GCC governments are looking to increase borrowing to help tackle the economic impact of the virus-related shutdowns. Qatar launched a USD 10bn bond sale with 5Y, 10Y and 30Y tranches on Tuesday, and Bloomberg reports that the Dubai government is in talks with lenders about a potential bond issue and/or loans. Dubai has not issued a Eurobond since 2016.

The White House is in talks with Congress to secure an additional USD 250bn to finance loans for small businesses hit by the coronavirus pandemic. Treasury Secretary Steven Mnuchin has spoken to congressional leaders about bolstering the USD 350bn scheme already in place.

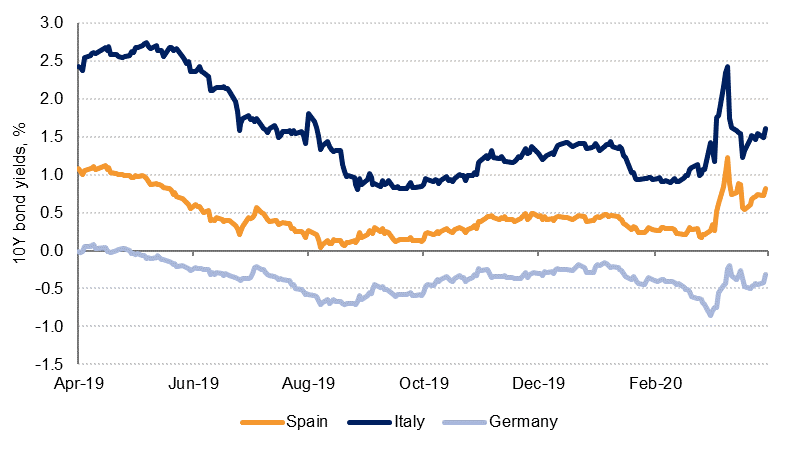

Eurozone finance ministers failed to reach agreement on a package of fiscal stimulus measures after a seven-hour meeting last night, with a press conference postponed to later this morning. The package being discussed could amount to EUR 500bn. The sticking point appears to be on the whether a jointly issued EU-wide debt instrument, dubbed coronabonds, are necessary. Northern countries are against this idea while some southern countries that have been hardest hit by the virus, including Italy and Spain are strongly in favour. A precautionary credit line from the Eurozone bailout fund for individual countries and EU support to pay wages of workers at risk of layoff are also being considered, as is guarantee fund from the European Investment Bank for businesses.

In Asia, PM Abe declared a state of emergency in Tokyo and the surrounding regions for one month. He called on all non-essential workers to work from home, although he does not have the authority to enforce a lockdown. Local authorities can now instruct schools and entertainment venues to close. Data released this morning show core machine orders unexpectedly rose 2.3% m/m in February, before the global impact of the coronavirus was felt. However, the economy is now expected to contract in Q2 as businesses are closed and consumers stay at home. Separately, Chinese FX reserves declined -1.5% to USD 3.06tn in March. The decline was due to valuation effects according to the PBOC.

The Reserve Bank of Australia kept rates on hold at 0.25% as expected yesterday and did not announce any additional stimulus measures. The RBA said that it would need to purchase smaller tranches of government bonds less frequently if conditions continue to improve.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries closed mixed following a reversal in risk sentiment late in the trading session. A weak 10y auction also weighed on USTs. Overall, the curve bear steepened with yields on the 2y UST and 10y UST ending the day at 0.26% (flat) and 0.71% (+4 bps) respectively.

Regional bonds remained under pressure ahead of the OPEC+ meeting later this week. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +2 bps to 4.70% and credit spreads remained flat at 400 bps.

Qatar raised USD 10bn from a three-part Eurobond sale. The country raised USD 2bn in five year bond, USD 3bn in 10 year bond and USD 5bn in 30 year bond. The shorter duration bonds were priced at 300 and 305 bps over USTs while the 30y bond was priced to yield 4.4%. The current Qatar 49s yield 4.23%. The order book for the deal exceeded USD 25bn.

Fitch affirmed Kuwait’s rating at AA with stable outlook. The rating agency cited Kuwait’s strong fiscal and external balance sheets as the reason for the affirmation.

Some signs of the coronavirus slowing in key areas caused demand for the dollar to ease yesterday as risk aversion improved. However, late losses for the S&P followed news that New York and London were still seeing rising death tolls reversed many of these losses. After falling below the 100.00 mark, the DXY index recovered back above this level overnight and is now in the 100.17 area. USDJPY was in a bearish mood for the day but there was support just below the 108.70 region after closing on Monday at 109.22, and is now hovering around the 108.80 area.

The Euro saw positive movement through most of yesterday, reversing its Monday losses to trade back above 1.09, but it gave back some of these gains in the overnight session. Sterling also experienced modest gains, despite the fact that Boris Johnson remains in the intensive care unit, increasing upwards of 0.80%, before slipping back slightly. The AUD and NZD held on to bullish momentum through Tuesday but succumbed overnight as S&P cut Australia's credit rating to negative from stable and as the RBNZ said it was open to increasing QE.

It was a rather volatile session of trading for developed market equities. Stocks gave up much of their early session gains as worries over coronavirus crept back. The S&P 500 index dropped -0.2% while the Euro Stoxx 600 index added +1.9%.

Regional markets closed sharply higher on the back of positive global backdrop during their session. The DFM index and the Qatar Exchange added +5.5% and +3.1% respectively. Gains were led by market heavyweights. Emaar Properties (+4.4%) extended their gains from the previous session. Most banking sector stocks rebounded from their early-week losses.

Oil prices continue to oscillate as headlines on whether an OPEC+ production cut deal can be reached later this week continue to float through the market. Benchmark futures both declined overnight but are trading higher on some optimism this morning with Brent at USD 32.64/b, up 2.4%, and WTI at USD 24.94/b, up more than 5.5%.

The EIA cut its projections for US crude supply growth in 2020 and 2021. The agency now expects the US to produce 11.8m b/d this year, a 1.2m b/d downward revision, while in 2021 they expect just over 11m b/d, a cut of more than 1.6m b/d from earlier projections. The downward revisions to forecasts reflects that oil producers in the US are already cutting back on capital expenditure which will lead to lower volumes. However, projections from an energy forecasting agency are unlikely to be enough to placate Russia, Saudi Arabia or other OPEC producers that the US is cutting as part of any deal. More likely is that the state-led producers would want the US government to mandate some form of ‘cap’ on the upper limit of US production. We don’t believe this is likely nor would producers seem willing to accept a limit on their growth (and profit potential) to benefit competing producers in OPEC+.