There has been an improvement in labour data in some key developed markets in recent months, indicating that the worst of the shock of the Covid-19 pandemic crisis is now behind them (for now at least – the situation in India presently is a salient reminder of how renewed surges in coronavirus cases can upend nascent recoveries). As vaccination programmes and lockdown measures have begun to curb the spread of the disease in the US and UK, those governments have started to ease restrictions and real life is starting to resume, or some semblance thereof at least, and this is being reflected in jobs being created.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

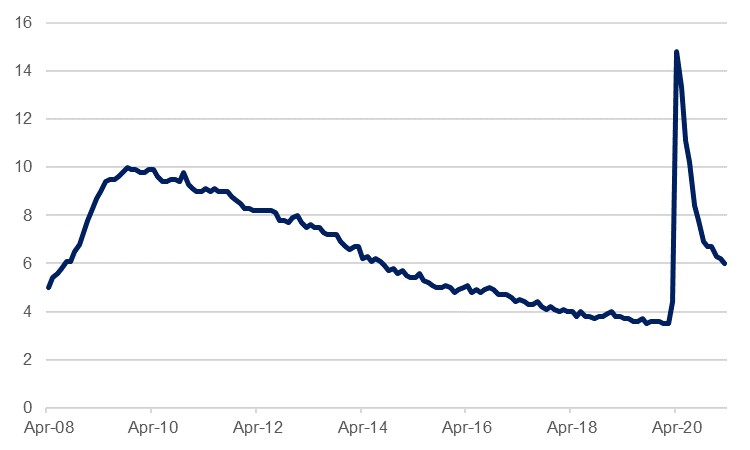

In the US, the headline U-3 unemployment figure has fallen to 6.0% in March, down from 14.8% at the peak of the crisis in April last year. Meanwhile the March NFP report saw 916,000 net new positions added, with the passing of the February weather freeze giving a further boost to job creation following the disappointing figure the previous month. Consensus projections are for a further 900,000 net new jobs in April, which compares favourably to the average of 350,000 over January and February. US real GDP growth is set to exceed 6.0% this year as massive fiscal stimulus under the American Rescue Plan is underway with some payments made, alongside the general recovery from the pandemic. Further, President Biden is pushing for an additional stimulus package aimed at infrastructure spending, all of which should prompt an ongoing recovery in the labour market.

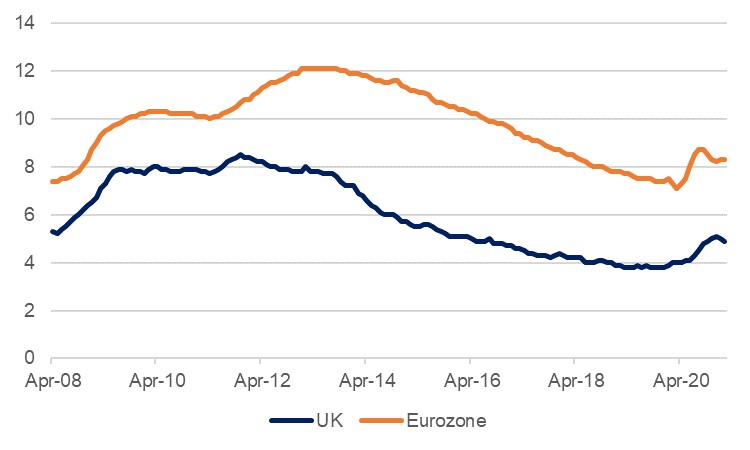

The UK is enjoying a similar flush to that of the US, as its headline unemployment figure fell to 4.9% in March, the lowest level since November last year, prior to the renewed lockdowns from which the country is only now starting to slowly emerge. The first quarter was economically difficult in the UK with the twin pressures of the lockdown and new trade frictions owing to the withdrawal from the EU, but the economy is projected to now rebound, benefitting from a rapid vaccination programme and pent-up savings waiting to be spent – a ‘coiled spring’ waiting to be released according to BoE chief economist Andy Haldane. The Eurozone is lagging somewhat behind owing to the slow start to its own vaccination rollout, but unemployment has come down from the levels seen last summer and has been relatively stable over the past few months at 8.3%. With vaccinations there starting to pick up pace, the expectation is for an ongoing improvement in the jobs situation in the single currency bloc as well.

