.jpg?h=457&w=800&la=en&hash=8F705D262609684572CC4770E6C1A40D)

The IMF cut outlook for 2019 global growth to 3.3%, down from 3.5% that it had forecasted in January this year. The 2019 growth rate would be the weakest since 2009, when the global financial crisis was at its peak. The IMF cut the expected growth rate in the US to 2.3% from 2.5%, in the Euro area to 1.3% from 1.6%, in UK to 1.2% from 1.5%, in Japan to 1% from 1.1% and in India to 7.3% from 7.5%. China’s growth rate was revised slightly upwards to 6.3% from 6.2%. It’s the third time the IMF has downgraded its outlook in about six months amid signs that higher tariffs are weighing on trade. The IMF expects the global volume of trade in goods and services to increase 3.4% this year, weaker than the 3.8% gain in 2018 and reduced from the IMF’s January estimate of 4%. Growth is likely to pick up next year to average at around 3.6% as the Federal reserve halts its tightening cycle and Chinese manufacturing data picks up pace. That said, risks remain to the downside, particularly if US-China trade talks collapse or a no-deal Brexit eventuates.

European Council President Donald Tusk is likely to reject Britain’s request for a brief postponement of the Brexit date, saying it would create a “rolling series of short extensions and emergency summits, creating new cliff-edge dates.” Leaders will finalize the length of the delay to Brexit at a summit this week. Tusk wants them to agree to an extension of up to a year, and diplomats from member states see December 2019 or next March as the likely new departure date.

While trade negotiations with China remain unsettled, trade tensions are increasing between the US and the EU mainly because of subsidies to their respective aviation companies. President Donald Trump said that the US would impose tariffs on $11 billion worth of good from the EU, mainly on farm products and autos, in response to EU’s aid to Airbus. On the other hand, the EU is preparing retaliatory tariffs against the U.S. over subsidies to Boeing Co.

Saudi Aramco’s dollar bond offering received orders in excess of USD 100 billion, the largest ever seen in emerging markets and facilitating the initial $10 billion deal to be upsized to $12 billion. The competitive pricing achieved on Aramco will facilitate tightening of sovereign curves and reducing cost of debt for high grade rated sovereigns in the region.

Source: Bloomberg,Emirates NBD Research

Source: Bloomberg,Emirates NBD Research

Sovereign bonds inched higher after renewed concerns about slowing global growth fuelled the safe haven bid. Yields on 2yr, 5yr and 10yr USTs closed lower at 2.35% (-1bp), 2.31% (-2bps) and 2.50% (-2bps) respectively and those on 10yr Gilts and Bunds were down to 1.10% (-1bp) and -0.01% (-2bps) respectively. Credit spreads were mixed ahead of earnings announcements with CDS levels on US IG closing wider by a bp to 61bps and Euro Main closing down by a bp to 61bps.

Regionally, GCC bonds had a constructive day with yield on Barclays GCC bond index contracting 2bps to 3.99% though credit spreads were largely unchanged at 159bps.

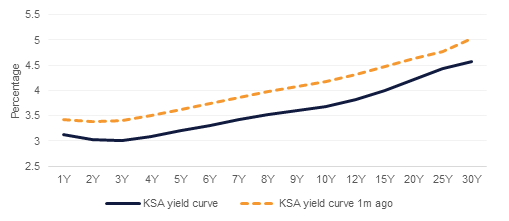

GCC primary market was all about Aramco’s debut international bond. After cancelling its floating rate offering, Aramco priced $12 billion in multitranche fixed rate bonds at T+55bps ($1b, 3yr), T+75bps ($2b, 5yr), T+105bps ($3b, 10yr), T+140bps ($3b, 20yr) and T+155bps ($3b, 30yr). Given its sovereign ownership, the Saudi government curve contracted in sympathy with yield on KSA 2029 tightening 20bps to 3.67% and Saudi 5yr CDS spread reducing circa 10bps to 76bps.

Dollar index inched slightly higher, rising 0.1% to 97.006 as IMF cut growth forecast for most of the United States’ trading partners. That said, the movements were marginal. The yen was at 111.18 per dollar, USDCNY held at 6.7231 and the euro was steady at $1.1259.

The British pound was slightly lower at $1.3052 as Brexit uncertainty continued to weigh on the currency. In contrast, INR strengthened against the dollar to 69.2950.

Concern that a new US-EU front was opening in the trade war pushed equity markets lower overnight. The EuroStoxx 600 index fell nearly 0.5% while the S&P 500 lost 0.6%. Retaliatory tariffs between the EU and US appear to be in the offing, threatening trade even as the prospect of a US-China deal nears.

Local equity markets were more positive with gains across the Tadawul, ADX and DFM.

Oil prices lost some momentum overnight with investors likely using the recent gains as levels at which to take profit. Brent fell 0.7% to USD 70.61/b while WTI ended the day slightly below USD 64/b.

The EIA revised up its forecast for 2019 production growth in the USD to 1.43m b/d, unwinding the previous month’s downgrade. The agency expects the US to hit 13m b/d of production by Q2 2020.

Russia’s energy minister, Alexander Novak, suggested that the OPEC+ production cuts may not be extended into H2 2019 as markets are already close to balance. Novak said a decision on the cuts would be made in June.