While the rapid spread of the Omicron variant of Covid-19 through the final months of 2021 initially prompted widespread concerns around the potential impact on growth in 2022, that concern is slowly turning to optimism that in fact this is the beginning of the end of the pandemic. While the data is as yet incomplete, indications are that this variant, while many times more transmissible, could be less deadly than previous strains, especially for those who are vaccinated. Extra booster shots provide still more protection.

.jpg) Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Nevertheless, the resurgent virus prompted widespread disruption through December, with thousands of people forced to self-isolate once more or otherwise choosing to do so for the sake of their health. Renewed restrictions in EU majors such as France, Germany and Netherlands will have weighed on growth in the final quarter of 2021 and through January 2022 at least. China continues to pursue a zero-Covid strategy which has implications not only for itself but also the rest of the world as supply chain issues are exacerbated. Travel plans and flights through the holiday period were cancelled as red lists started to change once more. And even in those countries which chose not to implement major new restrictions such as the US and England (the rest of the UK has been more stringent), activity has been impeded nonetheless by the sheer numbers of people testing positive, with restaurants and theatre shows forced to close and flights cancelled due to a lack of available staff.

.jpg) Source: IMF (October 2021 forecasts), Emirates NBD Research

Source: IMF (October 2021 forecasts), Emirates NBD Research

Nevertheless, the expectation is now high that Covid’s power to disrupt economies is waning, especially as many countries start to cut the self-isolation time required after a positive test. New variants may well yet emerge, but the hope is that they will continue to steadily weaken, and this has been reflected in market responses through the close of December. Trading depth is admittedly thin through the holiday period, but there was a notable return of risk appetite in equity and commodity markets, with oil in particular seeing strong gains – Brent futures ended the month up 10.2%. As such, we do not at present see much call for Omicron to prompt any global growth forecast downgrades for 2022, although the expansion will likely be slower than last year. With many of the ‘easy wins’ in terms of growth now achieved – more limited restrictions compared to the first year of the virus and following substantial 2020 contractions – the global expansion in 2022 is set to be slower than last year. The IMF is forecasting 4.5%, compared to its 2021 estimate of 5.9% (October projections).

The recovery in the US is set to continue, albeit at a slower pace than seen in 2021. Consensus projections are for 3.9% growth in 2022, compared to an estimated 5.6% in 2021. Aside from the persistent risks associated with new Covid-19 strains, other risks to the outlook are presented by the ongoing issues around supply chains, related higher inflation levels, and plans by the Federal Reserve to tighten monetary policy as it turns its attention from the labour market to that elevated price growth. The FOMC is betting that with the recovery seen in the labour market over recent months, the US economy is now in a strong enough position to withstand higher rates, but a too-hasty tightening could yet jeopardise the recovery were it to be accompanied by a renewed Covid surge and significantly less government spending than anticipated.

There is a diminished likelihood that President Biden’s spending plans will be implemented following the December curveball thrown by Democratic senator Joe Manchin, who came out against it following protracted negotiations. This makes the realization of the stimulus less likely, though it should be noted that much of this spending plan was in any case redistribution rather than new spending per se and was due to be spread over several years. As such, its potential negative impact on growth should not be overly stressed.

.jpg) Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Other developed markets are facing a similarly slower 2022 as the US, with growth expected to moderate in the UK, Eurozone and Japan also. While Japanese inflation has remained reliably low, European countries have seen similar surges in price growth to those seen in the US, and the squeeze on household incomes could constrain consumption. This is especially the case through the coming winter months as consumers contend with much higher energy costs and large numbers of Covid-19. Even those countries which have opted not to implement new restrictions yet will be impacted by Omicron, with UK Prime Minister Boris Johnson cautioning that as much as 25% of workforces could be forced to self-isolate.

Aside from higher prices and residual Covid-19 concerns, the issues facing Europe will be in large part political. Brexit still carries significant risks to growth as the UK and the EU face off over issues such as fishing rights and in particular Northern Ireland and related trading rules. The departure of UK negotiator Lord Frost could see a more amenable response from Westminster, but the risk of a trade war should Article 16 be invoked by the UK remains a salient one and would weigh on growth on both sides of the Channel. Meanwhile, the outlook for greater EU integration – and what this means for fiscal spending in particular – is perhaps boosted following the departure of Angela Merkel as Chancellor in Germany. Newly appointed Chancellor Olaf Scholz appears to align with the pro-integration policy of French President Emmanuel Macron, and while Macron faces elections himself in April, indications are at present that he will secure a second term. Meanwhile, with Hungarian Prime Minister Viktor Orban facing a stiffer, more united, challenge in upcoming Q2 elections there, one vocal opponent of further EU integration could be removed from office.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

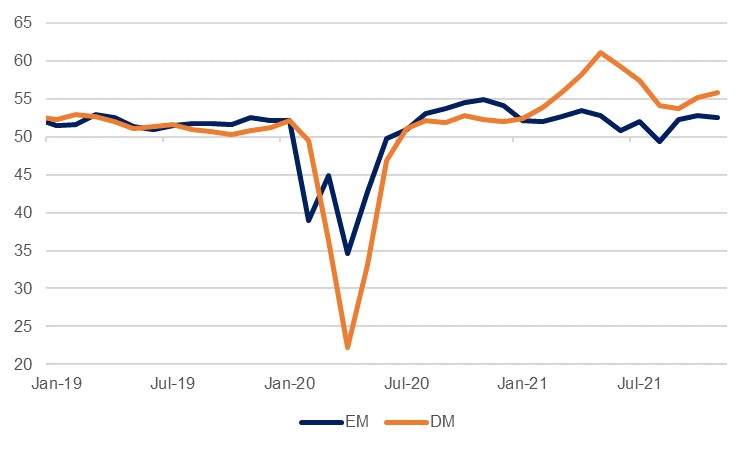

As 2022 begins, the outlook for many EMs is far more precarious as compared to the major developed markets. While the IMF predicts that EM growth will exceed that of DM in 2022 (5.1% compared with 4.5%), much of this will be driven by the giants China (one of the few major economies to be loosening monetary policy at present after a cut to the RRR in December), and India, which is pursuing accommodative fiscal and monetary policy. Many of the smaller emerging markets will see growth under pressure not only from the ongoing pandemic (with substantial proportions of many countries, especially in Sub-Saharan Africa, still unvaccinated), but also from tightening global monetary conditions. Many EMs have already started implementing rate hikes as they are faced with dollar strength, rising commodity prices and accelerating inflation, but even this might not be enough to ensure ongoing investment inflows to the level seen in recent years.