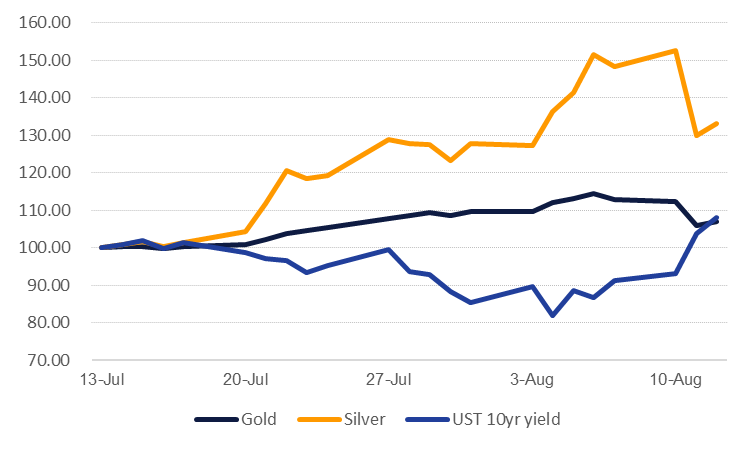

Gold prices have sold off sharply over the last few trading sessions, falling from a record level of USD 2,075/troy oz in early August to USD 1,863/troy oz in early trade today. Prices have managed to recover some ground but at around USD 1,930/troy oz remain around 7% below their peak levels.

The immediate catalyst for the sell-off in gold appears to be the uptick in UST yields. Yields on 10yr UST have gained over 10bps since the start of the week, trading at around 0.67% at present. Inflation adjusted yields have also moved higher, gaining around 10bps from their recent trough level of -1.08% to test -0.99% currently. The uptick in US producer price inflation for July, up 0.6% m/m, also should help to alleviate some near-term deflationary fears.

Source: Bloomberg, Emirates NBD Research. Note: Jul 13 2020 = 100.

Source: Bloomberg, Emirates NBD Research. Note: Jul 13 2020 = 100.

Both gold and UST markets will be anxiously watching the outcome of political debates between the Trump administration, Senate Republicans and House Democrats in the US as to whether a new fiscal support package can be achieved. So far the divisions remain wide—at least by around USD 1trn!—but given the political cost for either side of not reaching a deal some new fiscal plan is likely to emerge. We would expect a deal to help push the UST yields higher—our range for UST 10yr in Q3 is 0.55-0.65% and then moving to 0.65-0.85% in Q4—and also sap momentum away from gold prices. We maintain our forecast for gold at USD 1,790/troy oz on average in Q3 and Q4.

Silver prices have also come under considerable pressure in line with the move downward in gold and likely have further room to fall. Over the past month spot silver rallied from USD 18.93/troy oz to USD 29.86, a gain of 57%. Prices have fallen around 16% from their early August peak and given silver’s high beta to move in gold, a fiscal deal or further gains in UST yields could play out more aggressively in the silver market. We expect prices at an average of around USD 17/troy oz in Q3 and Q4 2020.