Despite downgraded global growth outlooks, financial markets have performed relatively well so far this year. However, this should probably be seen in the context of the sharp losses seen in December, as well as being due to the reassurance being offered by policymakers about monetary policy.

- Global macro: While markets have started the year in relatively good spirits, with equities and oil prices rising, growth forecasts have been pared already including by the World Bank which warned of ‘Storm Clouds’ this year.

- GCC macro: GCC growth rebounded in 2018, following a recession in 2017. We are cautiously optimistic on 2019, with oil production likely to be higher on average for most GCC producers, and non-oil growth underpinned by government spending.

- MENA macro: As some of the .global pressures on non-GCC MENA countries have eased over the past several months, locally driven political risk has returned to the fore in terms of negative drivers on the regional economies.

- Sub-Saharan Africa macro: China is investing in East Africa as part of its Belt and Road Initiative, with potential windfalls for China, Africa, and the UAE.

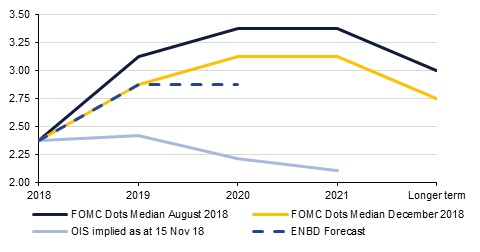

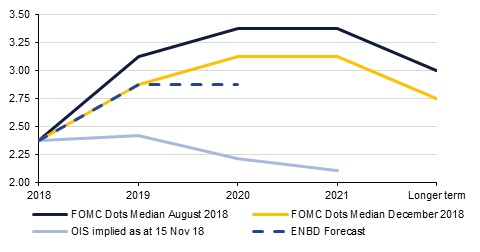

- Interest Rates: After increasing for much of the first three quarters in 2018, UST yields declined sharply in 4Q18 in response to evolving expectations of slower global economic growth.

- Credit Markets: GCC bonds outperformed their EM peers in 2018 mainly as a result of increased bid on the back of inclusion in the JP Morgan’s EMBI index.

- Currencies: The dollar has fallen since the start of the year, adding to December’s losses, and could be headed for a third consecutive January of declines.

- Equities: Global equities have started 2019 on a stronger footing following some progress on issues weighing on investor sentiment at the end of last year. Notwithstanding the positive start to the year, there are enough reasons to be cautious looking ahead.

- Commodities: We have revised our oil price forecasts for 2019 lower as global demand conditions look set to worsen amid still persistent supply growth. We now expect Brent futures to record an average of around USD 65/b and WTI futures close to USD 57/b.

Markets' progressively pricing out the Fed

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Click here to Download Full article