Last month we thought that some of the optimism that was driving markets higher was unsustainable, and the last fortnight has shown that this was indeed the case. Regional equity markets have been less affected by recent market volatility partly on account of them not participating as much in earlier rallies.

- Global macro: Evidence of returning inflation pressures are causing central banks to review their monetary policies amidst increasingly volatile financial market conditions.

- GCC macro: The effects of VAT’s introduction across the GCC were visible in January’s regional PMI’s.

- MENA macro: Fiscal deficits will narrow across North Africa and the Levant in 2018, although political pushback will slow the pace of this as populations tire of austerity measures.

- Sector focus: An overview of the GCC’s Artificial Intelligence (AI) sector.

- Emerging market focus: An overview of the outlook for India.

- Interest rates: Government bonds fell and yield curves steepened as expectations of higher inflation got firmly entrenched.

- Credit: GCC bonds suffered from bear steepening of the UST benchmark yield curve as well as widening credit spreads amid increased volatility in financial markets.

- Currencies: Midway through February, the USD is currently on target to decline for a fourth successive month, despite attempting to rally at the start of it.

- Equities: February has been a volatile month for global equities. The return of inflation was flagged as one key concern for 2018. However, it was not anticipated that the risk would manifest itself so early in the year.

- Commodities: We have marked our oil forecasts to market but expect further downside ahead as fundamentals and external factors drag down on prices.

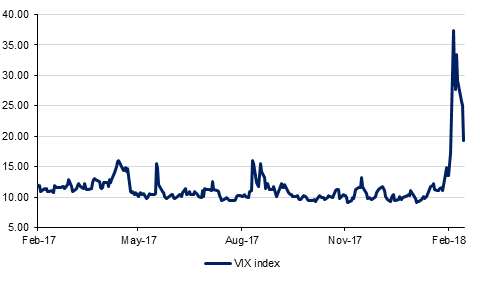

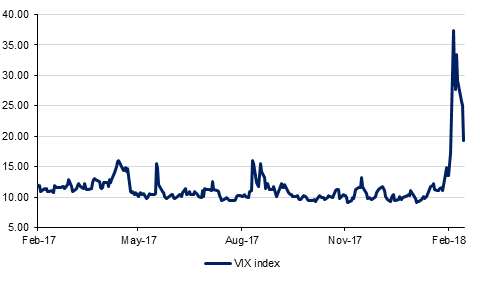

Volatility shoots up as inflation risks grow

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Click here to Download Full article