The end of last week saw a resumption of geopolitical tensions regionally, which helped oil prices stem losses seen earlier in the week and gold recover. However, with oil supplies from other parts of the world relatively plentiful the risks to output coming through the Arabian gulf may not have much lasting impact on prices, especially at a time when global oil demand also appears to be slowing. The tensions may adversely impact those directly affected however, with many Middle East stocks falling yesterday, and the with UK markets at risk at it was a UK vessel involved in the incident. The UK government is also in a state of flux, with a new Conservative leader and Prime Minister to be appointed this week, and now facing two pressing issues, Brexit and seizure of UK-flagged tankers. An emergency meeting will be chaired by the departing PM May today about how the government intends to deal with the tanker issue.

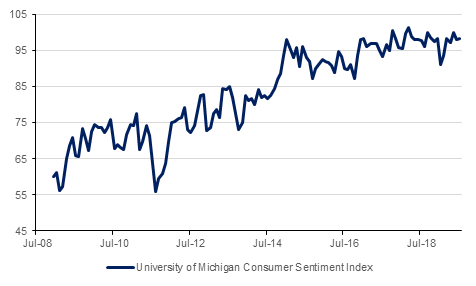

Otherwise interest rates will remain at the forefront of the markets attention, with some confusion seen at the end of last week regarding the intentions of the Fed. In the end the New York Fed had to row back on the impression given by two senior Fed officials that a 50bps interest rate cut might be on its way next week. With the Fed now in blackout period ahead of the 31st July meeting, this is probably going to be the last public word on the subject suggesting that a 25bps cut is the likeliest outcome. Advance US Q2 GDP to be released at the end of the week is expected to show a sharp slowing in growth, which will at least demonstrate the economic argument for making what many see as an ‘insurance’ cut in rates. Consumer confidence data released at the end of last week showed overall consumer sentiment holding up, however.

The ECB will meet on Wednesday and the chances are that it may preempt the Fed by trimming rates if only by 10bps from their current -40bps. Alternatively the ECB may decide to wait until September when it updates its economic forecasts and produces a more comprehensive raft of stimulus measures, including more asset purchases.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries ended the week higher as speculation continued whether the Federal Reserve will cut rates by 25 bps or 50 bps at its meeting at the end of this month. Mixed economic data and comments from various Fed officials have all but confirmed a rate cut but provided little clarity on the depth of the cut. Yields on the 2y, 5y and 10y USTs ended the week at 1.81% (-3 bps w-o-w), 1.81% (-6 bps w-o-w) and 2.05% (-7 bps w-o-w) respectively.

Government bonds in Eurozone closed higher ahead of the ECB meeting later this week. Yields on the 10y German bunds moved deeper into the negative territory to -0.325% while yield on 10y Italian bonds declined by 12 bps w-o-w to 1.60%.

Regional bonds continued to track moves in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -8 bps w-o-w to 3.44% while credit spreads tightened 3 bps w-o-w to 151 bps.

In terms of rating action, Moody’s changed Emirate of Sharjah’s rating outlook to negative even as it affirmed the rating at A3.

A 0.44% decline over the last week took EURUSD down to 1.1221, paring the gains of the previous week. The close at this level is the third weekly close below the 200-week moving average (1.1348). In addition, despite briefly breaking above the 50 and 100-day moving averages (1.1245 and 1.1249 respectively) the price closed below these levels after finding resistance at the 23.6% one-year Fibonacci retracement (1.1274). All of these developments are technically bearish for the cross and the 14-day RSI shows downside momentum at 44.973. This leads us to believe that further declines below the 1.12 level are possible in the week ahead.

A 0.18% decline meant that USDJPY closed at 107.71 on Friday, after finding support at the weekly low of 107.21, not far from the 23.6% one-year Fibonacci retracement of 107.15. Over the week ahead the risk is that a break and weekly close below this level can trigger a more significant decline towards the 105 level in the medium term.

Regional equities started the week on a mixed note. The DFM index dropped -0.9% while the MSM30 index added +0.6%. The decline was led by market heavyweights with Emaar Properties losing -1.2% and Dubai Islamic Bank dropping -0.4%. First Abu Dhabi Bank continued its positive run with gains of +1.0%.

Commodities

Oil markets weakened considerably last week despite an escalation of geopolitical tension toward the end of trading. Brent futures closed down 6.4% over the week at USD 62.47/b while WTI lost 7.6% to close the week at USD 55.63/b. The seizure of UK oil tankers and destruction of an Iranian drone have again raised concerns over the security of supply coming out of the Strait of Hormuz and helped prices stem losses somewhat on Friday.

Tensions in the Gulf remain high but they are occurring simultaneously with more uncertainty about the trajectory for global growth—China’s economy expanded by the slowest pace in nearly three decades in Q2—and a substantial downgrade by the IEA for oil demand growth. According to commentary from the IEA director, the agency expects demand to expand by just 1.1m b/d this year, compared with previous expectations of 1.2m b/d.