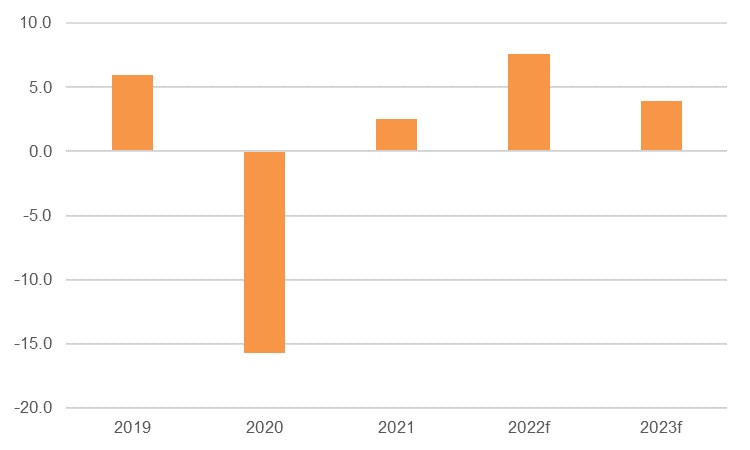

We hold to our view that Iraq will see robust GDP growth this year, maintaining our forecast for 7.6% which would represent one of the strongest growth performances in the MENA region. The risks are arguably tilted to the upside, and we are at the bottom end of the range with this forecast compared to the consensus outlook. However, while the oil sector has seen a strong production surge over the first nine months of the year, the non-oil sector has looked less positive and that will have weighed on the headline figure. Moreover, with OPEC+ agreeing on substantial cuts to supply this week, the rate of growth in the oil sector through the final quarter will also be weaker than it would otherwise have been. On this basis, and the expectation that there will not be a dramatic improvement in non-oil private sector activity, we forecast a slower pace of 4.0% in 2023.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Iraqi crude production averaged 4.39m b/d over the first nine months of 2022, according to Bloomberg data, representing y/y growth of 10.6% over the 3.97m averaged over the same period last year. Given that the sector represents around 40% of the total economy, a surge in production will have provided a significant boost to growth over the year so far. However, even if oil production is maintained at the same level through the final quarter, the base effects mean that this would slow to a y/y gain of 3.3% in Q4. With OPEC+ planning to take as much as 2mnb/d off the market, even as much of this would be a symbolic gesture (production quotas are not universally being hit as it is), some of this will come from lower Iraqi production, resulting in even slower growth in the oil economy through Q4.

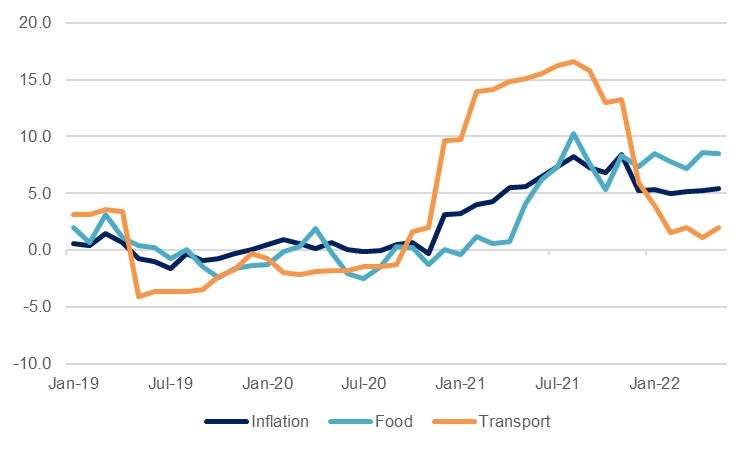

Less positive than the oil story, the non-oil sector has been weighed down by the aftereffects of the Covid-19 pandemic, rapid price growth, and political uncertainty that has dampened the investment outlook. Iraqi households came under concerted pressure through the pandemic crisis as the economy contracted -15.7% in 2020, and the central bank implemented a 20% devaluation to the dollar peg in December of that year which kept inflation elevated through 2021, averaging 6.0%. While price growth has slowed through 2022 to July, at an average 5.3% it remains high compared to the 0.2% averaged over the three years prior to the devaluation and it has been trending upwards in recent prints. While transport inflation has been kept in check through subsidies, the average y/y gain of 7.7% in food prices will have impacted households. Some of these pressures should soften through the coming months, but the recovery in consumption will likely be slow with unemployment still high.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Meanwhile, there has been no constructive progress on the political front since our last quarterly update, with still no government formation in sight now 12 months after elections were held. Indeed, the events in Baghdad in August following the resignation of Moqtada al-Sadr arguably indicate that a resolution is even further out of reach than it was three months ago. This failure to form a government will have held back government spending of its oil bonanza revenues as a supreme court ruling earlier this year stated that the caretaker administration had to abide by the 2021 spending limits. This will delay essential investment in infrastructure and the ability to support households through challenging times, potentially provoking more unrest. While the violence around Baghdad’s Green Zone has abated, there have been further protests around the country in recent weeks and in this environment, private sector investment will likely be slower also.