.jpg?h=457&w=800&la=en&hash=0ED6250608FE0E244CE5EA6178B6B9FF)

The IMF downgraded its expectations for global growth this year and next in its latest World Economic Outlook. The Fund estimates global growth of 3% this year, down from 3.3% as recently as April and expects growth of 3.4% in 2020, a 0.2 pp cut from previous expectations. The slowdown in industrial production globally along with heightened trade risks are among the catalysts for the downward adjustment. Growth in the Middle East and Central Asia generally was downgraded by 0.9 pp from its April projections to 0.9% for 2019 and 0.4 pp for 2020 to 2.9%. Lower oil production growth, as part of the OPEC+ production cut agreement, is dragging on regional output with the IMF projecting the UAE at growth of just 1.6%, down from 2.8% previously, and Saudi Arabia is expected to grow by just 0.2% this year (2.2% in 2020).

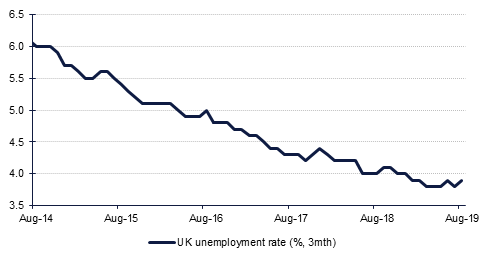

The UK labour market showed some signs of weakness in its latest print as total employment declined in the three months to August, taking the unemployment rate up to 3.9%. Wage growth also dipped to 3.8%. While headline unemployment is still at multi-decade low levels the fact that labour conditions are stabilising with a slightly weakening bias just a few months ahead of the UK’s pending departure from the EU will help to shake market confidence. Brexit negotiations continued well into the night in Europe after Michel Barnier, the EU's chief negotiator, said a deal had to be reached by Tuesday night so that it could be presented and debated at the EU leaders' summit on Thursday and Friday this week.

Germany’s ZEW index of investor confidence declined less than markets had been expecting this month. While still negative, the ZEW economic sentiment index fell to -22.8 in October from -22.5 a month earlier while assessments of the current economic conditions dipped to -25.3 from -19.9. The data suggests that Germany’s economy continues to underperform with PMI data for September well below 50 in industry. An escalation of trade hostility between the US and EU related to aircraft subsidies and tariffs on a rotating range of European goods will continue to weigh on sentiment in Europe’s largest economy.

An apparent pledge by China to purchase up to USD 50bn worth of American agricultural products won’t be met unless the US removes tariffs on its exports. It is becoming more and more apparent that both the US and China are trying to find a way towards achieving a trade deal but neither seemingly appears ready to make the first concession.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

It was a day of two halves for treasuries as strong corporate earnings helped shrug off initial skepticism over trade deal and Brexit. Eventually, Treasuries closed lower and yields on the 2y UST, 5y UST and 10y UST ended at 1.61% (+2bps), 1.59% (+4 bps) and 1.77% (+5 bps).

Regional bonds continued to remain in a tight range despite moves in benchmark yields. It appears that investors are currently focusing on the deluge of new issuances. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained flat 3.28% while credit spreads widened slightly to 162 bps.

Aldar Properties raised USD 500 mn in a 10y sukuk which was priced at MS+225 bps. Elsewhere, the Emirate of Sharjah mandated banks for a potential issuance.

As Brexit negotiations continue it is raising the odds of Article 50 being delayed and the UK not leaving suddenly at the end of the month. Points of debate still persist over customs and the treatment of Northern Ireland. Nevertheless, with an apparently diminishing chance that the UK crashes out at the end of the month sterling soared back up above 1.27 against the dollar, levels last seen in May.

This morning GBPUSD is trading 0.25% lower at 1.2755., with the move of the last day taking the price above the 200-day MA (1.2714) and the 50-week moving average (1.2729). A close above the 50-week moving average will be technically bullish for GBPUSD and cound result in a test of the 1.30 level, which was last seen in May 2019.

Developed market equities closed higher as optimism returned over both Brexit and the trade deal between the US and China. A positive start to Q3 2019 earnings season also helped investor sentiment. The S&P 500 index and the Euro Stoxx 50 index added +1.0% and +1.2% respectively.

Most regional equities closed lower as investors remained cautious ahead of the earnings season. Further, it is likely that the potential IPO announcement of Saudi Aramco is also weighing on liquidity in key indices. The DFM index and the Tadawul dropped -0.5% and -1.6% respectively. The decline was led by market heavyweights with Emaar Properties and National Commercial Bank losing -1.1% and -1.6% respectively.

Both benchmarks closed down yesterday, with WTI losing 1.5% to USD 52.81/b, while Brent prices declined by a slighter 1.0%, to USD 58.74/b.

OPEC’s secretary general, Mohammad Barkindo, said the bloc would commit to maintaining market stability beyond 2020, suggesting production cuts from key members would remain in place for the medium term. OPEC next meets in December and so far a deepening of production cuts has not been officially ruled out.