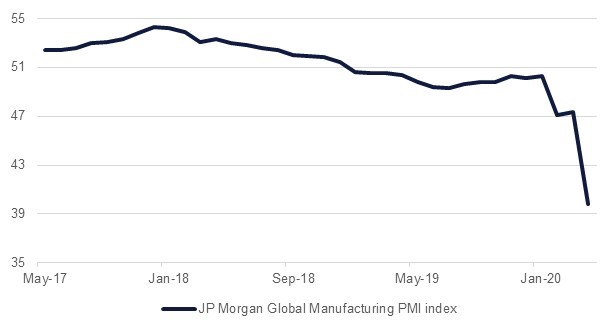

PMI readings from economies around the world confirmed that the global economy remains in a very precarious position. The JP Morgan global manufacturing PMI reading for April came in at 39.8, lower than 47.3 in March 2020. The reading was the lowest since March 2009 and showed a third consecutive month of contraction. All sub-indices showed a similar trend and pointed towards a slower-than-expected recovery going forward.

Regional PMIs released today showed the headline indices were remarkably stable at first glance, with the UAE PMI declining to just over 1 point from March to 44.1 in April, while the Saudi PMI actually rose slightly to 44.4 from 42.4 in March. However, the disruption to global supply chains around the world have resulted in PMI readings everywhere being artificially boosted by lengthening supplier delivery times. Usually longer delivery times denote increased demand but in today’s exceptional circumstances these are a reflection of factory and border closures that have disrupted global supply chains.

As a result, the output/ business activity and new work components of the PMI surveys are probably a more accurate reflection of the state of the private non-oil economies in the region than the headline PMI figures.

On these measures the situations have deteriorated significantly. In the UAE’s case output/ business activity declined at a record rate in April with the index falling to 39.9 as restrictions to contain the spread of the coronavirus led to many businesses closing for most of last month. In Saudi Arabia too output/ business activity in the non-oil private sector declined at a record rate last month, with the index falling to 37.5. In Egypt’s case the headline reading did not see any benefit from longer supplier delivery times, with the headline PMI dramatically falling back to 29.7, down from 44.2 the previous month and far below the neutral 50.0 level.

The governing body of World Expos (the BIE), has officially postponed Expo 2020 in Dubai from this year to next, meaning that it will now begin October 1st 2021 and last until March 31 2022. The news was not a surprise as the BIE had already signalled the likelihood of a postponement last month. The absence of Expo this year is another factor that will limit growth in the final quarter of 2020 in the UAE, but this will be made up for by a boost to growth in 2021.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries traded mixed in what was a choppy day of trading amid a slew of investment grade corporate issuances. The curve steepened with yields on the 2y UST and 10y UST closing at 0.18% (-1 bp) and 0.63% (+2 bps) respectively.

US treasury department said it expects to issue USD 3tn of net marketable debt in Q2 2020 and USD 677bn in Q3 2020. The increase is primarily driven by new stimulus measures announced to combat the impact of coronavirus.

Regional bonds gave up some of their last week gains. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose 3 bps to 3.94% and credit spreads widened 4 bps to 332 bps.

SAMA, in a statement, said it has enough foreign reserves to meet all foreign obligations and reaffirmed its commitment to maintaining a currency peg to the USD.

S&P affirmed Bank Muscat ratings at BB- with negative outlook.

The dollar started the week in positive fashion after poor economic data from Europe highlighted the depth of the slump.The DXY index met support around the 98.500 area to rise to 99.420 whilst the JPY was largely unmoved at 106.60.

The Euro experienced a bearish downturn after PMI data recorded poor results in the region, with IHS Markit stating that any recovery from factory shutdowns will be "frustratingly slow". The currency dropped over 0.70% to reach 1.0910. Sterling was similarly negative, declining over 0.50% to trade at 1.2460. Decisions on the state of the UK lockdown are still up in the air at this point, the uncertainty hindering the Pound's standing. Despite a choppy day the AUD has made some modest gains this morning to reach 0.6445, whilst the NZD reversed all its losses last night to end at 0.6060.

It was a volatile session of trading for developed market equities. US equities staged a late session recovery amid notes of optimism in fight against the viral outbreak. The S&P 500 index ended the day with gains of +0.4% while the Euro Stoxx 600 index lost -2.7%.

Regional equities closed lower for a second consecutive day. The Tadawul was an exception as it eeked out gains of +0.2%. Salama added +2.6% after the company increased its foreign ownership limit to 49% from 25%. Sabic reported a loss in Q1 2020 citing impairment provisions in capital and financial assets. The company suspended all discretionary capital expenditure. The stock ended the day flat.

After a rocky start to the day oil futures managed to close higher, extending their recent rallies. WTI prices continues to push upward this morning, adding more than 7.4% to hover a little under USD 22/b while Brent is trading around USD 28.50/b, up almost 5%. There have been few data points to push the market one way or the other at the moment so recent gains are likely a reflection of OPEC+ producers starting to limit their production.