The IMF expects GDP growth in the UAE to accelerate from an estimated 1.6% this year to 2.5% in 2020, on the back of fiscal stimulus and the boost to the non-oil sectors from Expo 2020. However, the Fund stressed that sustaining growth after the expo should be a key priority and recommended the promotion and support of SMEs as well as strengthening the government’s medium term fiscal frameworks. We estimate the UAE economy will expand 2.0% this year, accelerating to 2.6% in 2020.

China and the US may not end up signing the “Phase 1” trade agreement this month, as had been expected. While talks are continuing, the two sides have not yet agreed on a location for the signing, after the planned meeting in Chile was cancelled due to protests there.

Eurozone data released yesterday was better than expected as the services PMI rose to 52.2 from 51.8 in September, while September retail sales grew 0.1% m/m (3.0% y/y), faster than the 2.4% y/y growth the market had been expecting and suggesting that household spending has held up in Q3. German factory orders rose 1.3% m/m in September, well above the market’s forecast of 0.1% m/m, although factory orders were still down -5.4% on an annual basis. The focus today will be on German industrial production data and the ECB’s publication of its latest economic bulletin.

In the UK, campaigning for the December 12 election kicked off in earnest yesterday with the Conservative Party suffering some setbacks. Welsh Secretary Alun Cairns resigned, and senior minister Jacob Rees-Mogg was forced to apologise for comments he had made in an interview. The key event to watch today is the MPC meeting, where the market expects rates to be kept on hold at 0.75%. It remains to be seen whether the decision is unanimous or if some MPC members signal a desire to lower interest rates in the context of Brexit uncertainty.

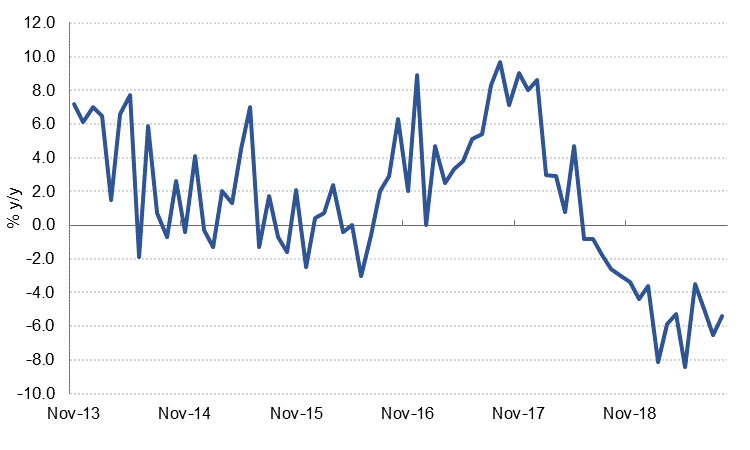

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasuries closed marginally higher as investors exercised caution following reports of a slight delay in trade deal between the US and China. The curve flattened, also helped by strong auction, with yields on the 2y UST, 5y UST and 10y UST closing at 1.60% (-2 bps), 1.63% (-3 bps) and 1.82% (-3 bps) respectively.

Regional bonds have restarted tracking moves in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -1 bp to 3.30% and credit spreads widened to 155 bps.

FX

This morning, the dollar is almost unchanged against a basket of currencies, the Dollar Index (DXY) currently trading 0.04% at 97.998. Yesterday’s close above the 100-day moving average (97.892) and 61.8% one-year Fibonacci retracement (97.895) means that further upside may be in store for the index with the first target being a retest of the 200-day moving average (97.488).

Equities

Gains in developed market equities faded away as investors speculated on latest headlines from the trade front. The S&P 500 index and the Euro Stoxx 600 index added +0.1% and +0.2% respectively.

Regional markets drifted lower amid mixed corporate earnings. The Tadawul dropped -0.4% while the EGX 30 index lost -0.5%.

Commodities

Oil markets suffered overnight as the EIA reported a nearly 8mbbl build in US crude stocks. Brent futures fell nearly 2% to USD 61.74/b and are edging lower this morning while WTI fell 1.5% to close at USD 56.35/b and likewise is lower in early trading today. News that a trade deal between China and the US would be delayed to December also weighed on prices.

US crude stocks rose by 7.9m bbl last week, including gains at Cushing. Production remains at record levels of 12.6m b/d while exports dipped back to 3.16m b/d (down 260k b/d w/w).