US industrial production in August was softer than expected, rising just 0.4% m/m compared with a 3.5% m/m rise in July, as Hurricane Laura affected mining production and utilities output declined as well. Manufacturing output rose 1.0% m/m but remains more than 7% below pre-pandemic levels. Separately, the WTO ruled that the US’s imposition of trade tariffs on a wide range of Chinese imports in 2018 broke international rules. The US can appeal the decision, so the ruling is unlikely to change the status quo. The US has removed the 10% tariff on aluminium imports from Canada, which had been imposed last month.

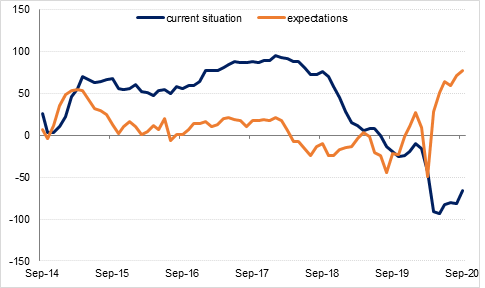

The German ZEW investor survey showed an improvement in both the current situation assessment and investor expectations in September. Both components came in higher than forecast at -66.2 and 77.4 respectively, although increased uncertainty around Brexit could weigh on sentiment in the coming months.

In the UK, the ILO unemployment rate rose to 4.1% in the three months to July from 3.9% in June. Unemployment is likely to continue rising in the coming months as the furlough scheme expires in October and a number of high profile companies have announced significant job cuts, including British Airways, Emirates Airlines (UK staff), Virgin Atlantic, London City Airport and food chain Pret a Manger.

The focus today will be on the Federal Reserve, where the market is expecting more detail on the Fed’s shift to an average inflation target, and the implications this would have for monetary policy. August retail sales data are also due to be released, which will indicate how consumption has fared following the expiration of federal unemployment benefits at the end of July.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The curve steepened as US treasury yields gained at the long-end yesterday, with the 10-year up one basis point and the 30-year gaining two, as risk-on sentiment returned and equity markets gained. All eyes will be on the outcome of the FOMC meeting later today, and any clarification on the new average inflation targeting regime. In any case, there is very little likelihood of any hike to the benchmark interest rate within at least the next two years.

Despite falling to a near two-week low, the USD reversed these losses and was little changed around the 93 handle this morning. The JPY declined by -0.41% and currently trades at 105.30, just below the 38.2% one-year Fibonacci retracement of 105.41. This marks its lowest point in two weeks.

GBP was once again amongst the biggest movers of the day, finally consolidating modest gains this morning after failing to secure a major headwind in any direction on Wednesday. Sterling rallied by 0.47% and trades at 1.2905. The same can be said for both the AUD and the NZD, recording modest gains to reach 0.7318 and 0.6730 respectively. The EUR reached a daily high of 1.19 but faltered in the evening off the back of the dollar's recovery, earning minor losses to hover around the 1.1850 area.

Despite threats to the tech sector about antitrust investigations, it helped drive a recovery in US equities yesterday, with the NASDAQ in particular enjoying strong gains. The tech-heavy index gained 1.2%, while the Dow Jones and the S&P 500 added 0.1% and 0.5% respectively. Asian stocks were broadly positive, with the Shanghai Composite adding 0.5% yesterday, bolstered by the first positive retail sales data this year. Within the region, the DFM gained 0.5% while the Tadawul closed up 0.8% on the day.

Oil prices staged a modest recovery yesterday, as Brent futures closed back above USD 40/b at USD 40.53/b, a gain of 2.3%. WTI meanwhile gained 2.7% to close at USD 38.28. Both benchmarks continue to rise in early morning trading. Oil markets managed to shrug off a pessimistic report from the IEA which adjusted its forecast for the decline in oil demand this year up from 8.1mn b/d to 8.4mn b/d, (which itself followed the demand forecast downgrade by OPEC reported yesterday), thanks to a surprise drop in inventories reported by the API. Stockpiles of crude in the US reportedly fell by 9.5mn bbl last week.