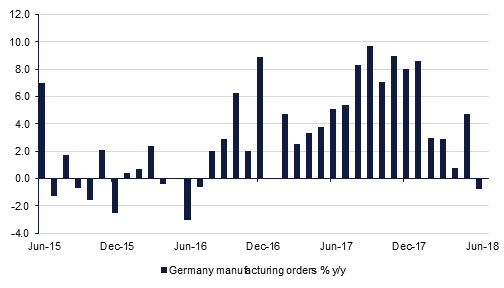

Markets have begun the week with trade still on their minds and with data that reinforces some of these concerns. German manufacturing orders for instance fell-4.0% m/m, much worse than expected and a result that adds to concerns that the German economy in particular will be hurt by the fallout from rising trade tensions and the increase in protectionism globally, despite a provisional trade deal being reached between the EU and the US recently. The annual rate also fell by -0.8% y/y, the first negative reading since July 2016. The data increases the risks of a fall in industrial production due later today, which could add to pressure on the EUR which is being further undermined by broad dollar strength as a result on firm US economic data.

GBP is another currency in the crosshairs as Brexit fears have eclipsed the rise in interest rates announced last week by the Bank of England. There is a theory that increasing talk of a ‘no deal’ Brexit actually helps the negotiating position of UK PM Theresa May, but it may take some time for this to theory to be fully tested and in the meantime the pound could still fall a lot further before the negotiation process gets more serious.

In terms of the US-Chinese trade dispute the markets remain wary following the announcement of tariffs on USD60bn of US products by China late last week. The CNY has been volatile in the last 24 hours, buoyed initially by the latest measures from the PBOC to support it, but not regaining enough strength to say that the negative pressure has completely gone away. Chinese foreign reserves data expected later today should reveal the extent of intervention last month to support the Chinese currency. Another currency that remains under pressure is the TRY which is caught between market concerns over inflation and interest rates domestically and external political concerns over the deteriorating relationship between Turkey and the US. Turkish officials are reported to be visiting Washington later this week in an attempt to end the dispute and bring the threat of sanctions to a close.

Source: Emirates NBD Research

Source: Emirates NBD Research

Lacking any material catalyst, US treasuries traded in a tight range yesterday with yield on 2yr USTs closing unchanged at 2.65% and that on 10yr edging just a bp higher to 2.95%. Mounting fears of no-deal Brexit kept a lid on Gilts with yield on 10yrr Gilts sliding 3bps to 1.30%. Slight uptick in oil prices failed to stimulate risk appetite with CDS levels on US IG remaining unchanged at 59bps and that on Euro Main rising a bp to 65bps.

Ignoring the stability in oil prices, GCC bond market moved in tandem with its global counterparts. Yields on Barclays GCC bond index closed unchanged at 4.45% even though credit spreads widened 3bps to 169bps.

As we highlighted before, barring Bahrain, credit rating trend in the region has turned slightly bullish. Moody’s yesterday upgraded DP World’s rating from Baa2 to Baa1 citing the company’s diversified business and strong operational performance. Z-spread on DPWLD 37s has narrowed to 231bps from 245bps at the beginning of this year. Also Fitch affirmed Egypt’s rating at B with a positive outlook. That said, Moody’s downgraded ratings on four Bahraini banks (BBK, National Bank of Bahrain, Bahrain Islamic Bank and Khaleej Commercial Bank) to B2, in line with the recent downgrade of the rating on the Bahrain sovereign.

The USD is benefiting from a variety of factors from the perceived fallout from protectionism and global trade tariffs, to the relative divergence of monetary policies around the world. USDCNY remains underpinned despite the latest efforts to reduce pressure on the Chinese currency, whilst the EUR and the GBP are being weighed on by soft data and Brexit (see macro). The JPY has perhaps been less affected in the last 24 hours, as rumours have surfaced that the BOJ has contemplated raising interest rates sometime this year.

As we to print, the Dollar Index is trading at 95.346 and remains above the 50-day moving average (94.52). We expect resistance at the one-year high of 95.652. A break and daily close above this level is likely to result in further gains towards 97.940, the 76.4% five year Fibonacci retracement. With the 14-day RSI (Relative Strength Indicator) showing bullish momentum at 60.13, the short term risks are for additional gains.

Ignoring the trade war fears, global equities remained buoyed with S&P 500 closing at its highest level since January, gaining +0.35% yesterday. Despite the Brexit fears, FTSE 100 also inched up higher by +0.06%. Asian equities are following suite with their western counterparts with Nikkei trailing higher at +0.61% and Hang Seng up by +0.94% in early morning trades.

GCC regional bourses were directionless yesterday. DFM closed unchanged, Abu Dhabi gained 1.61% on the back of solid gains in banking shares, Qatar reversed losses by gaining +0.37% yesterday and Tadawul was in the red by -0.15%.

Oil markets gained at the start of the week as new US sanctions went into effect against Iran. Both Brent and WTI futures gained around 0.75% overnight. Energy-related sanctions will come into place later this year but prohibitions on Iran’s access to US dollars and other trade are set to come back into place this week.

Click here to download full publication