As the economic impact of the Omicron variant of Covid-19 looks to be far less meaningful than initially feared, gold prices look unreasonably stable. Since the discovery of the much more transmissible Omicron variant, gold prices have oscillated from highs of around USD 1,870/troy oz to lows of around USD 1,770/troy oz and have spent much of 2022 so far holding at around USD 1,800/troy oz. With the threat to global growth seeming to diminish—even as major economies like China maintain a zero Covid policy—the allure of a haven asset like gold will fade.

Even if gold is not reacting to the diminished risk from Omicron, another salient threat to gold prices comes from the hawkish shift from global central banks, most notably the Federal Reserve in the US. As it looks clear that the Fed will engage on a brisk pace of policy normalization—we expect four rate hikes this year, beginning at the March FOMC—treasury yields have soared. The 10yr UST yield has added almost 40bps since the start of the year to just shy of 1.9% and yield gains have been spread across the curve. Inflation adjusted yields have also driven higher with 10yr real yields up to -0.59% as of mid-January compared with less than -1% at the end of 2021.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

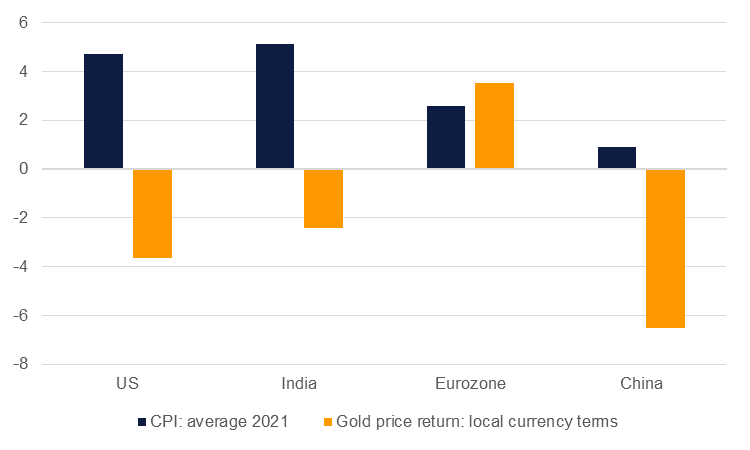

Gold failed to live up to its “inflation hedge” characteristic last year with spot prices falling by 3.6% in USD terms while US inflation averaged 4.7%. Gold also underperformed inflation in India and China, the two largest physical demand markets. The pull upward in UST yields—real and nominal—will likely incentive a flow of macro-oriented investors towards Treasuries and away from gold even as the outlook for inflation in the near term remains high. Exchange-traded fund holding of gold has slipped to its lowest levels since the peak of the pandemic in Q2 2020 while speculative net length in gold futures has also moved considerably lower in the last year and a half.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

As yields go higher so too should the dollar, making gold more expensive in key emerging market demand centres. High coronavirus case loads and restrictions on activity can limit retail purchasing, further weakening the outlook for demand this year. Imports of gold into India last year rose by just 6% in volume terms compared with more than 81% in 2020 with flows dropping substantially in Q2 as India endured a sharp rise in Covid-19 cases.

There is a risk that the Fed and other central banks may be too aggressive in tightening policy to contest inflation and consequently roil financial markets, and economic stability too. That scenario would likely prove near-term positive for gold and precious metals generally as investors move away from risk assets like equities or other commodities such as energy or base metals. However, we would expect the Fed to be alert to the destabilizing risk of tightening too much too quickly and temper their pace accordingly.

We expect that gold prices will fall in 2022 with an average price of USD 1,675/troy oz, a 7% drop on annual 2021 levels. For the rest of the precious metals complex we expect to see average prices lower than in 2021, principally as higher yields push investors away from the narrative of investing in precious commodities.