In a speech last night, Fed Chairman Jerome Powell maintained that the Fed’s policy of gradual tightening remained appropriate despite the recent pick up in wage growth and continued low unemployment. He stressed that inflation expectations remained well anchored, and that if this changed then the Fed would be able to respond.

Italy continues to weigh on European markets, with Italian equities declining a further -1.1% yesterday and the broader Stoxx600 down -0.5%. Italian 10Y bond yields rose to 3.45%, the highest level in more than four years. Reports this morning suggest that the Italian government may be willing to reduce the budget deficit to -2.0% of GDP in 2021, rather than keep it at -2.4% over the next three years as originally proposed. However, the deficit for next year remains -2.4% of GDP for now, which may be too high for the EU.

The Reserve Bank of Australia kept rates on hold at 1.5% as expected yesterday, and there was little change to the post-meeting statement. Most analysts are expecting rates to remain on hold in Australia until H2 2019 at the earliest.

Services PMI data released in Japan this morning showed slower expansion in the services sector in September. The services PMI fell to a two-year low of 50.2 from 51.5 in August although this was likely due to natural disasters experienced last month. Early indications are that activity has recovered in the areas affected by the earthquake and subsequent power outages, so the dip in the PMI may prove temporary.

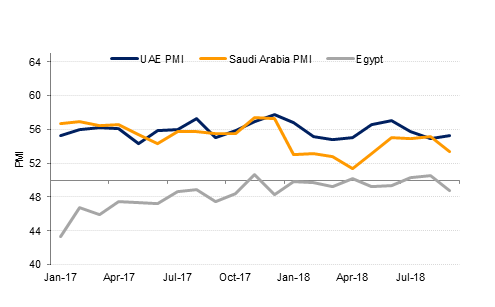

Regional PMIs in September were mixed. The UAE PMI was marginally higher at 55.3, although employment declined on average for the second month in a row. New order growth was boosted by firmer external demand. The PMIs for Saudi Arabia and Egypt declined in September, with Egypt’s PMI slipping back into contraction territory for the first time in three months on declining output and new orders.

Slight softness in the PMI data released earlier in the week kept a lid on US yields. UST curve recorded slight bear flattening yesterday with yields on 2yr, 5yr and 10yr reducing to 2.81% (-1bp), 2.95% (-1bp) and 3.06% (-2bps) respectively. Italy weighed on the sentiment in Europe, causing yields on 10yr Bunds to fall 5bps to 0.42%. Risk aversion caused credit spreads to widen with CDS levels on US IG and Euro Main closing wider at 59bps (+1bp) and 69 bps (+2bps) respectively

Regional bonds had little idiosyncratic news to trade. Yield on Barclays Bloomberg GCC bond index was largely unchanged at around 4.44% even though credit spreads were 3bps wider to 156bps. CDS levels on GCC sovereigns also had a widening bias. Bahrain 5yr CDS closed 3bps wider to 300bps, pending confirmation of details on the aid package from its neighbours.

In the primary market, Saudi Basic Industries priced $2 billion deal across two tranches at MS+115 ($1bn, 5yr tranche) and MS+155bps ($1bn, 10yr tranche) respectively.

JPY outperformed on Tuesday gaining on all the other major currencies as many developed equity markets closed in the red. Over the course of the day USDJPY fell by 0.25% to reach 113.65. As we go to print, the cross currently trades at 113.69. While the price remains above the 200-week moving average (113.20), further gains towards the one year high of 114.73 remain a possibility.

Elsewhere the Euro has rallied this morning on reports that Italy plans to lower its deficit. EURUSD is currently trading 0.24% higher at 1.1576 during the Asia session in a move that may result in further gains and a retest of the 50-day moving average (1.1604).

Global equities traded mixed following a volatile U.S. session as investors weighed continuing concerns in Indonesia and Italy and strength in commodity prices. The Dow Jones climbed 0.46% while FTSE and DAX were down -0.74% and -0.42% respectively. Japan and Hong Kong are trailing in the red in early morning trades today.

Regional equity bourses also had a mixed performance. Abu Dhabi index was boosted +0.29% higher by trading in bank shares while Dubai index fell – 0.38% Kuwait closed down by -0.11% though Qatar was up +0.27%.

Oil futures managed to hold close to recent elevated levels with both Brent and WTI hovering near USD 85/b and USD 75/b respectively. Markets have been relatively short on new fundamental catalysts to support a substantial push higher and any further move in the short-term may be related more to general market sentiment rather than commodity-specific news. Private sector data showed a modest increase in US crude inventories last week while also highlighting a further dip in refinery runs, likely down to seasonal factors.

Click here to Download Full article