Gold prices have hit record highs this month with spot gold touching USD 2,482/troy oz as of mid-July. Gold prices have rallied almost 20% year-to-date, among the strongest gains across commodities with its more volatile peer metal, silver, recording even stronger moves.

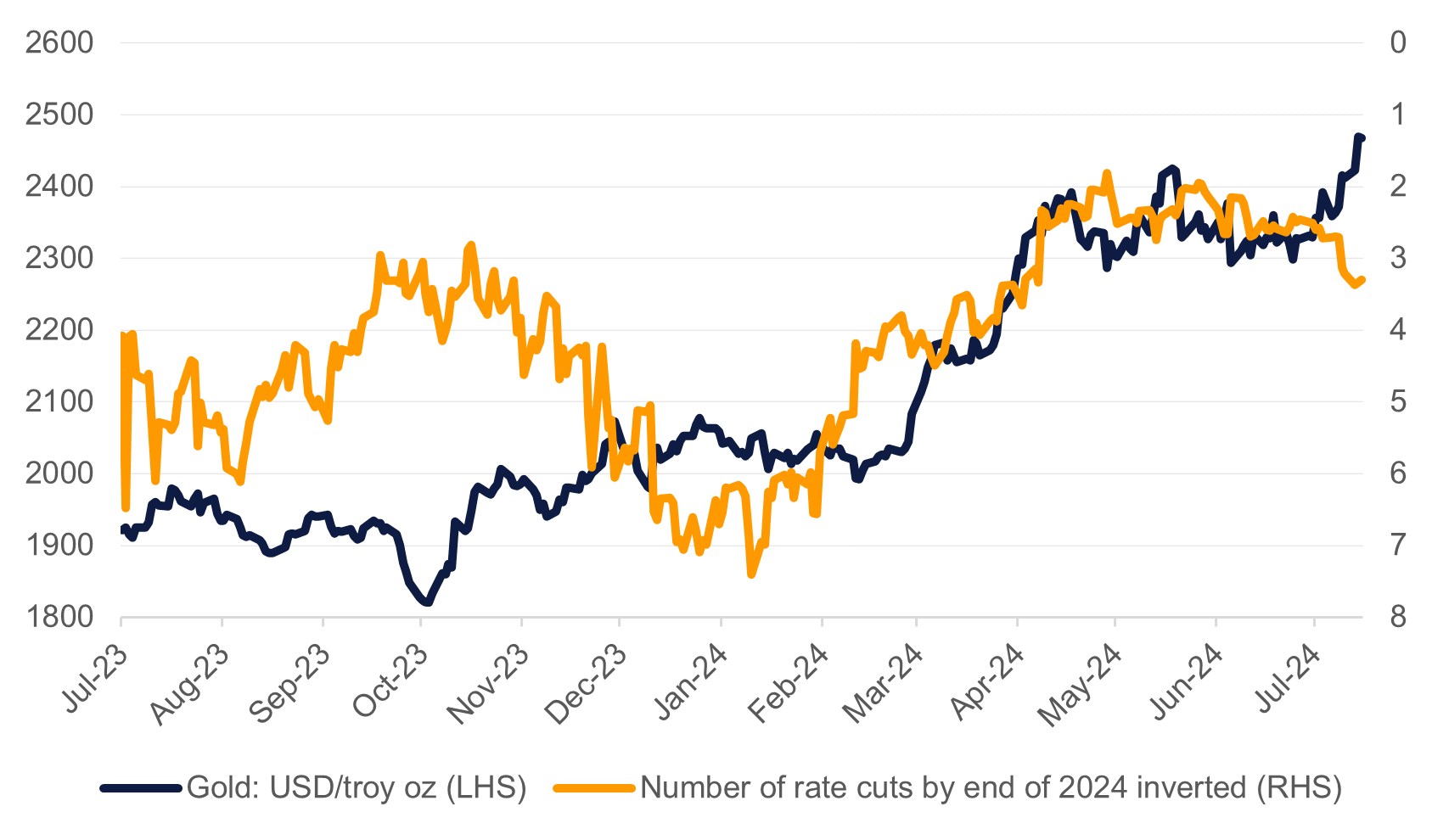

The current rally in gold seems to be built on expectations that the Federal Reserve will start to cut rates meaningfully before the end of 2024. At the start of July Fed funds futures priced in fewer than two 25bps cuts by the end of 2024, while by July 17th that pricing had increased to almost two and half cuts fully priced before year-end. The intuitive relationship between gold and rates is that as rates move lower and yields decline on US Treasuries and other fixed income instruments, gold becomes more attractive. However, while the gain in gold prices in July may have been catalyzed by rate expectations, in the medium- and longer-term their influence on gold prices holds less significance.

