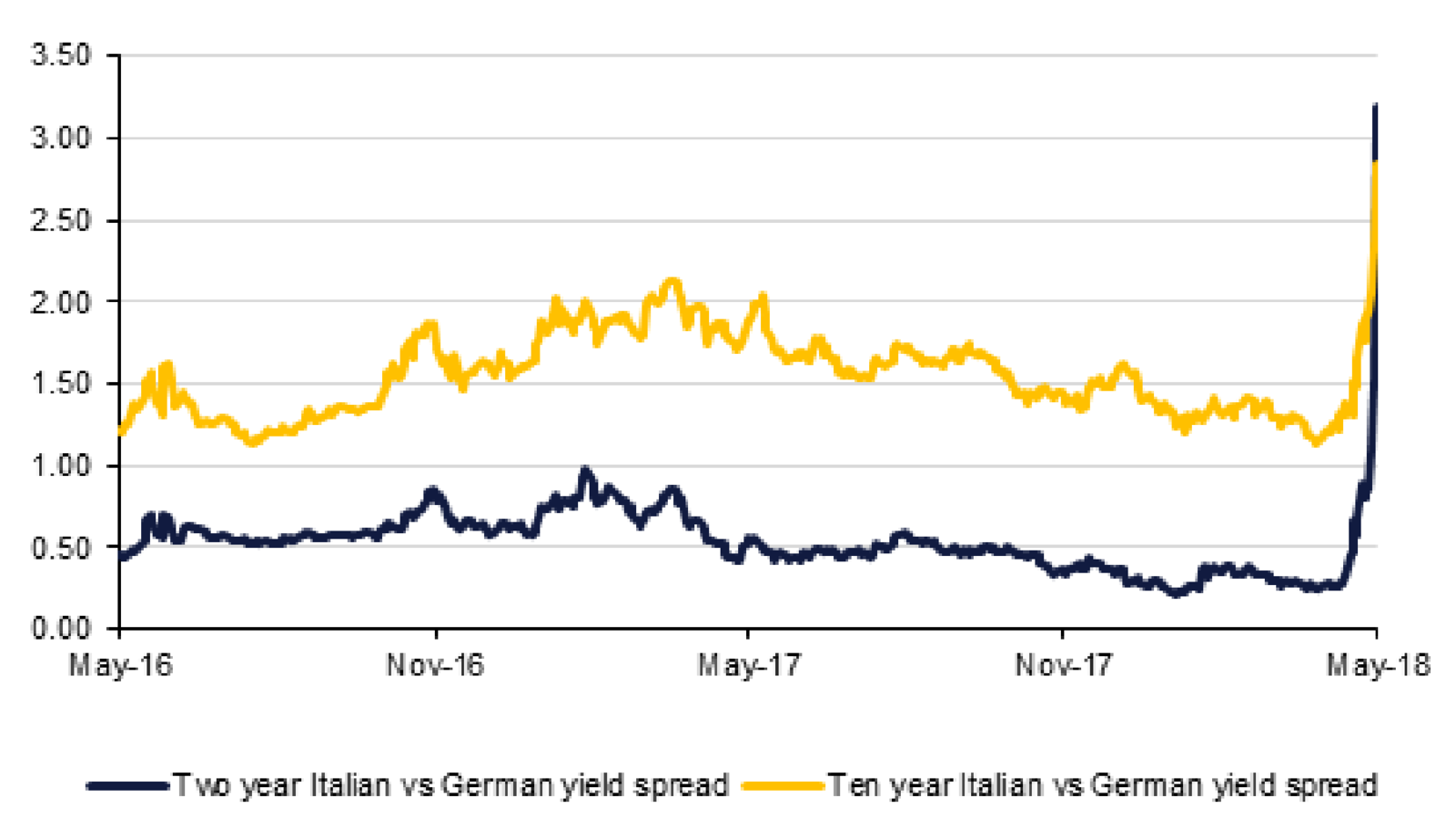

European markets continue to be convulsed by developments in Italy, which are posing a new existential threat to the Eurozone. Italian bond yields are continuing to rise, reaching their highest levels since 2014 yesterday (above 3.0%) while their German counterparts are plunging to historic lows (0.26%), with the consequence being that the gap between the two is widening sharply (see chart). The EURUSD exchange rate continues to sink while equity markets across Europe are also losing ground. Elections in Italy later this summer are likely to be the only way out of the current stalemate, but these are by no means likely to quell break-up fears. At the very least there will be three to four months of uncertainty, as the markets countdown to what will likely be seen as a referendum on the EUR. At worst it may well end with a government that is more eurosceptic than the one that has just been rejected. Greece was only 2.5% of Eurozone GDP yet its crisis managed to represent a threat to the Eurozone from 2011 to 2014. Italy meanwhile is 15% of Eurozone GDP and its national debt represents nearly 25% of total Eurozone debt, which is why the risks are much greater.

