Speculative positioning in precious metals futures and options has fallen to unusually low levels. On an aggregate net basis, managed money positions in gold, silver, platinum and palladium have been net short for the past two weeks. The short positioning is largely concentrated in platinum where prices have fallen to their lowest level since the global financial crisis and net short positions account for around a third of total market open interest.

.png) Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

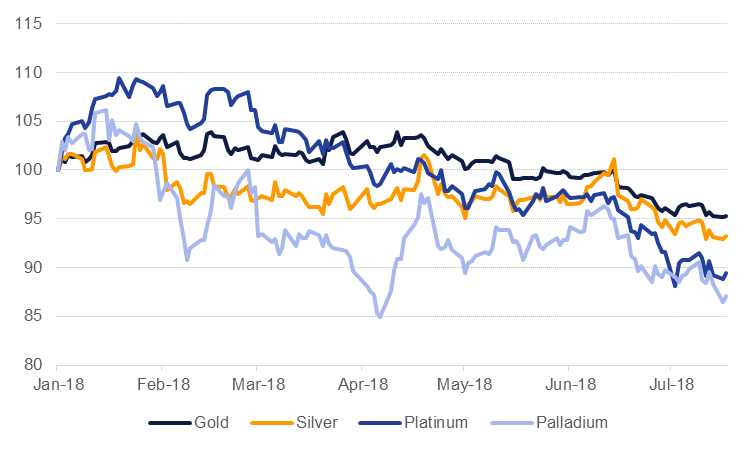

Prices have fallen across the four main precious metals year-to-date with gold down 4.5% as of mid-July and palladium the worst performer, down 11.5% but still holding onto most of the strong gains it experienced in 2017. A confluence of factors are weighing on precious metals in the near term, not least of which is the trajectory for US rates. Higher rates are acting as a short-run drag on gold prices and may help to explain some of the movement away from investor positioning. However, we expect that the exodus out of precious metals’ positions is due to be unwound considering an uncertain political and economic outlook.

Source: EIKON, Emirates NBD Research. Note: Jan 1 2018 =100

Source: EIKON, Emirates NBD Research. Note: Jan 1 2018 =100

Gold prices should benefit from rising trade tensions between the US and its trading partners even as the Fed manages to carry out at least two more hikes in 2018. There appears to be no let-up in the rhetoric around trade and the economic impact of tariffs and disrupted trade flows will start to show up data likely by the end of the year. More generally, the US economic cycle is growing very long in the tooth and signs of softer economic performance or a looser labour market would act as supports for gold.

Corporate results in the US are benefitting from lower tax rates introduced at the end of last year but this impact will fade once this year’s results are in the base and could sap some interest away from equity markets. The IMF’s latest projections for the US also show real GDP growth slowing to 2.7% in 2019 from 2.9% in 2018. Warning signals of a pending slowdown are also creeping in from financial markets; the UST 2-10yr spread has narrowed to around 25bps this week, around half its level at the start of the year.

Beyond economic considerations, political factors will increasingly pull investors back towards gold. US president Donald Trump’s disruptive foreign policy—his recent rancorous meeting with NATO contrasts sharply with the more congenial summit with Russian president Vladimir Putin—will create uncertainty about the strength of trans-Atlantic alliances. The much heralded meeting with Kim Jong-un, the leader of North Korea, has yet to materialize into a complete security stability in North Asia.

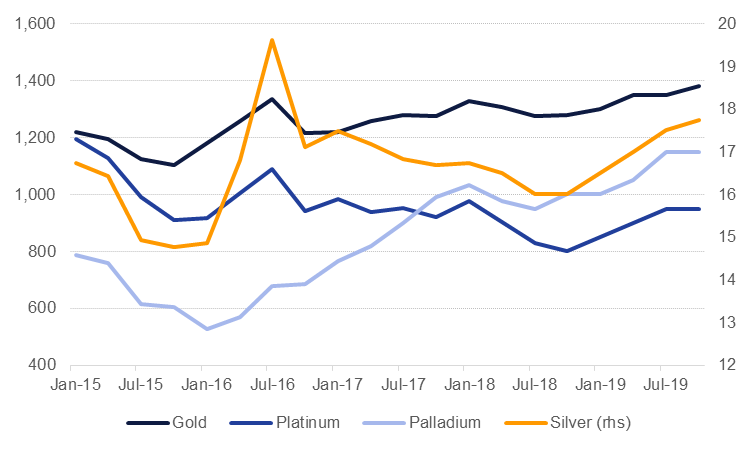

Our expectation for gold prices in the second half of 2018 is for a gradual move upward to an average of around USD1,280/troy oz from current levels of around USD 1,240/troy oz. Moving into 2019 we see more upside ahead for gold with prices expected to record an average of around USD 1,345/troy oz.

An escalating trade dispute will in the near term weigh relatively more on silver and the PGMs given their higher usage in industrial applications. Tariffs on cars and vehicles in particular will be particularly negative for platinum and palladium given their use in catalytic converters. However, an improvement in gold prices and the relative low level of investment allocated to precious metals at the moment will help to drag the rest of the complex higher into 2019, even if economic fundamentals soften.

Source: EIKON, Emirates NBD Research. Note: USD/troy oz

Source: EIKON, Emirates NBD Research. Note: USD/troy oz

We had been particularly bullish in palladium at the start of the year but are now marking our forecast to market and expect prices to average around USD 990/troy oz, an increase of around 13.8% y/y from 2017 levels. For 2019 we expect palladium will hit an average of around USD1,090/troy oz (9.9% y/y) as physical tightness persists. For platinum we expect there is a risk it could weaken further and expect an average of USD 877/troy oz this year before a modest recovery to around 910/troy oz in 2019.

Click here to Download Full article