The Emirates NBD Purchasing Managers’ Index (PMI) for the UAE rose to 57.3 in August from 56.0 in July, signalling the sharpest improvement in business conditions since February 2015. The increase was driven by faster new order growth and output growth last month, with firms attributing this to “new projects, enhanced marketing initiatives and good quality products.” New export orders increased slightly in August after two months of decline, and firms highlighted improved demand from other GCC countries. Stocks of pre-production inventories also increased at a faster rate last month as output accelerated and as firms anticipated future demand.

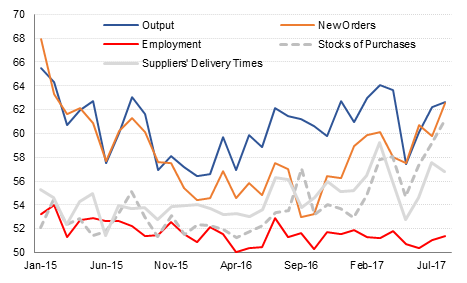

We have noted previously (“PMIs – A closer look” published 14 March 2017) that the headline PMI index is heavily weighted to the ‘volume’ components of the survey, which is what it is designed to do as a proxy for real GDP growth. “New orders” and “output” account for 55% of the headline index, with inventories accounting for another 10%. These components were all above 61 in August, significantly higher than the neutral 50.0 level and signalling very strong growth in the volume of goods and services ordered, sold and stored last month.

However, other components of the survey (some of which are not included in the headline index calculation) are more nuanced, and point to some strains in the economy. Employment, which accounts for 20% of the headline index, has been relatively muted even with output and new orders surging. Nevertheless, there has been a modest pick up in jobs growth over the last three months.

Firms’ margins continue to be squeezed as input cost inflation has been compounded by lower selling prices. The input price index rose to 54.1 in August from 53.2 in July and has averaged 52.9 year-to-date. Output (selling) prices were broadly unchanged in August but this index has averaged 49.4 year-to-date, indicating a modest decline in average selling prices. Firms have indicated they are unable to pass on rising costs due to intense competition, in order to secure new work and support demand.

The rise in the headline PMI to a 2 ½ year high does point to faster real growth in the non-oil sectors of the UAE in August, but it appears to have come at a cost of lower margins for most firms. It is perhaps unsurprising in this context that businesses are more cautious when it comes to increasing hiring.

Source: IHSMarkit, Emirates NBD Research

Source: IHSMarkit, Emirates NBD Research