Markets were again roiled by the spread of the coronavirus around the world, with equity indices globally taking another day of pummeling, and yields on the UST 10yr falling to a record low. Oil prices have also been tacking downward. Some of the language from officials around the potential severity and longevity of the disease has strengthened, with the US Centre for Disease Control warning Americans to be prepared, while reassurances from White House economist Larry Kudlow were not sufficient to calm markets. The rise in new cases in China is slowing, but the rapid spread in other countries and regions around the world makes the chances of a v-shaped recovery in the first quarter less and less likely, and this is being increasingly reflected in market moves. Iran, Italy and South Korea in particular have seen a swift spread of new cases, and the fact that they have also spread to their regional neighbours is concerning investors.

In the US, the Conference Board consumer confidence index came in under expectations at 130.7, up modestly from (a downwardly revised) 130.4 in January, but missing expectations of 132.2. Virus fears were likely not manifested in this initial reading given it was conducted mid-February, so there is a strong likelihood of a downward revision subsequently. Meanwhile, the Richmond Fed factory index came in at -2, missing expectations of 10. The survey is an outlier presently given the stronger performance we have seen in other manufacturing measures recently such as the Dallas Fed survey earlier this week.

Saudi Arabia has had a cabinet reshuffle, and also created a number of new ministries. The developments appear aimed at bolstering the economic diversification efforts illustrated in Vision 2030, with new ministries for tourism and sport, and also a new investment ministry. This will be headed by previous energy minister, Khalid al-Falih. Saudi inflation declined -0.2% m/m in January, but the annual rate accelerated to 0.4% y/y due to the low annual base. Food prices rose 2.2% y/y, as did healthcare. However housing costs, which account for 20% of the consumer basket, declined -3.2% y/y offsetting inflation in other components of the index. We expect inflation to continue to recover this year to average 2.0% in 2020. In Lebanon, it looks almost certain that the embattled country, which has been undergoing an economic and political crisis since October, will restructure its debt. The government has confirmed that it has hired Lazard and Clearly Gottlieb Steen & Hamilton as legal and financial advisers in this regard.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

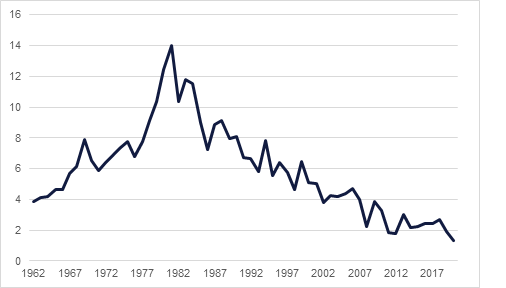

Treasuries continued their one-way move as risk-off mood continued. USTs traded at multi-year highs with yields on the 2y UST and 10y UST at 1.21% and 1.37% at the time of this writing.

Regional bonds did see some selling yesterday despite move in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose 2 bps to 2.86% and credit spreads widened 8 bps to 156 bps.

The global risk-off sentiment is manifesting itself in FX markets, with risk currencies continuing to look weak. The AUD has fallen to USD 0.6598/USD, its weakest in over 10 years, while the Turkish lira has continued its decline on the back of both global risk-off and regional concerns, falling to TRY 6.1487/USD this morning, levels last seen in May 2019.

For a second consecutive trading session, global equity markets closed sharply lower as concerns over coronavirus continued to mount. The S&P 500 index and the Euro Stoxx 50 index closed -3.0% and -2.1% respectively.

Regional equity markets were no different. However we did see bargain hunting in some pockets. The Tadawul dropped -0.8% while the DFM index eased -0.4%. Airline stocks saw sharp declines following announcement of flight disruptions in the region. Air Arabia dropped -3.3%.

Both benchmarks have been weak in recent days as the impact of covid-19 has escalated, losing ground in common with other markets. Brent futures lost 2.4% yesterday to close at USD 54.95/b, while WTI fell 3.0% to USD 49.9/b. Both have been trading up modestly this morning, but remain far off the closes they saw at the end of last week. The Saudi energy minister, Prince Abdulaziz bin Salman, said yesterday that there was as yet no fresh OPEC agreement with regards further cutting output in a bid to shore up prices, but that they were in constant communication and have not ‘run out of ideas.’ The chief concern is that Russia does not fall into line with regards a new deepening of the cuts by 600,000 b/d.