Iraq looks set to enjoy a marked rebound in 2022, benefiting not only from higher oil prices and increasing production, but also the gradual easing of the Covid-19 pandemic. There remain challenges, including elevated Covid-19 cases at the start of the year and ongoing political risk, but on the whole the outlook is for much improved conditions. We forecast real GDP growth of 4.9%, compared to an estimated 1.4% last year.

The Iraqi economy has been buffeted over the past several years, not only by the Covid-19 pandemic, but also the sharp fall in oil prices which hit government finances, alongside an OPEC+ mandated curb on production which weighed on real growth. These factors led to a real GDP contraction of -15.7% in 2020, and there was only a modest return to growth last year as these factors remained in play. As things stand, the producers’ bloc has steadily increased production through the second half of 2021, and Iraq produced 4.3mn b/d in December, compared to a low of 3.7mn b/d in August. In 2022 we project average production levels of 4.5mn b/d, which when annualised would mark an 11.4% increase on last year. Given that the oil sector still accounts for around two thirds of the Iraqi economy, this will provide a substantial fillip to growth.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

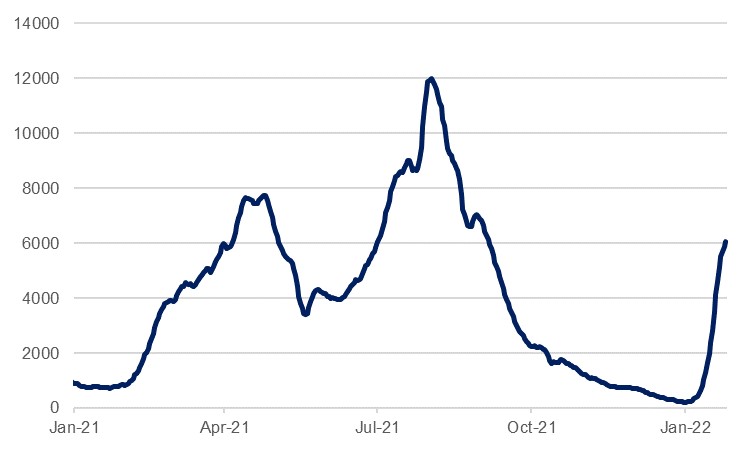

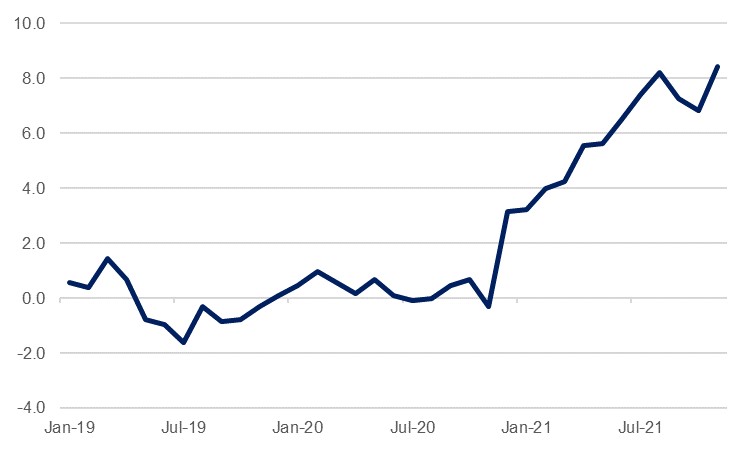

In terms of the non-oil economy, the expectation is that easing pandemic problems should lead to an improvement there also, although the spread of the Omicron variant does pose near-term challenges in the first quarter. Daily case numbers have risen to over 6,000 for the first time since September, and this could weigh on consumption levels over the start of the year. Nevertheless, we still anticipate an improvement on last year as restrictions on activity have been muted to now and with vaccination rates rising the impact of the virus on the economy should be steadily more muted. Household spending should also be boosted by easing inflation levels as the December 2020 devaluation of the dinar passes through. CPI inflation had risen to 8.4% y/y in November and we estimate an average rate of 6.5% over the year, but as the devaluation impact wanes we forecast that this will moderate to an average of 2.5% in 2022.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Iraq has been beset by sporadic protests over the past several years, with grievances such as unemployment and electricity shortages to the fore but improving economic conditions more generally this year should help alleviate some of this and encourage greater inflows of investment. Although the country is still without a government three months after October elections, negotiations on cabinet formation are reportedly making progress, and current prime minister Mustafa al-Kadhimi looks set to remain in post, with the support of the Sadrist movement. As such, a continued focus on tackling corruption is likely.