Eurozone industrial production fell by a heavy -1.7% m/m in November, while October data were revised down to 0.1% m/m from 0.2% m/m. The weak numbers are not a total surprise considering the soft national data reported last week, and will raise fresh concerns over the Eurozone outlook and the ECB's projections. For now the ECB is likely to stick to the central message at next week's council meeting, with rates seen on hold at least through the summer, although Draghi may repeat that the balance of risks is starting to shift lower.

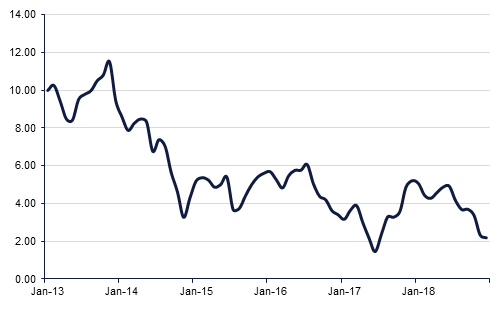

The INR was under pressure yesterday as disappointing Chinese trade data caused weakness across emerging market currencies. Furthermore India’s CPI for December 2018 came in at 2.19% y/y yesterday. This was the lowest reading in 18 months and was driven by the continued deflationary trend in food prices, although core inflation remained sticky at 5.7%. With the latest reading well below the central bank’s median inflation target of 4%, it looks likely that the recent bout of calibrated tightening by the Reserve Bank of India is over. In fact, with growth indicators also showing moderation recently, it will not be surprising if the RBI cuts interest rates by 25bps at its February meeting to address the monetary policy impediment to investment and spending.

In terms of the UK Brexit vote later today, most calculations have Prime Minister May losing and losing badly. In fact most of the focus is on what she will do following a defeat, with recent rule changes meaning that she will have 3 days to come back to parliament with a Plan B proposal.

Fixed Income

Treasuries closed mixed in what was a rather muted session of trading. Yields on the 2y UST, 5y UST and 10y UST closed at 2.53% (-1 bp), 2.52% (flat) and 2.70% (flat) respectively.

Regional bonds too traded in a tight range. The YTW on the Bloomberg Barclays GCC Credit and High Yield index remained flat at 4.58%and credit spreads hovered around 200 bps.

FX

The day commences with GBP as the best performing among the G-10 currencies, gaining ground in the build-up to the vote on Prime Minister May’s Brexit deal. Currently on target to gain for a third day, the latest driver behind GBP strength are overnight reports that some U.K. law makers who previously opposed May, might now support her deal. As we go to print, GBPUSD is trading 0.26% higher at 1.2897, just above the 100-day moving average of 1.2893. It is worth noting that the 100-day moving average has previously acted as a resistance level this week and has not been broken 8th November 2018.

On the other end of the spectrum, increasing risk appetite has caused the JPY to underperform. Currently trading % higher at 108.53, USDJPY has cancelled out the losses catalysed by disappointing Chinese trade data earlier in the week and is currently trading back above the 38.2% one year Fibonacci retracement (108.38). In addition, the 14-day Relative Strength Indicator (RSI) currently shows bullish momentum, indicating that further short term gains are a possibility.

Equities

Developed market equities closed lower as trade data from China fuelled concern over slowing global growth. The S&P 500 index and the Euro Stoxx 600 index dropped -0.5% each.

Regional markets closed mixed with the DFM index losing -0.4% and the Qatar Exchange adding +0.2%. The decline on the DFM was led by Emaar-related names with Emaar Malls losing -2.9% and Emaar Development dropping -3.7%. Elsewhere, banking stocks continued their positive run with FAB gaining +1.7%.

Commodities

Oil prices dropped to start the week as more soft data out of China weighed on the outlook for the global economy. Brent fell back below USD 60/b to USD 58.99/b while WTI closed at USD 50.51/b. Markets will be tracking the release of the EIA’s short-term energy market views, due out later today, for its assessment of US oil production growth this year.