Positive data from Asia this morning should help the risk-on mood carry over from last week as Japan’s Q3 GDP data beat expectations and as economic data from China showed the economy broadly steady in the month of October. Japan’s Q3 GDP expanded at an annualized 2.2%, over twice as strong as expected helped by stronger than expected exports. China’s economic data also continued to point to a soft landing, with industrial production, retail sales and fixed investment all growing in line with expectations.

This good news out of Asia follows on from the positive trend that is developing in the US as markets increasingly warm to the outline of what Trump’s economics policy looks likely to be, including a powerful fiscal stimulus and less regulation. More benign language and rhetoric from the President-elect is also helping the mood. Meanwhile attention in the US will continue to be on the transition team that President-elect Trump is putting together, but fundamentals will also come back into focus this week with CPI inflation data due out along with retail sales, industrial production, PPI, and housing starts. The spotlight will also be on the Fed as bond yields continue to rise and with lot of Fed officials due to speak over the course of the week, including Fed Chair Yellen who will testify to Congress on Thursday.

Given the renewed optimism about reflation prospects any signs that inflation is continuing to pick-up already will put more pressure on the bond market, which will in turn make Yellen’s case for holding interest rates steady harder to sustain. At the end of last week the Fed Vice Chair Stanley Fischer indicated that the Fed was on track to raise rates later this year last week, saying that the Fed is reasonably close to achieving its goals. Implied futures prices have gone back to putting an 84% chance of a rate hike at the 13-14 December FOMC.

Source: Emirates NBD Research

Source: Emirates NBD Research

|

| Time | Cons |

| Time | Cons |

| Italy CPI | 13:00 | -0.1% | EZ Industrial Production | 14.00 | -1.0% |

Being bond bullish had paid off for much of this year. However violent market gyration post the surprised outcome of the US election saw material sell off in the bonds last week. Although President elect Mr Trump’s exact policies are not yet clear, market has already priced the prospect of higher inflation from increased fiscal stimulus under a Trump presidency. UST curve steepened substantially with 2yr, 10yr and 30yr treasury yields closing at 0.91% (+10bps), 2.15% (+32bps) and 2.93% (+33bps) respectively over the week. Yields on sovereign bonds across the rest of the developed world followed suite.

Against this backdrop, GCC bonds reported one of its worst weeks with longer dated bonds getting particularly hammered. Yet they outperformed the wider emerging market bonds as investors shifted focus to higher quality issuances amid sell-off in developed market bonds. Most GCC issuers are in top quartile of the rating helped by government ownership. The option adjusted spread on the BUAEUL index (liquid UAE bonds) tightened 15 bps to 150 bps even as the yield increased to 2.893% from 2.788%. Relatively, the OAS on the Bloomberg EM Composite bond index tightened 3 bps to 317 bps while yield on the same jumped from 4.664% to 4.938%.

Asian equities have started the week on a negative note as investors’ pause to assess the impact of Trump’s policies on the Asia-Pacific region. The MSCI Asia Pacific index was trading -0.3% at the time of this writing.

In regional equities, Saudi Arabia was at the forefront again with the Tadawul rallying +2.1%. The index is now +21.6% since mid-October 2016. Real estate sector stocks continue to gain with Dar Al Arkan and Jomar adding +5.4% and +2.4% respectively.

Elsewhere, Egyptian equities continue to its post-devaluation rally with the EGX 30 index adding +2.1%. Within UAE bourses, the focus continues to remain on small-cap stock with market heavyweights suffering. Emaar Properties dropped -3.0% while Aldar lost -4.2%.

If what comes out of the Presidential handover is a mix of loose fiscal policy and tighter monetary policy, this would theoretically be seen as a very positive combination for the dollar, and this was certainly how things ended on Friday, with the dollar up across the board last week despite the interruption of the election. This is also how the new week is starting with further gains being registered especially against the JPY.

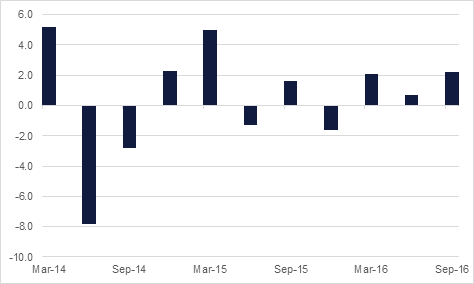

Oil markets whipsawed last week but ultimately ended the week lower as fundamentals outweighed the shock election of Donald Trump as US president. Brent futures closed down over 1.8% while WTI lost 1.5%, both ending the week below their 100- and 200-day moving averages. OPEC's latest estimate of its own production showed the bloc producing at a record high in October of 33.6m b/d thanks to major increases from Libya and Nigeria. The next OPEC meeting is only a few weeks away and the bloc is putting itself into a more challenging position if it indeed intends to cut to try and raise prices. Outside of OPEC, US oil companies added another two drilling rigs last week: since bottoming out in May, the US rig count has increased more than 40%.