The IMF slashed global growth projections for 2020 in its latest World Economic Outlook, expecting global GDP to contract by 3% this year, the worst annual performance since the Great Depression of the 1930s. The fund anticipates a contraction in both developed (-6.1%) and emerging markets (-1%), unlike the 2008-09 financial crisis when emerging markets still managed to record some growth. Among major economies the IMF expects the US to contract by 5.9%, the Eurozone by more than 7%, the UK by 6.5% while negligible growth in China and India (1.2% and 1.9% respectively) are the only nations keeping the global recession from being even worse. The IMF does anticipate an improvement in 2021—global growth of almost 6%—but that the pre-coronavirus growth trajectories of major economies will have been derailed lower.

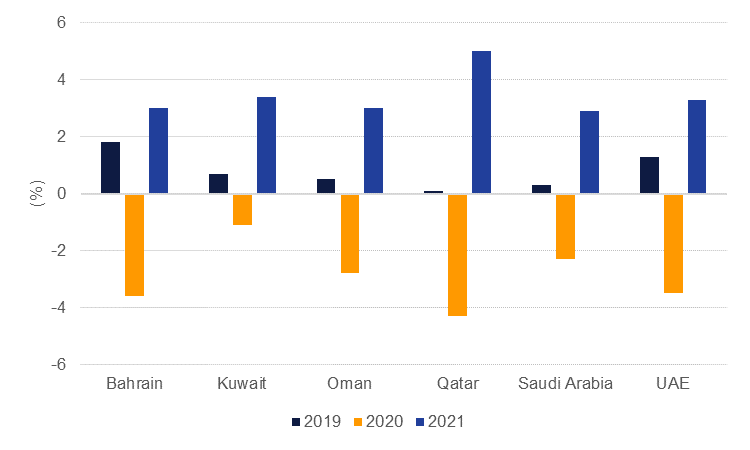

For the GCC, the IMF unsurprisingly downgraded growth forecasts for 2020 across the region. The Fund now expects the UAE economy to contract -3.5% this year, while Saudi Arabia is forecast to contract -2.3%. Budget deficits are also all projected to widen sharply this year, with Oman and Bahrain likely to be the largest in the GCC at -16.9% of GDP and -15.7% of GDP respectively. The IMF is forecasting a budget shortfall of -12.5% in KSA and -11.1% in the UAE this year. However, growth is expected to rebound in 2021 with the UAE expected to grow by 3.3% and Saudi Arabia by almost 3%.

India’s prime minister, Narendra Modi, has extended the country’s lockdown period until May 3 after it was due to expire this week. India has had a relatively low case number given the size of the country—just over 10,000 infections and fewer than 360 deaths—but the government will want to ensure that there is a lower chance of the virus spreading. An extended lockdown will keep downward momentum intact in India’s consumption focused economy: the head of India’s chambers of commerce estimates that as many as 40m jobs may be a risk over the next six months as a result of the lockdown measures.

Source: IMF, Emirates NBD Research

Source: IMF, Emirates NBD Research

Treasuries closed higher even as equities rallied hard. The curve steepened with yields on the 2y UST and 10y UST ending the day at 0.21% (-3 bps) and 0.75% (-2 bps) respectively.

Regional bonds benefitted from renewed and sustained appetite for risk. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -16 bps to 4.38% and credit spreads tightened to 370 bps.

According to reports, Saudi Aramco in in early talks with banks for a loan of USD 10bn to finance its purchase of Sabic.

Dollar bearishness resumed with the DXY index slipping 0.40% to below the 99.000 mark, currently at 98.89. As a result the JPY saw some modest gains, meeting resistance just below the 107.00 level and is now trading at 107.15. The mood in Europe was upbeat with hopes that a gradual end to lockdowns are in sight. The Euro was bullish for the day, increasing to 1.0980 after closing at 1.0914. Sterling saw similar strength, moving above the closing price of 1.2515, currently sitting at 1.2610. It was a largely positive day for the AUD and despite some volatility, it currently sits at 0.6410 which is over a 0.90% increase, but the currency looks to be in a downtrend in the early hours of this morning.

Developed market equities took weak earnings and dire economic growth projections in their stride to close sharply higher. The focus of investors appear to be only on the reducing number of new coronavirus cases and not on the impact of continued economic restrictions. The S&P 500 index and the Euro Stoxx 600 index added +3.1% and +0.6% respectively.

Regional markets also benefitted from broad risk-on sentiment. The DFM index and the Tadawul added +2.9% and +1.0% respectively. Gains were broad based as investors added position in stocks which have seen sharp declines in the last fortnight.

Oil prices sank again overnight as the market largely discounted the impact of OPEC+’s 9.7m b/d agreement to cut production. WTI fell more than 10% to settle just above USD 20/b while Brent futures fell back below USD 30/b and closed down 6.7%. An extension of India’s lockdown measures (see above) reinforced the scale of demand destruction as a result of the coronavirus, nullifying the impact of major supply cuts.

Private sector data from the API reported a 13m bbl increase in crude stocks along with builds in gasoline and diesel. EIA data will be released later this evening.