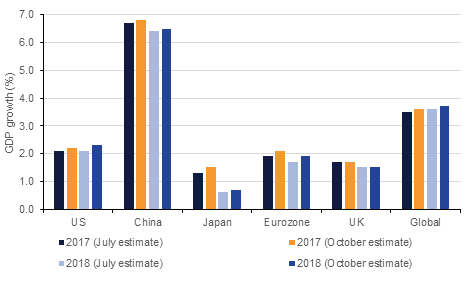

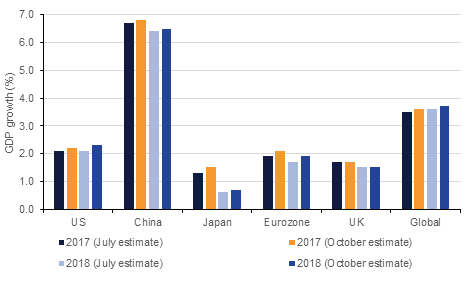

Global growth is on the mend with a broad-based recovery underway according to the IMF, taking in adavanced economies and emerging ones including here in the GCC. This constructive outlook along with a tightening oil market is also providing welcome stability for petroleum prices.

- Global macro: Despite an increasing incidence of geopolitical risks and uncertainty the momentum in the world economy appears to be improving, such that the IMF felt able to upgrade its economic outlook at its October meetings. Amidst stronger growth discussions about policy adjustments are continuing.

- GCC macro: The latest monetary surveys for Saudi Arabia and Qatar showed a decline in the central banks’ net foreign assets over the last few months, although there was an improvement m/m in Qatar in August.

- Sector Focus: UAE’s agricultural and utilities sector overview.

- Rates: Upbeat monthly economic data further cemented prospects of a December rate hike in the US. However, the UST curve flattened, with long term yields remaining anchored at low levels as inflation continues to linger below the Fed’s target range.

- Credit: Rising USD rates and substantial new supply weighed on GCC corporate bonds. However, positive sentiment on the back of higher oil prices and reducing government budget deficits in the region helped to contain the loss.

- Currencies: Although it remains the poorest performing G10 currency YTD in 2017, the dollar has outperformed its peers over the last month to pare some of those earlier losses.

- Equities: Over the last month, global equities continued their positive run as geopolitical risk was largely contained and macro-economic factors remained strong.

- Commodities: OPEC’s production cuts have run for nine months. How OPEC measures how successful they have been in restoring balance to markets will be key in determining the outlook for oil in 2018.

IMF makes upwards revision to global growth forecasts

Source: IMF, Emirates NBD Research

Source: IMF, Emirates NBD Research

Click here to download the full publication

Source: IMF, Emirates NBD Research

Source: IMF, Emirates NBD Research