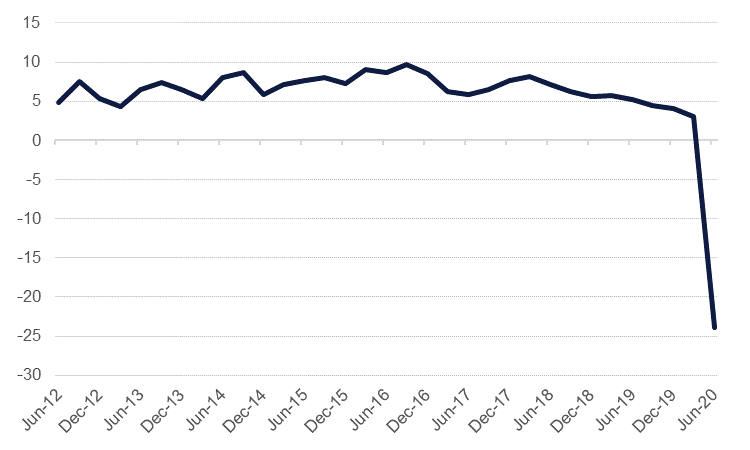

India has reported a -23.9% y/y Q1 contraction for the April-June period, far worse than the -18% consensus estimate. Construction and private consumption performed particularly poorly, as did manufacturing which shrank by 40% y/y. The manufacturing PMI is due to be released today which could indicate if there is a nascent recovery beginning to take hold. However, India’s new coronavirus cases remain on an upward trend, with near 80,000 new cases reported each day, running the risk of renewed lockdowns and a further hit to the economy. Turkey has also reported its latest GDP figures, seeing a real GDP contraction of -9.9% in Q2 (April-June). The economy shrank by considerably less than the -10.7% anticipated by analysts.

Lebanese political parties agreed upon a new prime minister-designate yesterday, nominating Mustapha Adib, the former ambassador to Germany, to the post. Lebanon has had a caretaker government since the resignation of Hassan Diab and his cabinet in the wake of the Beirut explosion on August 4. Adib must now try to form a government, a process which has been a drawn-out affair in Lebanon in recent years, but which he yesterday cautioned must be done in record time if the country is to implement its urgent reforms and secure a crucial IMF deal. The Beirut blast compounded the problems Lebanon was already facing from its ongoing economic and financial crises, not to mention its pandemic-related health care crisis.

Bloomberg has reported that the Emirates airline has received USD 2bn from the Dubai government since the start of the pandemic crisis which has hit airlines and tourism companies especially hard, and that it is prepared to do more as necessary.

The Caixin manufacturing PMI for China rose to 53.1 in August, up from 52.8 in July and beating consensus expectations of 52.5. This is the fourth month in a row that the index has been in expansionary 50.0-plus territory, and was also the strongest reading since 2011.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries rallied at the end of the month as markets continued to digest a new inflation strategy from the Fed. Yields on 2yr USTs closed marginally higher while yields on the 10yr fell by 2bps. The Fed’s vice chair, Richard Clairda, said that the FOMC may “reassess” the need to use yield caps to keep rates low but that current conditions did not warrant them being deployed. Meanwhile the Atlanta Fed president, Raphael Bostic, suggested that the Fed may not make use of stronger forward guidance at upcoming meetings. We recently lowered our expectations for UST yields in light of the new inflation targeting strategy from the Fed as the options that that have left would likely put additional downward pressure on yields.

Emerging market debt capped off five months in a row of gains at the end of August, gaining 0.5% over the month. Prices for EM debt are now comfortably above their pre-Covid 19 levels although the pace of gains has stalled somewhat in recent weeks. The expectation of low rates for longer from the Fed should help to provide a boost to EM debt, both in USD and local currency issues.

Press reports indicated that FAB is preparing to issue around USD 750m of tier 1 perpetuals later this month.

The dollar extended its downtrend on Monday. The DXY index fell by -.59% and hovers around 91.830, its lowest point since 2018 as the Fed's dovish approach is weighing on the currency. USDJPY advanced for the day and has held onto some minor gains, but lost momentum this morning to trade at 105.70.

Broad-based dollar weakness has provided a boost for nearly all pairs. The euro rallied and has extended its gains this morning to reach 1.1990, its highest point since 2018. Similarly Sterling has advanced to highs not seen since 2018 as well, trading in the 1.1340 area. Both the AUD and NZD experienced modest gains to trade at 0.7405 and 0.6760 respectively.

Most equity indices started the week on the back foot. While Japan’s Nikkei gained 1.1%, that was largely due to a recovery from the 1.4% sell-off after Prime Minister Shinzo Abe announced his resignation at the end of the week, as markets calmed on the realisation that it would likely remain business as usual. Otherwise, month-end profit-taking saw the S&P 500 close down 0.2%, the DAX 0.7% and the Shanghai Composite 0.2%.

November Brent futures fell 1.2% overnight, failing to hold onto a peak of more than USD 46.50/b. WTI futures for the same month fell by 0.9% to close at USD 42.90/b but they are back above USD 43/b in early trade today. There are few forces in the oil market at the moment to push prices one way or the other. Aramco OSPs are expected to be lower for October loadings as the company responds to still soft refining margins, particularly in Asian markets.