Source: Bloomberg, Emirates NBD Research. Note: number of rate cuts as implied by Fed Funds futures.

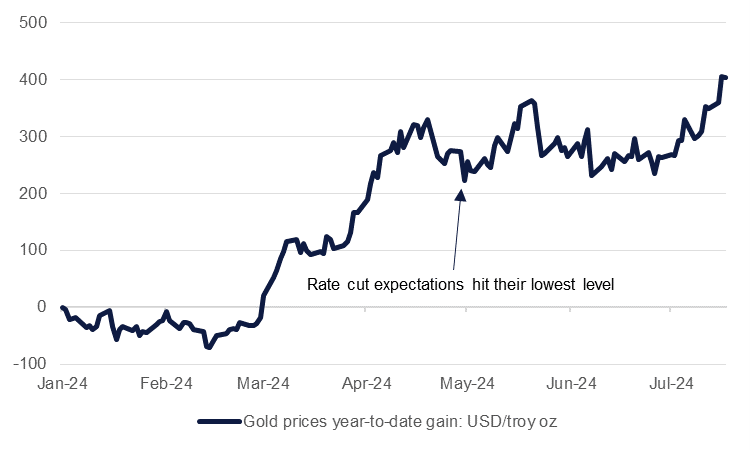

Source: Bloomberg, Emirates NBD Research. Note: number of rate cuts as implied by Fed Funds futures.

In July, as rate cut expectations have increased gold prices have rallied by USD 140/troy oz or about 6%. But most of the year’s gains in gold came during Q1 and the early parts of Q2 as rate cut expectations were actually declining. Inflation estimates in Q1 for the US economy were higher than expected and investors adjusted their rate cut expectations lower. During that period gold prices rose by nearly USD 330/troy oz or roughly 16%.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

