Japanese manufacturing PMI softened slightly in October, easing to 52.5 from 52.9 in September but still pointing to expansion in manufacturing this month. The only major data releases scheduled for today are the Eurozone and US PMIs. In the Eurozone, both manufacturing and services PMIs are expected to soften slightly compared with September, but analysts still expect strong readings for both sectors at 57.8 and 55.6 respectively. Yesterday, Eurozone consumer confidence came in marginally better than forecast at -1.0 in October, marking the third consecutive month of improvement in sentiment. This suggests that recent events in Spain have not weighed on consumer confidence so far.

The UK CBI’s industrial trends survey showed a mixed picture, with a softening in business sentiment overall, but with key readings of future activity holding up relatively well. The headline quarterly business optimism index fell to a -11% reading for the three months to October, down from +5% in the three months to July. However, expectations for total new orders rose to a balance of +20%, which is the most upbeat reading since April. The survey also found that cost pressures remained quite firm and that companies with spare capacity was at its lowest in nearly two decades, keeping the onus on the Bank of England to start withdrawing monetary stimulus. The mixed readings illustrate the contrasting pressures on British companies, especially within the context of difficult Brexit negotiations which appear to be going very slowly and with little visibility about the eventual outcome.

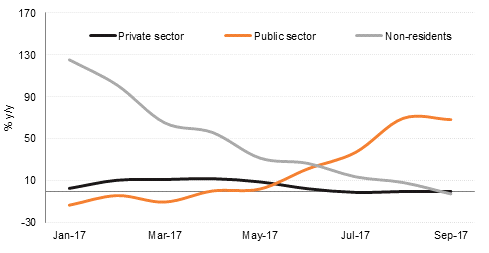

Non-residents’ deposits in Qatari banks declined by a further -QAR 6.2bn in September, bringing the total outflow of non-residents’ deposits since the end of May to -QAR 41.8bn (-22.6%). However, the rate of decline in foreign deposits has eased. Residents’ private sector deposits increased for the second month in a row (+QAR 3.1bn) and public sector deposits increased by QAR 7.3bn last month, more than offsetting the outflow from non-residents. Public sector deposits have grown by QAR 102.4bn (USD 28bn; +51%) since the end of May 2017, when trade sanctions were imposed by the UAE, Saudi Arabia, Bahrain and Egypt. Total bank deposits in Qatar grew 0.5% m/m and 17.5% y/y in September.

Source: Haver Analytics, Bloomberg, Emirates NBD Research

Source: Haver Analytics, Bloomberg, Emirates NBD Research

US Treasury bonds halted their decline as market participants wait for more news on the Federal Reserve leadership succession and the U.S. budget. US Yield curve was down 2bps across the tenures with yields on 2yr, 5yr, 10yr and 30yr closing at 1.56%, 2.00%, 2.37% and 2.88% respectively. Ahead of ECB’s meeting on Thursday market participants are speculating about a possible nine month extension of the QE program albeit at half the current rate. Yields on 10yr Bunds closed 2bps lower at 0.43%. Global credit spreads were mixed with CDS levels on US IG rising by a bp to 53bps and those on Euro Main declining by a bp to 55bps.

Regional market followed suit with its developed world counterparts. Gaining support from falling benchmark yields, cash bonds in the region had slight bid bias with yield on Barclays GCC index closing at 3.41% (-1bp) while credit spreads were stable at 128bps. That said, without any material catalyst, CDS levels on Dubai rose by 7bps to 127bps and those on Kuwait tightened by 4bps to 62bps while remaining range bound on other GCC sovereigns.

On the credit rating front Moody’s affirmed Invest Corp’s rating at Ba2 and revised the outlook from negative to stable citing Investcorp’s strong franchise and long track record. In the primary market, Oman’s OMGRID owned Mazoon Electricity (rated Baa2/BBB) is on the road for a benchmark sized USD sukuk transaction.

The dollar managed to start the week on a broadly stronger footing, gaining against most peers. With few macro catalysts on Monday to affect the greenback, speculation over the next Fed chair will be jostling the currency and rates markets over the course of the week. Sterling was a notable gainer against USD overnight, if only just, after optimistic messages about Brexit negotiations from UK Prime Minister Theresa May.

US Equities retreated a little, taking a breather from the stellar run over the recent weeks. Dow Jones closed down by -0.23% mainly due to some softness in technology shares. In contrast, European equity bourses closed mostly in black even though Catalan separatists planned their response to Spain Prime Minister Mariano Rajoy. FTSE 100 and DAX closed up at +0.10% and 0.27% respectively. Asian equities have opened mixed this morning with Hang Seng and Nikkei trailing in green and ASX 200 in red by -0.01%.

Regionally, sell off in property shares such as D&S, Emaar and Union Properties led the Dubai Index down by 0.70% yesterday though Abu Dhabi index was stable. Tadawul fell 1.17% despite the country announcing intension to attract more foreign participation on its listed companies’ share register. Softness in oil also saw weakness in other GCC bourses with Qatar and Kuwait closing down by circa 0.5% each.

Oil futures were split to start the week with Brent falling 0.7% and WTI up 0.8%. Reports of disruptions to exports from Iraq will provide a near-term floor under prices as now flows from the southern parts of the country, unaffected by recent political tension, are also dipping. The dip in Brent helped compress the backwardation at the front of the curve to its narrowest in nearly two months, just USD 0.10/b compared with as much as USD 0.52/b in late September.