Non-conciliatory tone of ongoing trade discussions between the US and China and increasing geopolitical risks weighed on investor sentiment during the month. Consequently the increase in safe haven bid saw yields on US treasuries to fall even though the Federal Reserve is set to raise rates again this month. Yields on 2yr, 5yr, 10yr and 30yr treasuries closed the month of May at 2.43% (-6bps m/m), 2.70% (-10bps m/m), 2.86% (-9bps m/m) and 3.03% (-9bps m/m) respectively.

Supported by falling benchmark yields, USD denominated bonds and sukuk portfolios received some respite, however, total return on Markit iboxx Emirates NBD sukuk index remained negative as credit spreads widened. Total return for the month was negative 0.9%, taking the YTD return to negative -2.0%. This is much in sync with a generalised sell off in EM bonds and sukuk as investors’ appetite for EM risk waned in the face of rising US rates, strengthening dollar and political uncertainties in several EM economies.

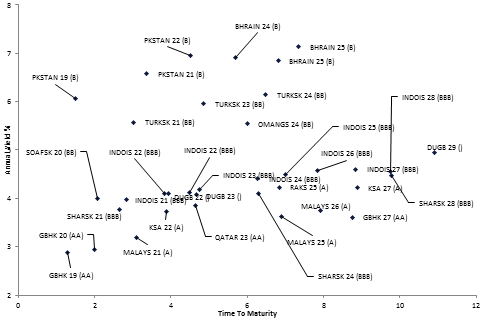

Looking at current yields, following relative value observations are made:

Source: Markit, Emirates NBD Research

Source: Markit, Emirates NBD Research

Click here to Download Full article