.jpg?h=457&w=800&la=en&hash=DFA786B1E30E0DB28F54CFE68C4C970C)

Fear of a renewed trade dispute between the US and EU roiled markets overnight as the US Trade Representative published a new list of EU-origin goods that could face tariffs. More than USD 3bn of goods from the EU, as well as the UK, were targeted, in particular luxury beverages and foods as well as trucks. The WTO is due to report on whether it will award the EU the right to a retaliation award against the US next month as part of the two trade partners’ long-running dispute over aircraft subsidies. The Euro weakened on the news while European equity indices ended the day sharply lower.

Prior to the trade news hitting markets the German IFO gauge reported an improvement for June with the expectations component rising to 91.4 from 80.5 a month earlier (and a nadir of 60.5 in April). The assessment of current conditions also improved although the gain (to 81.3 from 78.9) was more muted and is in line with the modest pick-up in Germany’s June PMI data released earlier this week. Should the US target the EU more aggressively in a trade conflict some of the optimism related to easing of lockdown measures could dissipate quickly and put investment and consumption in the Eurozone’s biggest economy on ice for much of the rest of 2020.

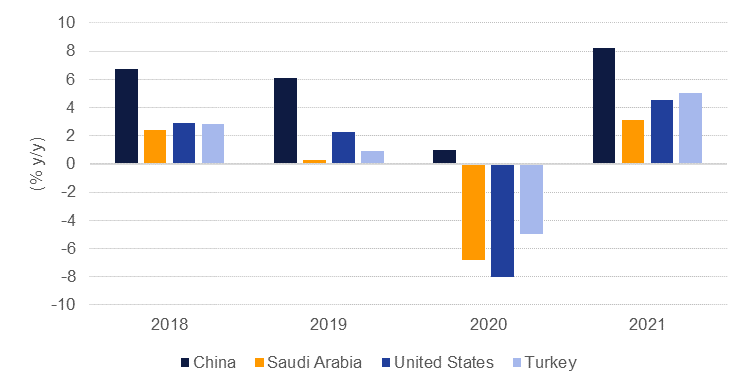

The IMF lowered its forecast for global growth this year to a contraction of -4.9% compared with -3% in its April projections. For 2021, the IMF expects a recovery of 5.4%, also slower than previously anticipated. As more countries have endured lockdowns and social distancing measures since the Fund’s initial projections a downgrade to growth was always likely. They expect the US economy to contract by -8% this year, the Eurozone by -10.2% and China will record growth of just 1%. The IMF expects the Middle East and Central Asia region to contract by -4.7%, including a -6.8% decline in Saudi Arabia’s growth, compared with its previous forecast (April 2020) of -2.3% and our forecast of -4.0%.

Consumer prices in Saudi Arabia declined -0.2% m/m in May, as lower transport, housing and household furnishing prices offset higher food costs. Food prices rose 1.1% m/m after jumping 2.1% m/m in April. On an annual basis, food inflation surged to 7.0% y/y, the fastest since December 2018. Headline inflation moderated to 1.0% y/y from 1.3% in April. While inflation has averaged 1.1% y/y in the first 5 months of the year, higher customs duties and a rise in VAT to 15% from July will push up prices sharply in H2. We expect full year inflation to average 1.8% in the kingdom this year.

Source: IMF, Emirates NBD Research

Source: IMF, Emirates NBD Research

Markets were generally shaken yesterday as the acceleration in Covid-19 cases weighs on the near term outlook for growth while the IMF’s weaker assessment for the global economy and concern over the build-up of public debt also sapped confidence. Yields on 2yr USTs were roughly flat on the day at just shy of 19bps while more of the decline was felt at the longer-end of the curve with yields on 10yr USTs down by 3bps along with a more than 6bps drop in the 30yr.

The BUAEUL index of UAE bonds ticked slightly higher overnight as the UAE focused on restoring economic activity. However, as oil prices wobble again and markets grow anxious about how well entrenched new Covid-19 cases could become the outlook for regional credit markets could sour quickly.

DP World’s tentative pricing for its perpetual sukuk has reportedly coming in a 6.125% with USD 1.5bn expected to be issued. Apicorp’s 5yr USD 750m issue priced at +110bps over midwaps.

The Central Bank of Egypt is set to make its latest policy decision today, where we expect a continued hold of the overnight deposit rate at 9.25% despite recent disinflation. We anticipate that the threat of renewed inflationary pressures as the EGP depreciates, combined with the aim of maintaining real rates positive enough to encourage a return of foreign portfolio investment, will preclude any further rate cuts for the time being, following the unscheduled 300bps cut implement in March.

In Turkey on the other hand, we believe that the TCMB will implement its 10th consecutive cut to the benchmark one week repo rate. In line with the consensus view, we anticipate a 25bps cut to 8.0%. In contrast to Egypt, this would push real rates even deeper into negative territory at -3.4%, meaning that despite ongoing political support for lower rates, economic fundamentals might mean that this cutting cycle is nearing its end, notwithstanding the recent appreciation of the lira from its recent record lows.

Wednesday saw the dollar rise for the first time all week, with its DXY index rallying over 0.65% to reach 97.300 as a resurgence in coronavirus cases in both the US and Europe has led investors to seek safer assets. USDJPY has recovered from seven-week lows set on Tuesday, earning modest gains to trade at 107.20 amid broad based USD strength.

The reinforced dollar has weighed on the Euro despite some encouraging business surveys from Germany and France. The currency declined to 1.1250 in the evening. Sterling trades around 1.2420 amidst a dismal market mood and growing concerns that the UK's plan to lift lockdowns in early July, could set off a second wave of infections. Brexit woes also remain in place. The AUD and NZD also suffered from the strengthening dollar, declining by over -0.90% and -1.10% respectively, with the former trading at 0.6865 and the latter trading at 0.6415.

Global equity benchmarks sold-off heavily overnight as Covid-19 cases accelerate, particularly in the US, and the economic recovery remains fragile. The S&P 500 gave up 2.6% overnight while the FTSE 100 and DAX recorded greater than 3% declines, even as German investors reported a more optimistic outlook. Regional equities were mixed with the DFM off by 1%, the ADX up by 0.2% and Tadawul declining by 0.7%.

Oil prices fell heavily overnight as the IMF’s growth downgrade, trade anxiety and a resurgence of the Covid-19 cases all weigh on the outlook for demand. Brent futures lost more than 5.4% to settle at USD 40.31/b while WTI gave up 5.8% to close just above USD 38/b. Both contracts are showing a negative bias in early trading today.

EIA data showed a relatively small 1.4m bbl build in US crude stocks lost week while there were draws on gasoline and kerosene. Total inventories rose by 3.9m bbl with propane accounting for most of the build. US crude production rose last week by 500k b/d to 11m b/d, its first increase since mid-March. Gasoline demand ticked higher, up by almost 740k b/d last week.