The IMF has cut it’s global growth forecasts citing that “growth may be stabilizing, though at subdued levels”. After forecasting in October a global growth rate of 3% for 2019 and of 3.4% for 2020, The IMF has now revised down those forecasts to 2.9% and 3.3%, respectively. The Fund noted some of the biggest economic uncertainties, highlighted in October, have dissipated, namely with the announcement of a US China Phase 1 deal and the lower likelihood of a no deal Brexit. The IMF also noted that central banks are playing an important role by continuing to support their local economies. However the funded did sound a warning that new trade tensions could emerge between the United States and the European Union, and U.S.-China trade tensions could return, along with alongside rising geopolitical risks and intensifying social unrest which could disrupt growth.

Weighing on the IMF’s projection on the world economy, the fund sharply slashed its estimate on India’s 2019 economic growth to 4.8% from the 6.1% expansion it projected in October. The IMF pointed to a sharper-than-expected slowdown in local demand and stress in the non-bank financial sector. The IMF also revised India’s 2020 growth forecast to 5.8%, down 0.9 percentage point from the previous estimate. For 2021, the estimate is 6.5%.The fund cited monetary and fiscal stimulus, along with its expectation of subdued oil prices, as factors behind the projected improvement in India’s growth this year and the next.

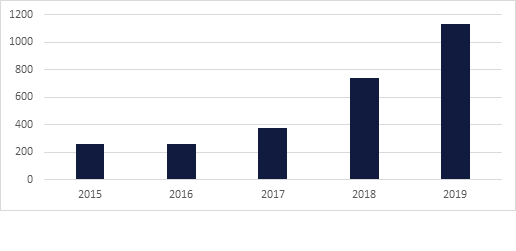

Saudi Arabia announced a 54% increase the foreign investor liscenses in 2019. The report by the Saudi Arabia General Investment Authority, said a total of 1,131 new international companies set up operations in the kingdom in 2019, against 736 companies in 2018. FDI Inflows for the Jan to Sept 2019 period increased by 10.2% to USD 3.5 billion against USD 3.18 billion for the same period last year. Keen to advance its diversification agenda under the banner of Vision 2030, the report pointed to 150 investor deals were signed by the authorities across high-priority sectors from tourism to value-added manufacturing. The report also pointed to the establishment of 193 new construction companies, 190 manufacturing firms and 178 information and communication technology companies.

Asking prices for British houses put on sale in the five weeks to Jan. 11 rose by a 2.7% compared with the same period a year earlier, marking the strongest growth since July 2017, according to figures by the property website Rightmove. This is reflective of a post-election rebound in consumer and business confidence. The figure confirms what Britain's Royal Institution of Chartered Surveyors and major mortgage lender Halifax have also reported as stronger than expected housing market activity post the Election of Prime Minister Boris Johnson on December 12.

Source: Invest Saudi

Source: Invest Saudi

Regional bonds closed largely unchanged in what was a dull day of trading owing to a US holiday. The YTW on Bloomberg Barclays GCC Credit and High Yield index was flat at 3.12% and credit spreads held around 137 bps.

The Japanese yen is trading firmer against the other major currencies this morning in the aftermath of the Bank of Japan policy meeting. While the central bank left interest rates unchanged, policy makers painted a more optimistic picture of the economy, largely in part due to Prime Minster Abe’s USD 120 billion stimulus package unveiled last month. With this reducing the probability of further stimulus being needed. In aiddition 2020 growth forecasts were raised from 0.7% (October’s forecast) to 0.9%. As we go to print, USDJPY is trading 0.2% lower at 109.97.

Developed market equities drifted lower in what was a sluggish day of trading due to a holiday in the US. The Euro Stoxx 600 index dropped -0.1%.

Regional markets closed mixed. The DFM index lost -0.4% while the Tadawul added +0.2%. There was a clear divergence between performance of midcap and large cap stocks. Deyaar Development and Aramex gained +0.5% and +1.4% respectively while Emaar Properties and Emaar Malls dropped -0.2% and -2.1% respectively.

Oil markets have failed to hold on to gains sparked by a collapse in Libyan production with Brent futures moving back below USD 65/b in early trade this morning. WTI futures have barely nudged in the last few days and now are down by 0.2% at USD 58.41/b. Downward revisions to global growth projections from the IMF will also be weighing on commodities generally.

The disruption to Libya’s supply remains subject to political negotiations over the future of the country. Hence the market may be discounting that there has been no unforeseen damage to oil infrastructure in the country.

Click here to Download Full article