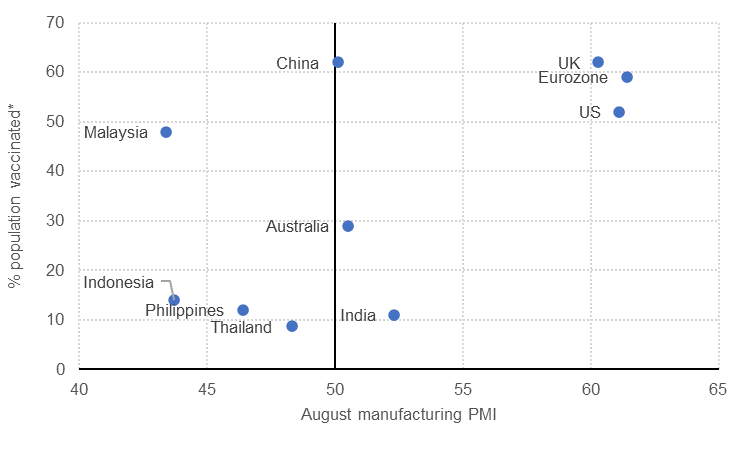

Global growth is slowing, according to the most recent economic data for August. The extent of the slowdown, and in some regions contraction, depends on how governments have responded to the spread of the Delta variant of the coronavirus, which in turn has largely depended on progress with coronavirus vaccine rollout.

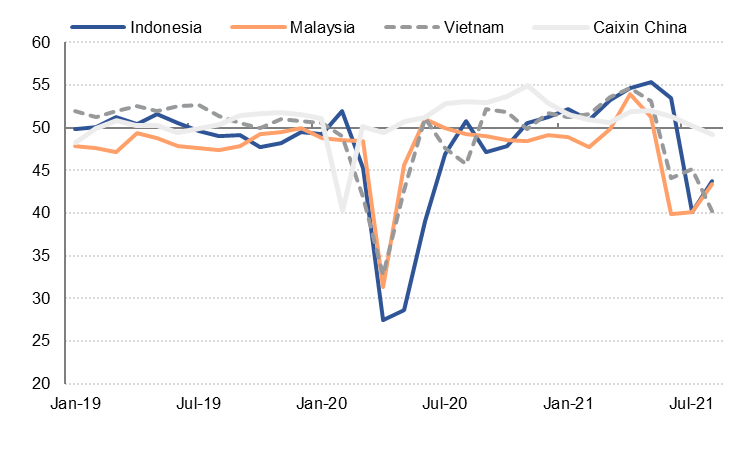

In Southeast Asia, purchasing managers’ indices (PMIs) for many countries including Indonesia, Vietnam, the Philippines and Malaysia showed an outright contraction in manufacturing sectors in August, as lockdowns and other measures to slow the spread of the coronavirus have weighed on activity, along with shortages of raw materials and other inputs. With fewer than one-fifth of populations in these countries fully vaccinated against the coronavirus, governments have had little choice but to impose lockdown measures to safeguard public health, despite the economic cost.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

China’s manufacturing sector was broadly stable in August, but the services sector contracted sharply, the first decline since February 2020, again largely due to government-imposed restrictions on movement to prevent the spread of the Delta variant of the coronavirus. China’s vaccination rate is relatively high at around 61%, but the government’s zero tolerance approach to managing the pandemic meant that very restrictive measures were imposed in response to a relatively small number of new cases.

