The IEA revised its oil demand growth forecast for 2024 higher by 110k b/d to 1.3m b/d. Demand growth will still be concentrated in emerging economies, 1.37m b/d, compared with developed markets where the IEA revised their expectations higher but still see a contraction of roughly 40k b/d this year. Among emerging markets, Asia will lead growth with 1.1m b/d of demand growth in 2024 though a much slower pace than the more than 2m b/d estimated for 2023 when China’s economy reopened from stringent Covid-19 restrictions.

In developed markets, the IEA was more upbeat on the outlook for the US and sees OECD America’s demand essentially flat in 2024 after growth of 270k b/d last year. For OECD Europe and Asia the agency is more downbeat.

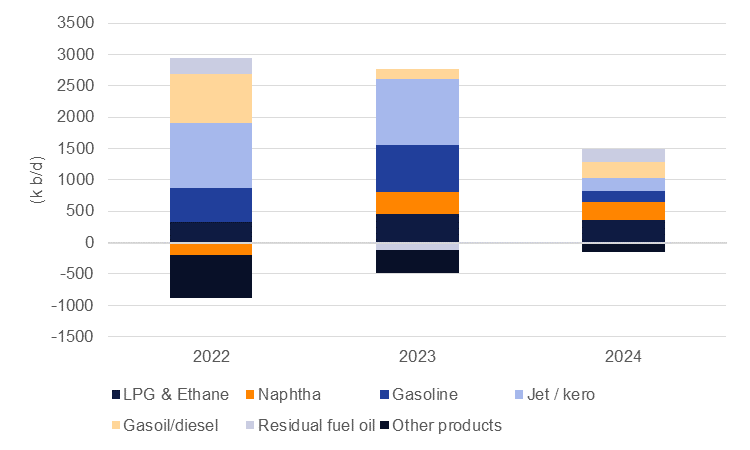

On a product basis, petrochemical feedstocks will be the primary source of demand in 2024 as the recovery in jet demand is now in the base and any further travel related gains will be more incremental. The IEA expects gasoline demand growth of just 170k b/d this year, down from almost 800k b/d in 2023.

Source: IEA, Emirates NBD Research.

Source: IEA, Emirates NBD Research.

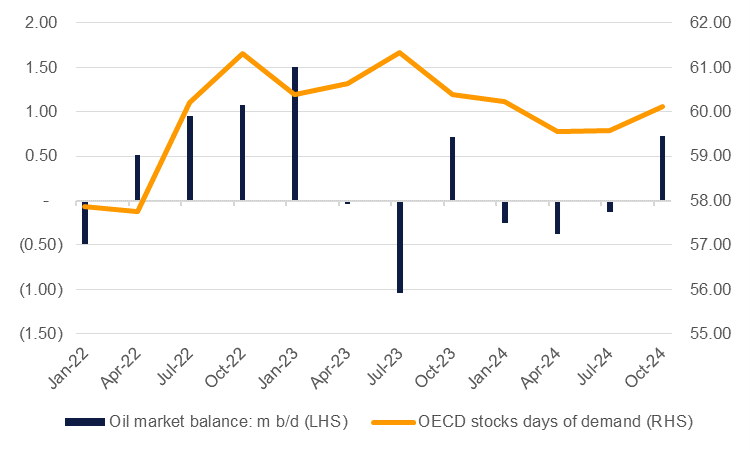

For supply the IEA expects non-OPEC+ supply additions of 1.6m b/d in 2024, down from 2.4m b/d in 2023, thanks to supply increases from the US, Guyana, Brazil and Canada. The IEA has also now assumed that OPEC+ producers will keep their production cuts in place for the rest of 2024 until the market is notified otherwise. Taken together with their improvements to demand forecasts and our pre-existing expectation that OPEC+ will only return barrels back to the market later in the year, oil market balances are poised for a small deficit over 2024, down from a small surplus expected previously.

Source: IEA, Emirates NBD Research.

Source: IEA, Emirates NBD Research.

The small market deficits now in the balance will help to support our expectation for oil prices to hold close to their current range of Brent futures between USD 80-85/b for 2024. Depending on how strong compliance with OPEC+ cuts are, there may be some upside risk to prices testing higher if demand performs better than expected.

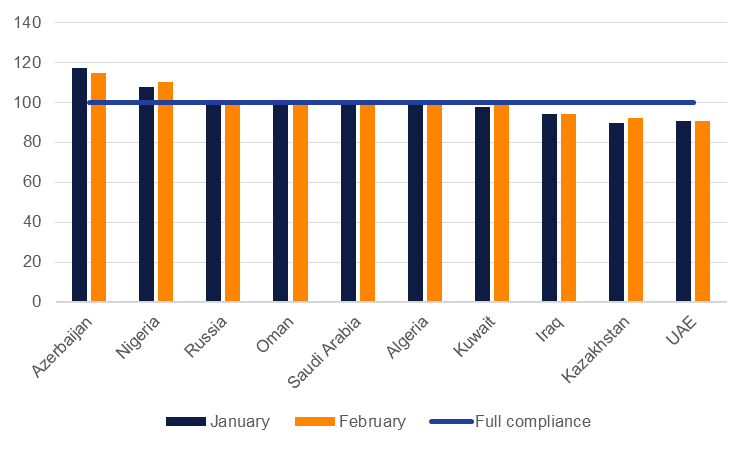

Based on the IEA’s estimate of OPEC+ supply, aggregate compliance has been fairly good with the new cut targets announced for 2024. For OPEC members on aggregate they have actually over-delivered on cuts with collective compliance of 103% while the non-OPEC members have hit 101% compliance (cutting more than targeted). On the IEA’s metrics, Iraq, Kazakhstan and the UAE have still failed to hit their targeted levels so far in 2024.

Source: IEA, Emirates NBD Research.

Source: IEA, Emirates NBD Research.