Gold prices have failed to hold on to the gains catalyzed by a jump in geopolitical risk premiums related to Russia’s invasion of Ukraine. After hitting a 2022 peak of USD 2,070/troy oz in early March, spot gold has now fallen to around USD 1,820/troy oz. Near-term conditions appear negative for gold, particularly in the context of the current move in financial markets away from assets with any potential risk characteristics.

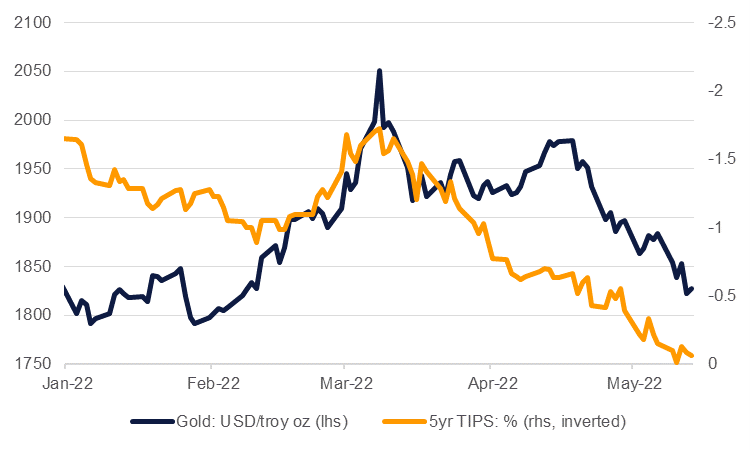

Gold is dealing with several near-term headwinds. Most salient is the rise in US Treasury yields. Yields on the 10yr US Treasury have pushed up to near 3% in response to the Federal Reserve starting to normalize policy and preparing to continue with further aggressive rate hikes. We expect another two 50bps hikes at the June and July FOMC meetings while the Fed will also start to wind down its balance sheet from June onward which will help to push yields higher yet again. Inflation-protected yields have also moved higher, close to or into positive territory as of mid-May, giving gold’s ‘inflation hedge’ characterization a more tradeable alternative.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

As yields have been going higher so has the dollar against all peer currencies, including gold. Central bank policy differentials still heavily favour the USD against other currencies, even as other central banks are starting to fall in step with the Fed on hiking rates. A strong dollar will add a further drag on gold and commodity prices from a policy perspective alone.

But gold is also losing out on the geopolitical risk haven bid to the dollar as well. Prices jumped higher following Russia’s invasion of Ukraine but have steadily given back those gains and are now basically flat year to date, compared with as much as 12% higher in the days following the start of the war. Conversely the dollar is up 9% since the start of the year (DXY basis) with no immediate barriers to further gains. Multiple asset classes—equities, foreign exchange, corporate credit, cryptocurrencies—are all suffering thanks to the prospect of even higher US rates, a slowdown in global growth and still high geopolitical risks.

Investors also look to be increasingly bearish on gold. Managed money short positions have risen for the last six weeks in a row, bringing net longs as a share of total open interest in gold futures and options down to 11%, lower than its five-year average level and with considerable scope for further liquidation of long positions. Holdings in gold exchange-traded funds look to have hit a crest in the last few weeks and have begun to come off modestly too.

In the near term the risks for gold look to us to be weighted to the downside and we are adjusting our price expectations accordingly. We had though gold would dip lower in the second half of the year on the back of rising yields and waning growth but are now bringing that outlook forward and expect gold at an average of USD 1,920/troy oz in Q2 before falling to an average of USD 1,850/troy oz in Q4.

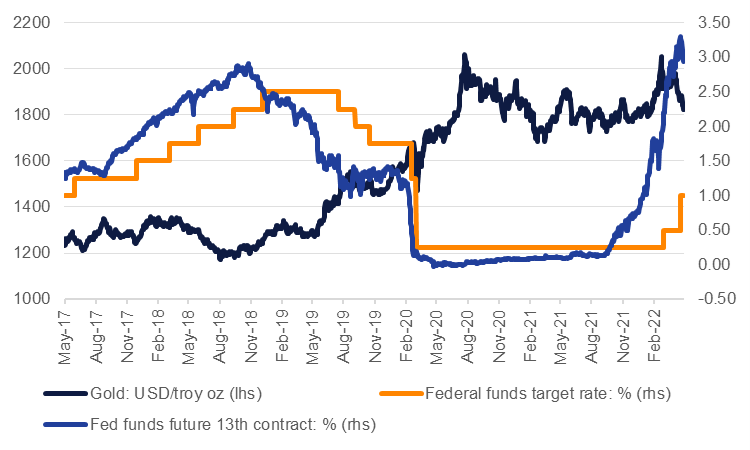

But once markets start to price in a stabilization for rates then we believe it could set up another push higher in gold prices. In the last hiking cycle from 2015-18, one-year forward Fed fund futures peaked at around 2.8% before markets started to price in rate stabilization. That occurred in tandem with a move higher in gold prices from around USD 1,200/troy oz to USD 1,400/troy oz before rate cuts in 2019 helped to propel gold considerably higher.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

We think that Fed fund futures have some way to run lower before they start to price in a stabilization in rates—they are currently at an implied yield of around 3% on the one-year future compared with growing consensus for a terminal Fed funds rate of 3.25%. Stabilization in rates in the context of slower global growth and likely higher baseline inflation levels should allow for positive conditions for gold prices.