In its latest Regional Economic Outlook (April 2021), the IMF upgraded its growth forecasts for the GCC to 2.7% in 2021 from 2.3% previously, citing early vaccine rollouts relative to many other countries in the region. This is significantly higher than our own forecast of 1.2% real GDP growth in the GCC this year. Looking at the breakdown between the oil and non-oil sector growth estimates, it is evident that the IMF is much more optimistic about oil sector growth in the GCC this year than we are, while our non-oil GDP projections for 2021 are similar.

For 2021 as a whole, the IMF expects crude oil production for the OPEC members Saudi Arabia, UAE and Kuwait to average 14.5mn b/d, unchanged from 2020, with the UAE increasing production by 2.9% y/y. However, data for Q1 show that oil production across these countries has declined to 13.5mn b/d, down -7.1% from the 2020 average, with UAE oil output down -8.1% in Q1 2021.

With OPEC only starting to unwind its production cuts from May, and at a gradual rate, we expect GCC oil production to recover slowly over the remainder of the year, remaining well below the average production level in 2020. As a result, we expect oil GDP to remain a headwind to overall GDP growth in the GCC in 2021.

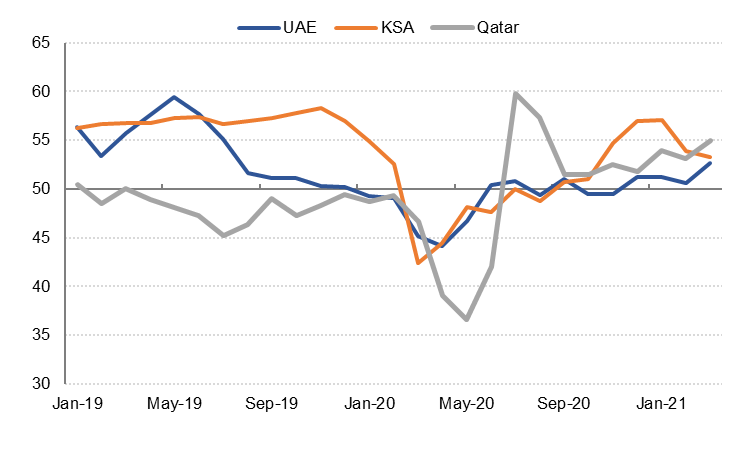

We expect non-oil sector growth to continue to recover across the region this year, although some uncertainties remain. PMI survey data show improving business conditions in the non-oil private sectors of Saudi Arabia, the UAE and Qatar in the first quarters of this year, even as extended lockdowns in Europe and Asia weighed on external demand. The UAE PMI was the lowest of the three in Q1 2020 likely reflecting the impact of global travel restrictions on the key tourism sector. With the slow pace of vaccine rollout in Europe and the surge in coronavirus cases in India in recent weeks – both key source markets for international visitors – the sector is likely to remain somewhat challenged in the near term.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

Other indicators suggest that domestic demand in the UAE remained relatively soft in the first few months of the year, including the lack of private sector job growth (the employment component of the PMI was just shy of the neutral 50-level in Q1 21), and weak private sector loan growth. While bank lending to the private sector increased slightly m/m in January and February, on an annual basis it is still contracting.

In contrast, private sector credit growth in Saudi Arabia remained robust, averaging 14.6% y/y in the first two months of 2021. While the PMI survey also doesn’t point to job growth in the kingdom’s private sector, the unemployment rate for Saudi nationals fell to 12.6% in Q4 2020 from a peak of 15.4% at the height of the pandemic in Q2 2020, as Saudi workers displaced expatriates in the private sector, and employment in the public sector grew as well.

We expect growth momentum to accelerate over the course of the year, as vaccines continue to be rolled out across the region and monetary policy remains accommodative. However, uncertainty around when travel restrictions will be eased globally remains high, as the number of new coronavirus cases rises in parts of the GCC as well as in parts of Asia and Europe.

In a bid to drive a recovery in domestic demand without increasing budget spending, both Saudi Arabia and the UAE have announced measures to boost investment domestically. Recently, Saudi Arabia’s crown prince called on the 24 largest companies in the kingdom to freeze dividend payments and instead channel those funds into domestic investment. This would potentially cost the Saudi budget SAR 275bn in foregone dividends from Saudi Aramco this year, although higher oil prices (resulting in higher royalties and taxes) will help to offset some of this impact. If Saudi Aramco does withhold dividend payments to the state this year, we estimate the budget deficit would be closer to the -4.9% projected in the 2021 budget statement than the -1.4% of GDP we have pencilled in for this year. For now, Aramco has indicated it will maintain dividend payments so we have left our budget forecast unchanged until there is more clarity on the extent of any reduction in these payments.

However, the crown prince estimated that corporate investment in lieu of dividends could see an additional USD 1.3tn invested domestically over the next decade, in addition to the Public Investment Fund’s commitment of USD 40bn pa in domestic investment for the next five years. This implies an extra USD 170bn of domestic investment per year over the next five years. To put this in context, gross fixed capital formation in Saudi Arabia totalled USD 160bn in nominal terms last year, so if these ambitious investment plans are implemented, it would drive significantly higher GDP growth over the medium term.