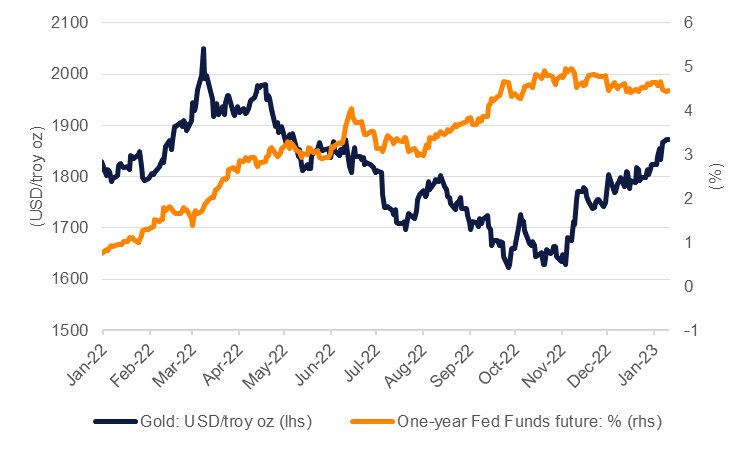

Gold prices have started 2023 in good shape, extending a rally from the last two months of 2022. Broad financial market expectation that the Federal Reserve will need to pull back on aggressive monetary tightening is helping to support the gold market even as Fed speakers show no sign of turning yet. We had expected that gold will do well in 2023 but thought the rally would come later in the year. We are now bringing forward our expectation that gold prices will move higher and be able to sustain at higher levels.

Spot gold prices have gained around 2.6% year-to-date as of January 10, trading close to USD 1,870/troy oz and have rallied about 15% from the 2022 low of USD 1,622/troy oz. However, prices remain below their 2022 peak of more than USD 2,050/troy oz, hit in March last year when the Russian invasion of Ukraine first threatened geopolitical stability and prompted a flight to havens.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The relentless rise in rate expectations and UST yields, along with a stronger dollar, helped to sink gold prices over much of H2 2022 but now the outlook for rates is more uncertain. Fed officials still expect to see the Fed Funds rate at more than 5%—Raphael Bostic of the Atlanta Fed and Mary Daly from San Francisco were the latest speakers to support holding rates above that level—but markets aren’t buying that the Fed will need to be as hawkish. The latest nonfarm payrolls report for December showed another strong headline gain in jobs numbers but accompanied by a slowdown in average hourly earnings. In addition, near-term indicators of US economic activity have turned decidedly negative: the services ISM for December fell sharply to 49.6 from 56.5 a month earlier. The evident slowdown in the economy—perhaps even qualifying for the Fed’s mythical soft landing—has meant that markets are anticipating that rates will peak at 5% mid-year and then start to move lower by the end of 2022.

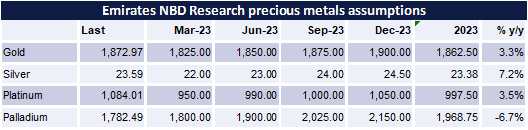

Such a rate trajectory should mean range-bound UST markets and a softer picture for the dollar, all of which are positive for gold. Combined with a slowing but still high inflation environment and a fraught geopolitical environment, gold prices look warranted to remain bid this year. We expect spot gold to record an average of USD 1,825/troy oz in Q1 before pulling higher over the rest of the year with a target of USD 1,900/troy oz on average in Q4.

Source: Bloomberg, Emirates NBD Research