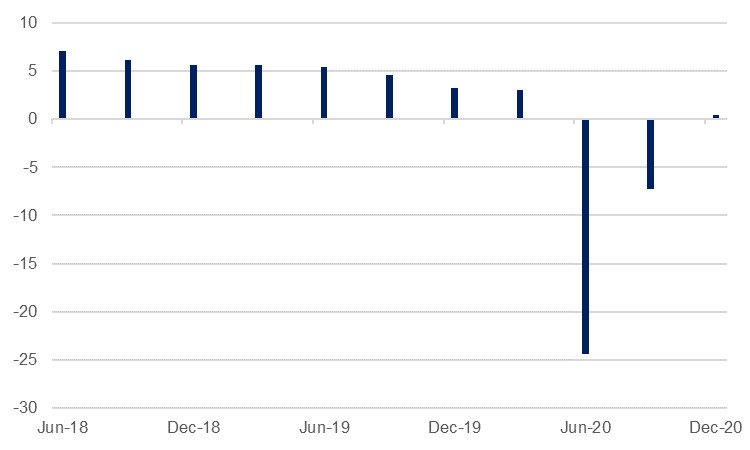

India’s real GDP growth surprised to the downside in the third quarter of the current fiscal year ending in March. The October-December 2020 period saw an expansion of 0.4% y/y, compared to consensus expectations of a slightly stronger 0.6%. Given this comparative underperformance, and likely return to contraction in the current quarter as lockdowns have been reimposed and extended, we maintain our view that the year as a whole will see a contraction of -8.0%, moderately more bearish than the Bloomberg consensus projection of -7.5%.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Looking ahead, fiscal 2022 will see a substantial rebound, bolstered by an anticipated recovery from the coronavirus pandemic and sizeable fiscal stimulus. Growth will likely reach double digits, but persistent Covid-19 outbreaks and rising commodity prices temper our view for the start of the year and so we think the risks to our 10.0% projection for next year are weighted to the downside.

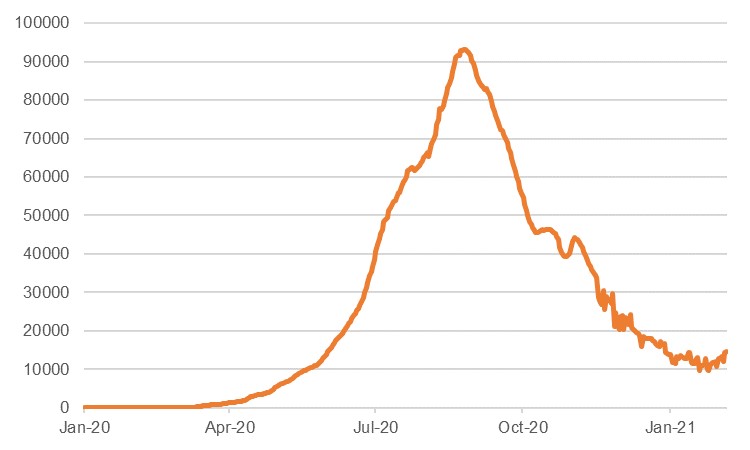

The 0.4% y/y growth in Q3 FY21 compares favourably to the -24.4% and -7.3% contractions recorded in Q1 and Q2 respectively, and underscores the effect that the Covid-19 pandemic has had on the Indian economy. The finance ministry called the return to growth a ‘reflection of a further strengthening of V-shaped recovery that began in Q2 of 2020-21.’ New daily case numbers hit a seven-day moving average of over 93,000 in September, but fell substantially over the following months to just 20,000 by the end of the year. A loosening of restrictions towards the end of 2020 helped boost activity, with growth in manufacturing (1.6% y/y) and construction (6.2%) in particular seeing strong turnarounds after a very difficult first half. Construction activity was boosted by tax discounts across the country. Meanwhile, agriculture, forestry and fishing, which accounts for nearly 20% of GVA, recorded growth of 3.9%. The wheat harvest is on track to hit a record in the current fiscal year on the back of a healthy monsoon.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

