.jpg?h=600&w=800&la=en&hash=2ADE177867075ED4D46C5D5A2319BF3C)

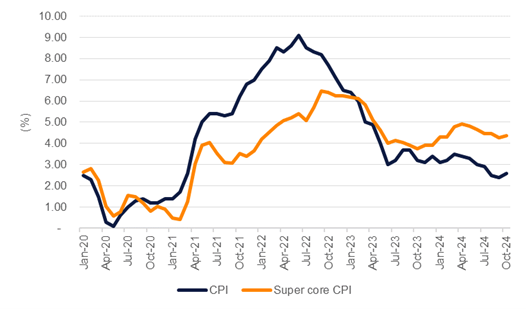

Inflation in the US picked up in October with the headline CPI index rising by 2.6% y/y compared with 2.4% a month earlier. On a monthly basis prices rose by 0.2%. Core inflation was steady at 3.3% y/y in October, the same level it recorded in September while the monthly pace of core price increases was 0.3%. Super-core inflation, which strips our housing, energy and food services costs, rose by 4.4% in October, up from 4.3% a month earlier.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

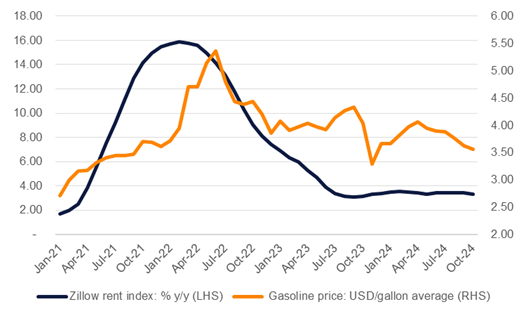

The primary contributor to CPI in October was core services with shelter in particular providing most of the annual increase. Core goods inflation remains in deflation though the pace of price declines is moderating. Lower energy prices are also helping to anchor inflation lower and as weaker gasoline prices feed through to the index, cheaper gas will help to limit any moves in the headline.

Producer price inflation will be released later today with markets watching closely as to whether the disinflation trend there remains intact. PPI inflation had pulled higher in the first six months of the year but since the start of H2 has moved lower, hitting 1.8% y/y in September. Elements from both the CPI and PPI feed into the Fed’s preferred measure of inflation, the PCE deflator, which as of September was barely above the Fed’s 2% target level.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

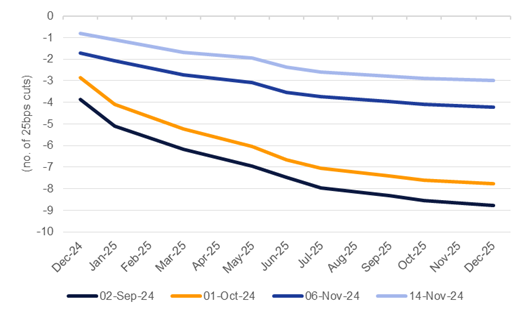

The impact of the October CPI print on markets is likely to fade quickly as focus remains on the proposed policies of President-elect Donald Trump and what a Republican-controlled Congress and executive means for inflation in 2025. The October CPI print was inline with market expectations and despite the marginal rise annual inflation is still consistent with a longer-run disinflationary trend. The print has in fact upped expectations for the FOMC to cut rates again in December with another 25bps cut priced in by about 83%.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

We maintain our expectation that the Fed will cut by 25bps at the December 18 meeting. For 2025, the outlook for the Fed will be complicated by interpreting the impact of some of President-elect Trump’s policies on tariffs, tax cuts and immigration, all of which are expected—at this stage—to be inflationary. Markets have substantially pared their expectation for rates in 2025 to just two additional 25bps cuts from almost five cuts at the start of October.

As the key economic priorities of the incoming US administration become clear we expect the Fed will need to take a forward looking assessment of their effect on inflation. However, we expect the Fed will still want to be responsive to the data it sees in the US economy and won’t want to commit to a preset path for rates in response to policies that may be implemented as part of a trade negotiating stance or that could be unwound if there is a negative political response to the inflation they may cause.

Click here to download full report