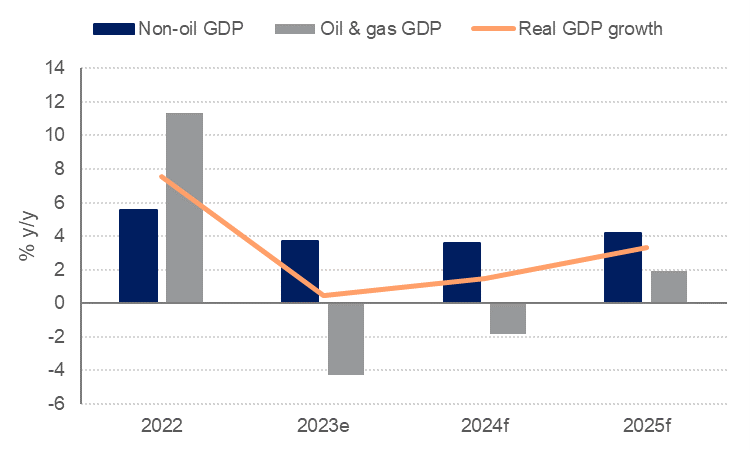

Global growth slowed in 2023 off the post-pandemic rebound of 2022 and central banks continued to tighten monetary policy. The GCC was not immune to this weaker global backdrop, with headline GDP estimated at just 0.5% in 2023 from 7.6% in 2022. However, this largely reflected significant cuts to oil production over the course of last year, particularly from Saudi Arabia, and non-oil growth was much more resilient at 3.7% for the region in 2023, down from 5.3% in 2022.

* Weighted by nominal GDP

* Weighted by nominal GDPNon-oil growth in 2023 was underpinned by looser fiscal policy, with Saudi Arabia and the UAE increasing government spending by an estimated 9.5% y/y and 7.9% y/y respectively, even as budget revenues declined on lower oil prices and production. Population growth likely supported aggregate consumer spending, offsetting the impact of higher interest rates and cost of living pressures, while a continued rebound in tourism also boosted activity in transport and logistics, hospitality and retail sectors.

Investment was likely also a key driver of growth across the region, with both government and private sector investment in strategic sectors and mega projects. Saudi GDP data showed gross fixed capital formation growth (GFCF) of 6.2% in the year to September, although this was front-loaded in H1 with GFCF contracting on a y/y basis in Q3.

In 2024, global growth is expected to slow slightly to 2.9% from 3.0% in 2023 as tight monetary policy continues to weigh on demand and investment, particularly in the first half of the year. This scenario is consistent with softer demand for oil, particularly in the advanced economies, and oil GDP growth in the GCC will remain a drag on headline GDP growth in 2024. We expect oil prices to average USD 82.5/b this year, similar to 2023.

However, we think non-oil growth will remain relatively robust, averaging 3.6% across the GCC in 2024, underpinned by continued investment as oil exporting countries push ahead with ambitious economic diversification programmes. While government expenditure growth will likely be more modest in 2024 than over the last couple of years, we do not expect governments to cut spending or tighten fiscal policy through higher taxes (other than those already announced such as the UAE’s corporate income tax, which came into effect in mid-2023).

In addition, economic and social reforms are likely to support continued private sector investment, and growth in the expatriate population particularly in Saudi Arabia and the UAE. Rate cuts from the Fed, expected in H2 2024, should also boost demand for credit and support investment and consumption.

Finally, tourism is expected to remain a key driver of economic growth in the region in 2024 (and beyond), with the return of visitors from China and the growth of the Saudi tourism sector off its relatively low base.

Inflation slowed to an average 2.8% in the GCC (weighted by nominal GDP) from 3.5% in 2022. Lower fuel, food and services inflation were offset in the UAE and Saudi Arabia by rising housing costs. We expect the disinflation trend to continue in 2024, with average CPI inflation for the region forecast at 2.6% this year.

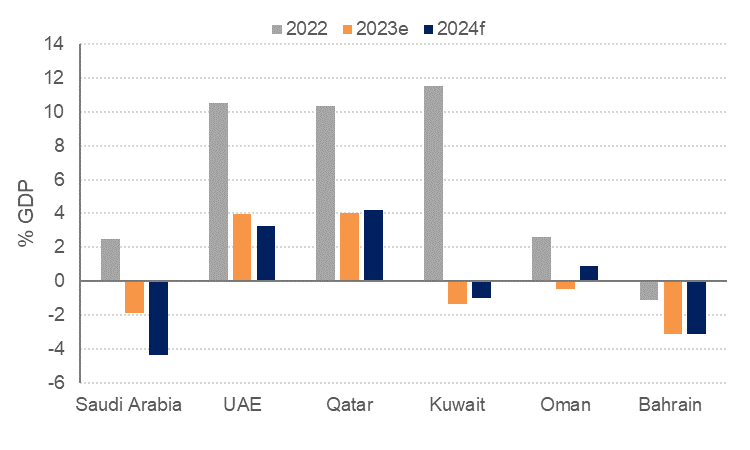

The budget surpluses enjoyed in 2022 narrowed sharply last year on oil production cuts and lower oil prices, while spending increased. With little rebound in oil revenues expected in 2024, governments will need to rein in spending growth to prevent budget balances shrinking further. We expect Saudi Arabia to run a deficit of -4.3% of GDP this year, up from -1.9% in 2023, as ambitious development plans will require continued investment spending. Bahrain and Kuwait are also likely to run small deficits this year, but Oman, the UAE and Qatar are expected to record surpluses. Overall, sovereign balance sheets in the GCC are much stronger than a few years ago, with lower public debt and healthy FX reserves, which should allow governments to tap capital markets at attractive rates, if needed.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research