Italy’s political crisis deepened overnight after the President rejected the coalition government’s choice of Finance Minister, an avowed Eurosceptic, threatening the possibility of fresh elections and the possible impeachment of the President Sergio Mattarella. The EUR has recovered as the formation of a 5 Star/League coalition government now looks much less likely taking with it the risk of more contentious policies especially over Europe and over government spending. However, if elections do follow the chances are the outcome could be much worse if voters continue to reject the conventional political parties.

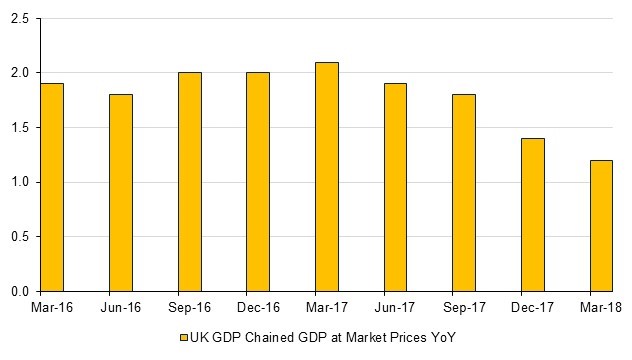

Data out at the end of last week showed the UK economy expanded 1.2% y/y during Q1 and up 0.1% q/q, consistent with the advance reading. This is a slowdown from Q4 2017’s 1.4% and is the fourth consecutive quarter that growth has slowed. With both soft and hard economic data showing downside surprises in the first quarter, the pound has continued to find itself under-pressure as the next round of Brexit talks loom. However, we expect Q2 economic growth to show a pick-up over Q1, a prospect made more realistic with retail activity already showing a bounce in April.

More encouraging out of the Eurozone were the IFO surveys which reflected a more positive picture. German business confidence rose to 102.2 in May compared with 102.1 the previous month, halting a five month slide in Europe’s largest economy. This latest report may signal that the economy is stabilizing following a quarter in which exports fell by the largest amount in over five years and is supportive of comments from the Bundesbank that they expect economic momentum to accelerate in Q2 2018.

In the UAE, central bank data showed both bank deposits and bank lending slowed -0.1% m/m in April. On a y/y basis, deposits were up 3.4% while loan growth slowed sharply to 0.7% from 2.1% in April.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Last week, Treasuries closed higher as minutes from the last Fed meeting eased concerns over a faster pace of rate hikes in the US. The USTs also received support from a flight to safe haven as political uncertainty persisted in Italy and resurfaced in Spain. Yields on the 2y UST, 5y UST and 10y UST closed at 2.47% (-11 bps w-o-w), 2.76% (-12 bps w-o-w) and 2.93% (-12 bps w-o-w).

Regional bonds found some support as prices tracked moves in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped -9 bps w-o-w to 4.59% and credit spreads widened 2bps w-o-w to 187 bps.

Saudi Arabia raised SAR 3.95bn from a tap issuance under its SAR-denominated sukuk programme. The issuances were divided into three tranches of SAR 3.35bn (2023s), SAR 350mn (2025s) and SAR 250mn (2028s).

Fitch placed Alawwal Bank’s ratings on positive watch following a non-binding agreement with SABB to merge.

Over the last five trading days, the Dollar Index has risen 0.66% to reach 94.25. Over the last month, there have been many key technical developments. The index broke above the former resistive 100 day moving average (90.613), for the first time since December 2017 and with this key level providing support, continued to compound additional gains and break above the 200 day moving average (91.947). The same move has resulted in a break of the former daily downtrend that had been in effect since January 2017. Analysis of the weekly candle chart also shows that further gains may lie ahead for the dollar in the short term. On May 18th, the Index closed above the resistive 50 week moving average (92.498) for the first time since May 2017 and has now closed above this level for two weeks. In addition, the weekly close on the 25th of May is above the 61.8% one year Fibonacci retracement (94.197). An additional weekly close above this level will be bullish for USD.

Regional markets closed lower as weakness in oil prices over the weekend weighed on investor sentiment. The DFM index and the Tadawul dropped -0.8% each. Volumes continued to remain low across the board.

The stocks which had rallied last week gave up some of their gains. Emaar Properties lost -1.4% while FAB declined -2.8%.

Oil prices continued to fall overnight dropping a further 2.5% after slipping 4.5% on Friday after Saudi and Russian energy ministers agreed to restore some of their output they had halted as part of their accord with other OPEC producers, to compensate the lost output from Venezuela and Iran. OPEC meets on June 22 to set production policy for the rest of the year and perhaps into 2019 with expectations being that the producer group will fall behind the Saudi-Russia initiative.