Meanwhile trade tariffs are back in the headlines as well as U.S. President Trump said he is moving forward with plans to impose tariffs on $50 billion of Chinese imports and curb investment in sensitive technology, ahead of trade talks between the U.S. and China in a few days. A decision on tariffs for steel and aluminium imports from the EU and other allies is also expected to be taken at the end of this week.

Passenger traffic at the Dubai International Airport (DXB) rose to 30.4mn in Jan-Apr 2018, up by 0.8% y/y. In April alone, traffic remained flat with 7.6mn passengers passed through DXB. Passenger traffic is expected to exceed 90mn at DXB by the end of 2018, according to Dubai Airports. Separately, freight volumes at DXB fell slightly by -0.7% y/y in April to 216,333 tons. Year to date volumes totalled 832,186 tons, down by -2.6% over Jan-Apr 2017.

Treasuries rallied sharply across the curve with the belly leading the gains amid a broad risk-off sentiment. The flight to safety trade was fuelled by political developments in the Eurozone and renewed concerns of a full blown trade war between the US and China. Yields on the 2y UST, 5y UST and 10y UST closed at 2.31% (-16bps), 2.58% (-18 bps) and 2.78% (-15bps).

The trend in Eurozone bonds continued to remain the same since the start of this political crisis. Yields on 10y bunds dropped -8bps to 0.26% and increased +48 bps on 10y Italian government bonds.

The fall in benchmark yields has not translated into gains for regional bonds. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped only -2bps to 4.57% and credit spreads widened by 12 bps to 200 bps.

S&P affirmed Saudi British Bank at BBB+ and outlook remained stable. The rating agency said that it sees the proposed merger with Alawwal Bank as neutral for SABB’s creditworthiness.

The Euro continued to come under pressure on Tuesday, declining against most of the other majors. EURUSD fell for a third consecutive day, breaking below the 50 month moving average (1.1590) for the first time since October 2017. While political issues persist in Italy, the risk of further declines towards the 23.6% one year Fibonacci retracement of 1.1451 remain a possibility.

Today, investors will be looking at inflation and employment data out of Germany, for cues on the performance of the Eurozone’s largest economy. In addition, this afternoon’s European Commission surveys will come under scrutiny. With the 14-day RSI showing oversold conditions for EURUSD, following seven consecutive weeks of declines, traders may use any upside surprises in the economic data to take profit.

On the other side of the Atlantic, investors will be looking towards the Bank of Canada, who are expected to hold the interest rate at 1.25%. However, with markets currently pricing in a 92.3% of a rate hike before the end of 2018, any renewed bias towards tighter monetary policy in the central bank’s communication is likely to be constructive for the CAD.

Global equities closed lower as political developments in Italy and trade war between the US and China took center stage. The S&P 500 index dropped -1.2% and the Euro Stoxx 600 index declined -1.4%. The FTSE MIB index dropped -2.7%.

Regional equities closed largely positive on the back of gains in the Tadawul (+0.5%) and EGX 30 index (+1.3%). Banking sector stocks led the gain on the Tadawul with Samba adding +1.6% and Al Rajhi Bank gaining +1.1%.

Oil benchmarks continue to be under pressure as major producers consider whether to raise output in the second half to offset some of the declines in production from Venezuela and potentially Iran. WIT futures gave up 1.7% to close at USD 66.73/b while Brent was roughly flat at around USD 75.39/b. A general risk-off tone in markets is also weighing on commodities generally as fear of a trade war has resurfaced ahead of negotiations between China and the US next week.

According to reports, energy ministers from Saudi Arabia, the UAE and Kuwait plan to meet later this week to discuss OPEC matters. The proposed meeting comes ahead of the formal OPEC meeting on 22 June 2018 where potential increase to oil output will be discussed.