While Q3 FY21 benefitted from an improvement in the Covid-19 situation in India, the outlook for the current quarter is somewhat less bright as there are mounting concerns over renewed rises in Covid-19 cases and the seven-day moving average has risen to the highest level since mid-January. At 14,600 they remain far off the 2020 peaks but of primary concern to the economy is that there have been renewed outbreaks in Maharashtra and Gujarat, the largest and fourth-largest states by GDP. Night curfew has been extended in Gujarat, while authorities in Maharashtra (which comprises the financial hub of Mumbai) have warned that the state might also implement one, alongside other measures aimed at preventing the disease’s spread that would potentially impinge on economic activity.

Our full-year fiscal 2021 forecast is predicated on -0.5% y/y growth in the current quarter. We will look out for the survey for February later this week for any timely indication as to the ongoing strength of the economy, and for any new restrictions on activity implemented.

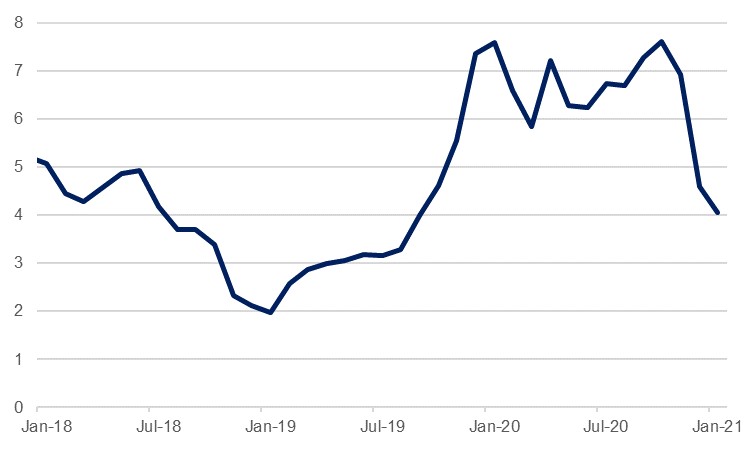

In fiscal 2022, starting in April, the outlook is substantially brighter, and not only owing to the base effects of the 2021 contraction. The expectation is that the pandemic crisis will gradually recede in the rearview mirror, and that a gradual return to normality will ensue, with restrictions on movement and activity eventually all lifted. India will benefit from this domestically, but also from the general improvement in activity globally; the trade, hotel, transport and communications component of GVA (18.3% of total) endured a third consecutive quarter of negative y/y growth in Q3 FY21, shrinking -7.7% y/y, but the expectation is that this will return to growth as things normalise. Meanwhile, monetary policy is expected to remain supportive with low rates and easy money, and the government is now due to step up to the plate also.

To an extent it was the RBI that did the heavy lifting in terms of economic support last year, but the government’s budget for the next fiscal year will help support the economy by providing considerable stimulus. The government’s projection is for a budget deficit of -6.8% of GDP as it boosts spending next year, with capital expenditure set to rise 35% compared to the current year. Finance minister Nirmala Sitharaman has pledged to ‘spend big on infrastructure’. The government is also loosening restrictions on foreign investment into India’s insurance sector, allowing FDI into firms to rise from 49% to 75%, both of which measures will likely see investment as the primary growth driver in India next year.

The agricultural sector will likely remain an outperformer next year as it is expected to post another record wheat crop following an expansion of the planting area by 1mn hectares to a new record. The strong harvests expected across the industry should support growth not only exports, but also helping to ease the inflation seen through 2020.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The risk is that the current Covid-19 outbreaks which are weighing on our outlook for Q4 FY21 extend into the next fiscal year, thereby jeopardising the recovery at the start of fiscal 2022. Meanwhile, rising commodity prices also pose a risk to growth as a potential drag on consumption levels should it lead to a similar inflationary spike to that seen last year. Our expectation is for a robust recovery in India next year, but while pandemic-driven uncertainty remains in play we believe the risks remain to the downside for now.