average (93.73) and results in the USD starting 2018 on softer ground. We expect further declines in the short term with support coming in at the one year low of 91.01. Should this level fail to hold, we could see a larger decline towards 88.42 (the 50% five year Fibonacci retracement).

CAD was Friday’s outperformer, gaining against all the other major currencies after stronger than expected economic data. Data from STCA – Statistics Canada showed that 78,600 jobs were added in December, compared with market expecations for 2,000 jobs. These additions helped reduce the unemployment rate to 5.7% from 5.9% the previous month in contrast with expectations for an increase to 6.0%.

Regional equities made a positive start to the week. The Tadawul rose +0.6% after King Salman announced a monthly allowance for citizens to ease the transition to VAT. Retail sector stocks rallied on the news with Jarir adding +2.6%.

Elsewhere, Arabtec jumped +6.5% after one of the company’s units won a AED 250mn contract from Emaar Properties.

Oil prices gained for the first week of the new year, rising for three weeks in a row. Brent futures closed the week at USD 67.62/b after having breached USD 68/b earlier in the week while WTI closed at USD 61.44/b. Market surveys of OPEC production suggest compliance with the deal improved in December, in part thanks to deterioriating output from Venezuela but also from the UAE which cut output to below its targeted level. Political unrest in Iran will also act as a near-term positive catalyst for oil prices although there is unlikely to be much immediate impact on production.