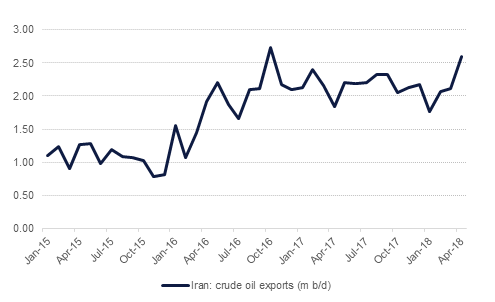

President Donald Trump withdrew the US from the JCPOA, the Iran nuclear deal, last night. The US will now impose stiff economic sanctions on Iran, some of which will come into effect in 90 days (targeting Iranian purchases of US dollars and some exports to the country) and more restrictions on Iran’s energy sectors will come into effect in 180 days. We estimate that the re-imposition of US sanctions could curb Iranian crude oil exports by at least as much as 500k b/d by the end of the year although there are at least 1m b/d that we feel are at risk from some disruption. Oil prices have gained sharply this morning, up over 2% in both Brent and WTI markets as of early trading in Asia.

The US JOLTS report, which tracks the number of job openings, rose to a new high in March. A total of 6.6m job openings were recorded, up 472k month on month. Hiring, however, dipped to 5.4m which implies companies are still struggling to find workers that match the skills they need. The quits rate, which measures workers voluntarily leaving in search of better opportunities, also increase to 3.3m in March from 3.2m in February. Both indicators give a sign that improvements in wages should be on the cards even if data from the recent NFP report was a little disappointing.

UK consumer activity slipped in April according to new data from the British Retail Consortium. Total retail spending fell by 3.1% y/y in April compared with a gain of 2.3% in March. An early Easter holiday may have played an impact in the decline in sales but the general underlying soft performance of the UK economy also appears to be weighing on consumption. Elsewhere in the UK the government again received a defeat by the House of Lords which voted to remain in the EU’s single market. US prime minister Theresa May has been trying to find a way in which the UK could potentially remain in the EU’s customs union but still remain free to negotiate its own trade deals, a strategy which is threatening to split her cabinet along hard and soft Brexit lines.

Treasuries closed lower across the board as economic data remained strong and equity markets remained volatile following Donald Trump’s decision to withdraw from the Iran deal. Yields on the 2y UST, 5y UST and 10y UST closed at 2.51% (+1 bp), 2.81% (+3 bps) and 2.97% (+2bps).

The sharp gains in oil prices seem to having limited impact on regional bonds as they follow the move in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose +2bps to 4.62% and credit spreads remained flat at 186 bps.

S&P affirmed Aldar Properties rating at BBB but revised the outlook to Negative from Stable. The rating agency believes that the recent deal to acquire assets would weaken financial ratios due to higher debt requirements.

Commercial Bank of Qatar will be meeting clients for a benchmark USD bond issue.

The dollar generally strengthened against peers overnight, including sharp gains against the Euro. Further challenges to the UK government’s ability to enact Brexit came from the House of Lords overnight which voted to remain in a customs union with the UK.

The biggest mover this morning is USDJPY which has risen 0.36% to reach 109.52. This puts the cross on course for a second day of gains and leaves the 200 day moving average of 110.20 within reach. A break and daily close above this level is likely to result in further gains towards 110.85, the 61.8% one year Fibonacci retracement. However, first the price must surmount the 50% one year Fibonacci retracement of 109.65.

Developed market equities closed mixed in what was a rather volatile day of trading. The S&P 500 index closed flat while the Euro Stoxx 600 index added +0.1%. The narrative was dominated by Trump’s decision to withdraw from the Iran deal.

Regional markets closed lower across the board with the DFM index losing -0.5% and the Tadawul dropping -1.3%. Geopolitics and weak Q1 2018 earnings weighed on investor sentiment. Zain KSA closed limit down after reporting Q1 2018 loss of SAR 77mn compared to a profit of SAR 45mn a year ago.

Oil prices declined yesterday ahead of US president Donald Trump’s decision to pull out of the JCPOA, the Iran nuclear deal, as traders were likely selling the fact and taking profit on crudes extended rally. Since then spot prices have gapped higher and Brent was up as much as 2.4% at USD 76.64/b and WTI up more than 2.2% at USD 70.59/b in early Asia trading. The impact on physical markets will be felt over the coming 180 days as companies look to move away from purchasing Iranian crude to avoid sanctions from the US Treasury Department.

Messages from other OPEC officials were mixed in response to the news that sanctions were coming back into place. Officials from Saudi Arabia said the country could consider raising production to offset declines in Iranian output while the UAE’s energy minister said they would be sticking to the terms of the deal.

Click here to Download Full article