While there is no doubt an ongoing improvement in developed market labour markets, it must be acknowledged that the headline figures in these countries somewhat obscure the reality, with the actual environment rather more precarious than they might initially suggest. This is especially the case in Europe, where government furlough schemes have helped keep job losses to a minimum as governments have paid wages to varying degrees, helping to keep workers attached to their firms.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

While there are other significant differences between this crisis and the GFC, this government intervention helps to explain the markedly lower levels of unemployment this time around when compared to those seen in the UK and Eurozone in 2009 – or indeed in 2013 following the Eurozone debt crisis. The preliminary data from the UK for February shows that there remained 4.7mn jobs on furlough that month, and while the scheme has been extended to the end of September, the fact remains that without this government life support the actual unemployment rate would be much higher. In Germany, where unemployment was stable at 6% in March, there remain 3mn workers benefitting from the furlough scheme, and Germany is in any case an outperformer within the bloc with regards to its labour market given the heavy weighting of manufacturing and industry in the economy compared to its peers.

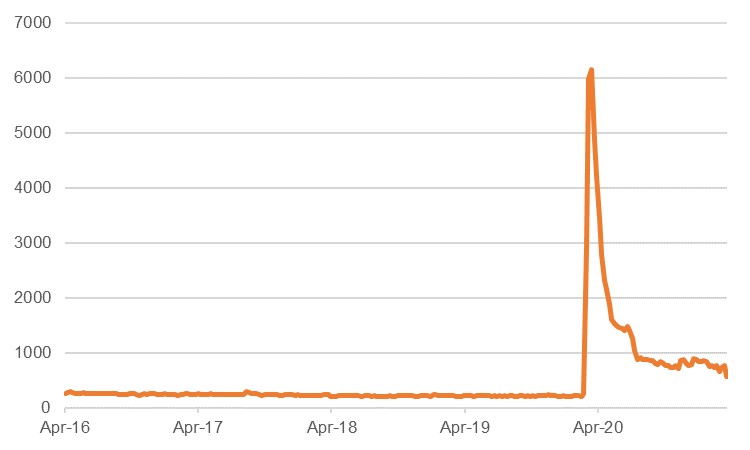

The fall in the U-3 and headline unemployment figures also obscure other changes in the labour market, not least the high numbers of discouraged workers. Many have put their job searches on hold, retired earlier than planned, or delayed their entry to the workforce, and in the US, the total number of jobs remains 9mn shy of where it was prior to the pandemic. There also remains much volatility in the labour market, even in the current environment of easing restrictions. In the US, new weekly joblessness claimants, while falling, remain over two and a half times the pre-pandemic norm.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Given that the labour market improvements are not as comprehensive as a cursory glance at the data might suggest, we do not expect any rash actions by governments or central banks that might jeopardise the ongoing recovery, even in the face of reflation. Inflation did accelerate on a y/y basis in the US in March, rising to 2.6%, but we maintain that much of this is base effect driven and unlikely to persist into 2022. Similarly, the jump to 0.7% y/y in the UK is likely the start of several months of faster price growth, but we think that this will be transitory here too. The labour market, while improving substantially, will take some time to return to where it was pre-pandemic, even leaving aside the long-term trends of automation and remote working that have been accelerated by the crisis.

Source: Bloomberg Emirates NBD Research

Source: Bloomberg Emirates NBD Research

In any case, the orthodoxy of the Phillips Curve has been increasingly rejected by policy makers in recent months, with the Federal Reserve in particular pushing back against the previous norm of pre-emptively hiking rates as employment recovers. Rather, it is now looking for full employment, and is happy to accommodate inflation of over 2.0% for a period without hiking rates as it pursues this. This aim is supported by the government, as Treasury Secretary Janet Yellen has also cast doubt on the efficacy of the U-3 employment figure at present; at the start of the year both Yellen and Fed Chair Jerome Powell claimed that the ‘real’ unemployment rate was closer to 10.0%. The recent fall we have seen in USTs would suggest that the markets are finally starting to take the Federal Reserve at its word, even as we begin to see strong NFP and initial jobless claims reports.