There is some greater positivity in global markets, despite the ongoing spread of the Coronavirus, which has neared 7,000 confirmed cases in China. Some positive earnings data from the US gave a boost to equity markets, while Brent crude has ticked back up over USD 60/b. Governments around the world have issued travel warnings regarding China, and there have been evacuations of foreign nationals from the country by governments and international firms.

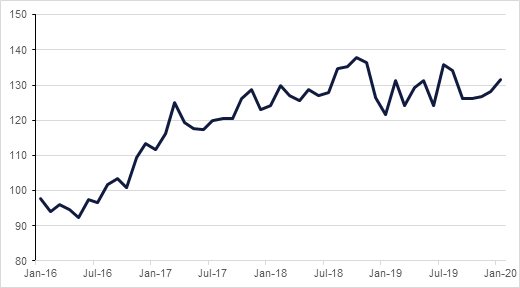

There was some positive data from the US ahead of the Fed decision later today as the Conference Board confidence survey and the Richmond Fed manufacturing index both exceeded expectations. Consumer confidence started the year on the front foot, rising to 131.6, from 128.2 the previous month. This was the strongest reading since August last year, likely profiting from the diminishing trade war risks, although too early to gauge concerns over the Coronavirus. Meanwhile, the Richmond Fed manufacturing index came in at 20, the highest reading since September 2018 and compared to just 5 in December.

Somewhat more ambiguously positive was the durable goods orders data release, which rose 2.4% in December, after a 3.1% fall in November (itself a downward revision). This expansion was far stronger than expectations of 0.3%. However, the headline figure somewhat belies the strength of the orders, given that there was a 168% increase in defence aircraft and parts orders. This buoyed up the rest of the survey, which did not perform quite so well. The troubles at Boeing were evident in the 75% fall in non-defence and parts, while stripping out aircraft, core capital goods declined 0.4%.

In Qatar there is a new prime minister as Khalid bin Khalifa al-Thani has been appointed following the resignation of the previous post holder, Abdullah bin Naser bin Khalifa, who had been in place since 2013.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The modest return in risk-on appetite has hit treasuries, which had been closing higher as concerns over the Coronavirus rose. Yields on the 2yr UST fell as low as 1.40% yesterday, after a report that flights between the US and China would be suspended. However, following a rebuttal from a White House official that the administration was calling for a ban on flights to China, coupled with the strong earnings releases last night, yields have risen back to 1.46% this morning. The US Fed is due make its rate decision later today. Despite pressure from President Trump to cut rates, the market implied probability of such a move is 0%, with a cut only 12% priced in.

The odds on the Bank of England cutting rates have risen modestly since yesterday, ticking up from 46% to 50%. The decision remains on a knife-edge, although we hold to the view that the MPC will keep rates on hold for now.

The more positive mood in global markets generally this morning has been reflected in the Japanese yen, which sold off back to 109.15 yesterday (from 108.9 on Monday) and is trading at 109.19 this morning as risk-on appetite has improved. The key market mover today will likely be the US Fed decision. While there is little likelihood of any chance in rates by the FOMC, any guidance from chair Jerome Powell, especially in light of the Coronavirus, will be instructive.

Although the Hang Seng has lost 2.3% on its reopening after the Chinese New Year this morning, equity indices around the world have fared a little better generally. This is largely on the back of earnings announcements in the US as Apple and Starbucks both beat forecasts and contributed to the S&P 500 closing up 1.0% yesterday. The Nikkei is trading up 0.5% this morning on yesterday’s close, although it is still down w/w. financial markets in China, meanwhile, remain closed.

Oil prices managed to recover somewhat overnight and have added more than 1.3% in both benchmarks in early trading today. A risk-on move in equity markets after good corporate earnings helped to shift sentiment away from coronavirus demand fears. Brent is currently back above USD 60/b and WTI is holding at USD 54.18/b.

Inventory data from the API showed a decline in US crude stocks of 4.3m bbl last week. Official data from the EIA will be released later this evening. Focus again will be on whether a draw in crude stocks is matched or unwound by a build in product inventories.