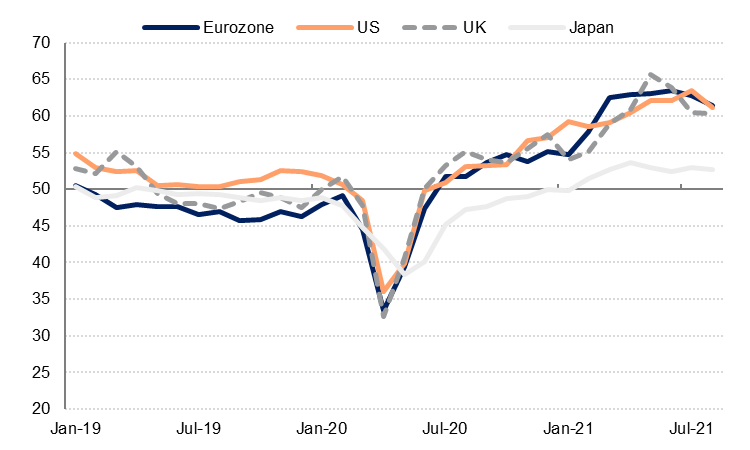

Meanwhile, survey data for the US, Eurozone and the UK showed that growth slowed but remained in positive territory last month despite the spread of the coronavirus in those regions. In fact, the Eurozone’s PMI was just shy of a 20-year high in August, indicating a very strong rate of expansion in both manufacturing and services.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The main reason these developed economies have outperformed their Asian counterparts is because they have continued to ease restrictions on movement and activity even as the Delta variant of the coronavirus has spread. This has arguably only been possible because of the high levels of vaccination against the coronavirus. Despite its slow start, the EU announced last week that 70% of its adult population was fully vaccinated, just behind the UK’s 75%. Although the US adult vaccination rate is lower at around 60%, it remains well above most Southeast Asian countries.

* Total population vaccinated, which is lower than the adult vaccination rate

Source: Bloomberg, OurWorldInData, Emirates NBD Research

As supply chains connect the world’s economies, the contraction in manufacturing activity in Asian exporters is having an impact on the rest of the world as it exacerbates already severe shortages of parts, raw materials and shipping capacity. Backlogs of works – the difference between the volume of orders received and what a business has started to work on or complete - in developed markets is the highest in almost twenty years. Supply shortages are starting to constrain growth in developed markets, and push up production costs.

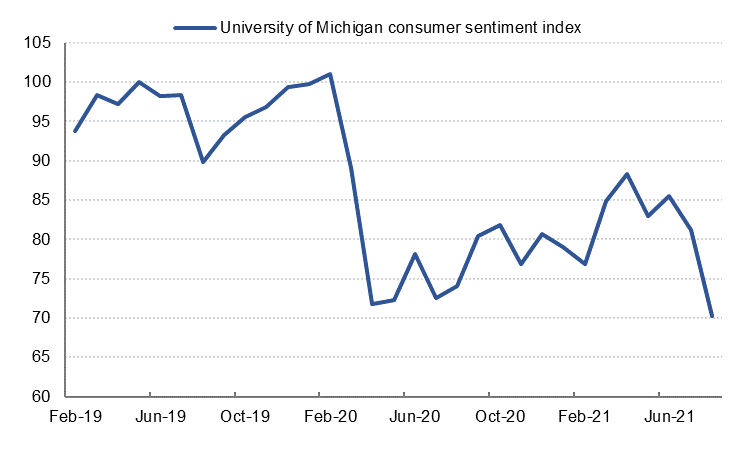

In the US, the slowdown in activity is most evident in the services sector as consumers appear more reluctant to travel and dine out on the back of the recent surge in coronavirus infections. Only 235,000 new jobs were added in the US last month, significantly fewer than had been the case in June and July and also well below what economists had expected. The retail sector shed jobs in August and there was no job growth in the leisure and hospitality sectors last month. Nevertheless, average hourly earnings increased by a faster than expected 4.3% y/y as firms paid more to attract and retain staff, adding to cost pressures for businesses.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Slowing growth and rising prices present a challenge to the US Federal Reserve and other major central banks as they start to consider withdrawing monetary stimulus. Inflation hawks at the Fed and the European Central Bank are becoming more vocal about price increases and pushing for a faster withdrawal of stimulus, while those concerned about the fragile recovery and still high unemployment may be more focused on the risks posed by the Delta variant.

The much weaker than expected non-farm payrolls figure in August makes it less likely in our view that the FOMC will vote to taper asset purchases at the September meeting. However, we think tapering is still likely to start by the end of this year unless the next two jobs reports (for September and October) are even weaker than the August reading. Notwithstanding the recent moderation in consumer spending, and the slower rate of hiring in August, the US economy is still growing and output has recovered to pre-pandemic levels. However, we retain our view that the Fed is unlikely to start raising interest rates before 2023, with the bar for rate hikes much higher than for tapering of asset purchases.

A version of this article was published in The National.