ZEW’s measure for current conditions in Germany slid from 95.2 in January to 92.3 in February and the Index of investor expectations declined to 17.8 from 20.4 in January reflecting impact of recent stock market volatility on investor confidence. While a slide in global equity prices dragged down Germany’s benchmark stock index by nearly 11% in the past weeks, the country’s economy has been enjoying a strong run, supported by domestic spending and solid global trade. German economy is estimated to expand by 2.7% this year and 2.0% next. In the wider Euro Zone, consumer confidence came in below expectations at only +0.1, falling from +1.4 in January, however is well above its long run average of -12.0. Despite dropping for the first time in seven months, the index continues to point to a pick-up in household spending growth.

Japanese Central Bank Governor Haruhiko Kuroda didn’t discuss monetary policy during an appearance in parliament yesterday. Since the central bank reduced its purchases of government bonds in January, BoJ is now believed to be considering the possibility of scaling back its stimulus by switching its yield-curve target to 5-year government bonds from 10-year bonds.

Saudi Arabia issued SAR 7.22bn of domestic sukuk yesterday, following an issue of SAR 5.85bn in January. In total, the government has raised USD 3.5bn in domestic debt year to date, to help finance a budget deficit of USD 64bn. The finance ministry had indicated that approximately half of the overall deficit would be financed by debt issuance, and we expect the bulk of this to come from an international bond/ sukuk.

4Q17 Wage price index in Australia grew to 2.1% y/y vs 2.0% in the previous quarter, however, is still materially below the 3.5% wage growth forecast the Reserve Bank of Australia anticipates in coming years. Looking ahead, US PMI and meetings of FOMC January minutes are to be released today. Also BoE’s Mark Carney will unveil the bank’s latest inflation report.

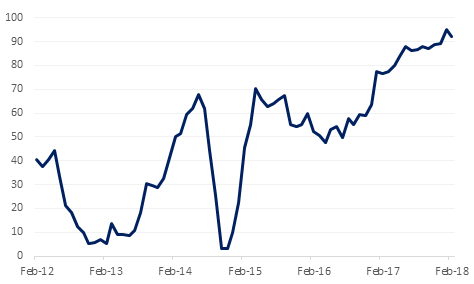

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US Treasury curve bear-flattened yesterday with 2-year yield rising 3bps to 2.22% and opening four bps higher this morning at 2.26% amid auction of circa $179 billion of new government securities. Yields on 5yr, 10yr and 30yr USTs closed higher at 2.64% (+1bp), 2.89% (+2bps) and 3.15% (+2bp) respectively. In contrast 10yr yields on Gilts and Bunds closed slightly lower at 1.58% (-2bps) and 0.73% respectively, as Euro Zone consumer confidence data showed some softness yesterday. Credit spreads rose marginally in response to mixed corporate result announcements. CDS levels on US IG and Euro Main closed higher at 55bps(+3bps) and 53bps (unchanged) respectively.

Local GCC bond market moved in sync with macro trend with yield on Barclays GCC bond index rising by 2bps to 4.15% even though credit spreads got support from stable oil prices and closed a bp lower at 153bps.

Activity in the hard currency primary market remained subdued, however in the Saudi local market, KSA priced its SAR denominated sukuk with tenures of 5yr at 3.40% (SAR 5.37 billion), 7yr at 3.65% (SAR 1.7 billion) and 10yr at 3.80% (SAR 0.15 billion). By comparison current yield on USD denominated KSA 23s is 3.61% and that on KSA 28s is 4.15%X

The dollar is trading firmer this morning, building on yesterday’s gains amid rising treasury yields. As we go to print, the Dollar Index is trading 0.12% higher at 88.83, and is eyeing its longest winning streak since December 2017. We expect the first level of resistance to be come in at 90, the capping trend line of the daily downtrend that has been in effect since 18 December 2017.

Despite an increase in wage pressures (see macro), the AUD has lost ground this morning. Currently AUDUSD is trading 0.34% lower at 0.78559, in a move that has taken the price below the 50 day moving average (0.7874). While the price stays below this level, the most likely path is test of the 61.8% one year Fibonacci retracement (0.7828). A break of this level will result in further declines towards the 0.7775 level. This level sits on the 200 day moving average and is close to the 100 day moving average (0.7773).

Developed markets closed mixed as investors’ exercised caution ahead of Fed minutes later today. The S&P 500 index dropped -0.6% while the Euro Stoxx 600 index gained +0.6%.

Regional markets closed lower with volumes continuing to drift lower. In terms of stocks, there was very little action. Emaar Properties dropped further -1.2% but managed to hold onto AED 6.0 level.

Oil markets were on an unsteady footing overnight with few fundamental data points to affect the market. Brent closed down 0.6% at USD 65.25/b and has now pushed back below the 65 handle while WTI is holding at around USD 61.25/b. Suhail al-Mazroui, the UAE’s energy minister, said OPEC and its partners were open to cooperating on production for ‘many more’ years after the expiry of the current round of production cuts. The minister also expects the UAE to beat its production target in Q1 thanks to maintenance on fields.