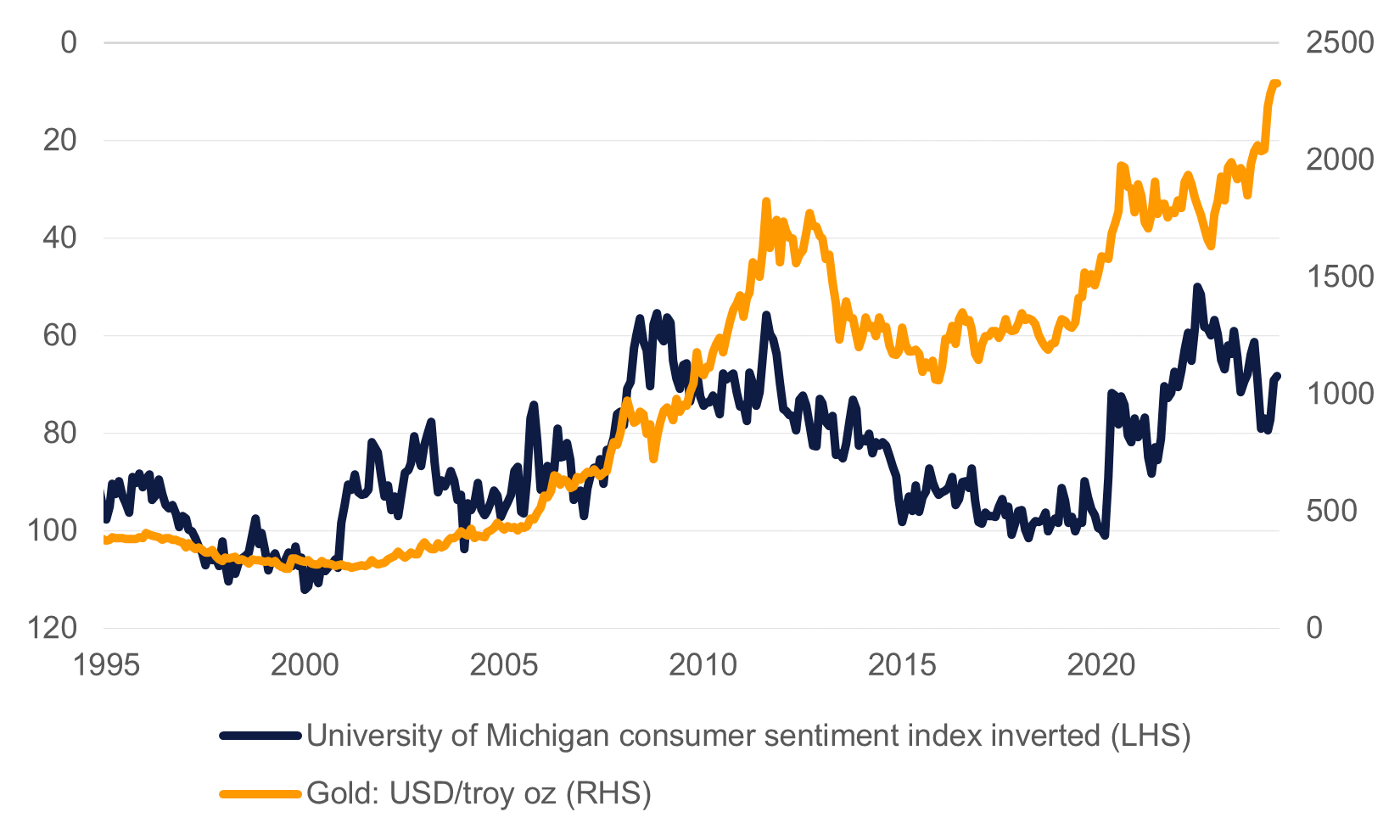

Over the medium- and longer-term the influence of factors like consumer sentiment, the performance of equity markets and the US dollar exert an apparently more powerful effect on gold prices. As gold is the near ultimate sentiment investment (it pays no dividend or yield and has limited commercial application) it appears to benefit from periods of deteriorating consumer and investor optimism. Gold has trended higher when the University of Michigan’s consumer sentiment survey has deteriorated: the global financial crisis and pandemic appear to highlight this relationship.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Consumer sentiment in the US dropped to 66 as of July 2024 according to the University of Michigan, worse than during 2020-21 when the index recorded an average of nearly 80 when Covid-19 lockdowns and interruptions to the US and global economy were at their most extreme. The drag-on sentiment is widely split along political lines with Democrats reporting much stronger confidence than Republicans. The outcome of the US elections in November this year may prompt a meaningful shift in consumer sentiment though if confidence in the economy by political party simply inverts (Republicans for example growing more confident if Republicans win the presidency and Congress) then the composition of the headline index, and thus influence on gold, should be neutral. Rather, the trajectory of the headline consumer index is much more important than which political party is contributing to the positivity or negativity.

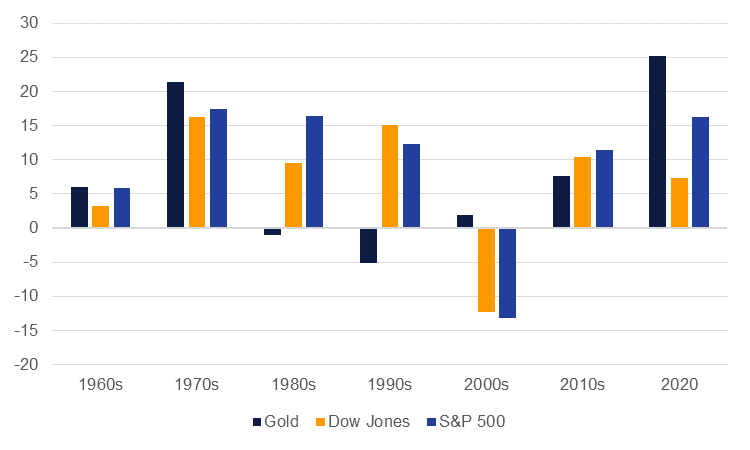

Source: Bloomberg, Emirates NBD Research. Note: average of annual return in US presidential election years.

Source: Bloomberg, Emirates NBD Research. Note: average of annual return in US presidential election years.

The relationship between consumer sentiment and the performance of equity markets may be circular. Equities tend to perform well during US election years even if policy plans of respective candidates are not themselves perceived as pro-markets. But an improving sentiment and equity market gains (the S&P 500 is up almost 19% so far this year) should be headwinds to gold prices pushing higher and higher.