The spread between 2-year and 10-year US treasury yields is close to a decade low, narrowing to just 22bps in mid-September compared with more than 50bps at the start of the year. We expect the flattening of the US curve to continue and for it to eventually invert, particularly as the Federal Reserve is set to raise rates again this month. While some investors (and also policy makers) have fretted over the recession signals this phenomenon has historically sent, we think there are other factors at play here instead of impending contraction of the US economy.

The last time the curve was inverted was in 2007. Though Fed officials want to take the signal from the yield curve more seriously, we don’t think it will convince them to deviate from the current projection of two more rate hikes in 2018, followed by three in 2019. We think the UST yield curve will soon invert but the inversion would probably be shallow as the economy is expected to avoid recession.

Below factors account or our sanguine approach to yield curve inversion:

Real rates are still very accommodative

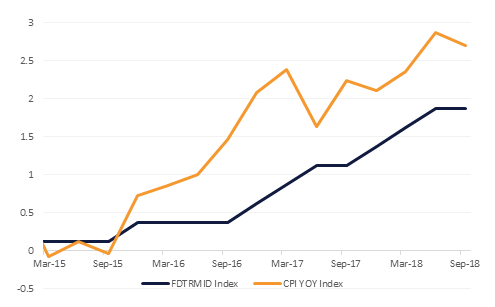

It’s not the shape of the yield curve that affects economic growth as much as the actual level of real rates. Restrictive real rates will constrain growth and vice-versa. The historical average real rate in the US over the last 50 years has been around 1.2%. By comparison, the current real rate of around -0.8% (FDTR target rate range 1.75% to 2% less headline CPI of around 2.7%) still remains well into the accommodative territory.

Assuming there is no significant pick-up in inflation, real rates will remain supportive of economic growth even with at least three more rate hikes. Looking at the recent trend, the wide spread expectation is for the inflation in the US to pick up pace as consumer purchasing power gets a boost from strong job growth and recent tax cuts. Also higher trade tariffs will likely raise the price of several consumer items. Increasing inflation will translate into real rates continuing to remain accommodative even with ongoing rate hikes for some time to come. One concern would be if the Fed became more aggressive in hiking rates in response to inflation rising faster than the current expectations. In recent times, the Fed officials have alluded to becoming more tolerant of inflation breaching its 2% target. Also we expect Fed to remain cognisant of the current turmoil in emerging market assets and the general weakness in financial markets. We don’t expect Fed increasing the pace of rate hikes and consequently we don’t think that the approaching yield curve inversion will become the cause of recession any time soon. Historically, economic slow-down sets in anytime between 10 months to three years after real rates become restrictive and we don’t see real interest rates becoming restrictive until after the summer of 2019.