Governments globally are weighing up whether to allow some partial reopenings of their economies as Covid-19 cases stabilize in some countries. Austria may be the first country in Europe to partially reopen, allowing some stores and parks to resume operations. Meanwhile in France President Macron has announced an extension to the country’s lockdown until May 11. In the UK, Foreign Secretary Dominic Raab said that the lockdown will likely remain in place as the number of deaths in the country continues to rise. In the US, President Trump has said he has “total” power to order a reopening of the economy even as some state authorities resist pressure to restart their regional economies too quickly. No matter when restarts begin to happen there is unlikely to be a full scale burst of activity as health authorities will likely want to limit interactions between people to prevent a resurgence in Covid-19 cases. That suggests any consumption oriented recovery will be drawn out and insipid, weighing on growth over a much longer period.

Initial trade data for China from March showed a modest drop in exports of 3.5% y/y (CNY terms) while there was a tick up in imports of 2.4%. The data was far better than the market had been expecting but still shows a very vulnerable economy as China’s trade partners suffer from coronavirus, limiting demand for exports. While China’s economy may be reopening as it appears to have largely contained coronavirus to certain regions, its economy will still be suffering from low levels of trade and growth around the world, necessitating unorthodox and supportive economic policies in the medium term.

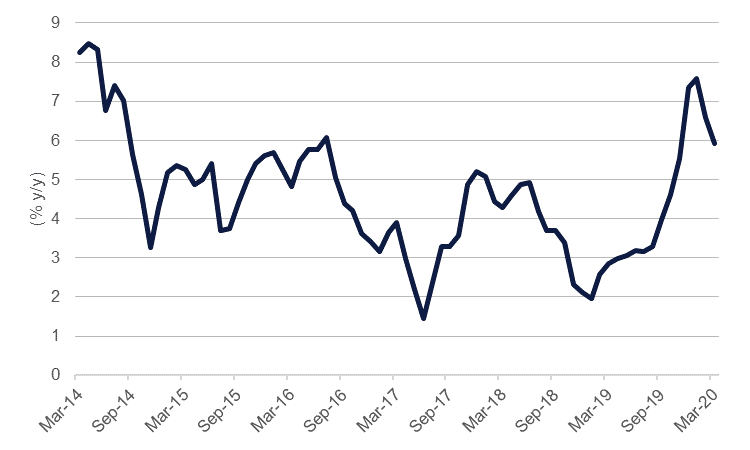

India’s CPI reading for March came in at a four-month low of 5.91% y/y relative to previous month’s reading of 6.58% y/y. The decline was because of moderation in food prices of 7.82% y/y (vs 9.45% in previous month). Inflation is expected to ease further going forward as lower demand owing to restriction in economic activities weighs. The minutes from the RBI’s last meeting acknowledged the same as it hinted that room for further rate cuts remains available. The minutes also suggested that the RBI is likely to continue with unconventional tools to support growth and maintain financial stability.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries traded in a tight range in a session which was marked by low volumes. The curve bear steepened with yields on the 2y UST and 10y UST closing at 0.24% (+2 bps) and 0.77% (+5 bps) respectively.

The Federal Reserve Bank of New York said that it will reducing the amount of funding it offers through both overnight and term facilities from May 4 2020 in light of more stable repo market conditions.

Regional bonds saw buying interest. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 3 bps to 4.54% and credit spreads tightened further to 385 bps.

Activity was light yesterday, as much of Europe remained on Easter holiday, which made for choppy FX trading against a background of greater risk aversion. The dollar’s DXY index reached lows of 99.139 and highs of 99.630 during the day but has since dropped in the early hours of this morning, reaching 99.180. The JPY had a consistent bullish tone, appreciating over 0.80% to reach 107.60. GBP reached its highest level in a month, making modest gains to reach 1.2560. Similarly the AUD and NZD also made moderate gains, continuing their positive movement from last week to reach monthly highs early this morning, increasing by over 1% and 0.60% respectively.

US equities closed lower as investors pared positions following last week’s massive rally. The S&P 500 index lost -1.0%.

Regional markets closed lower as they gave up part of their previous session gains. The DFM index and the Tadawul lost -1.1% and -0.9% respectively as investors remained wary whether the agreed OPEC+ deal will be enough to reduce the glut. Saudi Aramco lost -1.7%. Saudi Telecom lost -1.8% after the company extended its MoU for a period of 90 days to acquire Vodafone Egypt. Air Arabia gained +1.0% amid unconfirmed reports that the airline has sought support from the government and plans to delay the launch of the new low-cost carrier with Etihad Airways.

Oil prices ended the day mixed in response to the OPEC+ deal to cut by 9.7m b/d. Brent futures settled slightly higher, up 0.8% at USD 31.74/b despite having risen as much as 4% in early trading. WTI fell, however, ending the day at USD 22.41/b, down 1.5%.

US president Donald Trump continued to spout off on the oil market, saying that OPEC+ would actually be cutting 20m b/d, not the 9.7m b/d agreed as part of the deal. How the president’s calculation comes to 20m b/d of cuts is unclear but may be an effort to try and talk up the oil market and lift prices.

The EIA’s latest drilling productivity report showed that it expects to see production declines accelerate in shale basins in the US, with total crude production from major regions falling by 183k b/d m/m into May. Given the pace of decline in the rig count we’ve seen so far, there is a real probability that production from the shale patrch falls below 6m b/d by the end of the year from around 8.5m b/d at the moment.